Bob Mackin

The annual review of B.C. Lottery Corporation’s anti-money laundering activities found several illegal casino transactions.

Of 53 large cash transactions sampled by Deloitte, three broke the law.

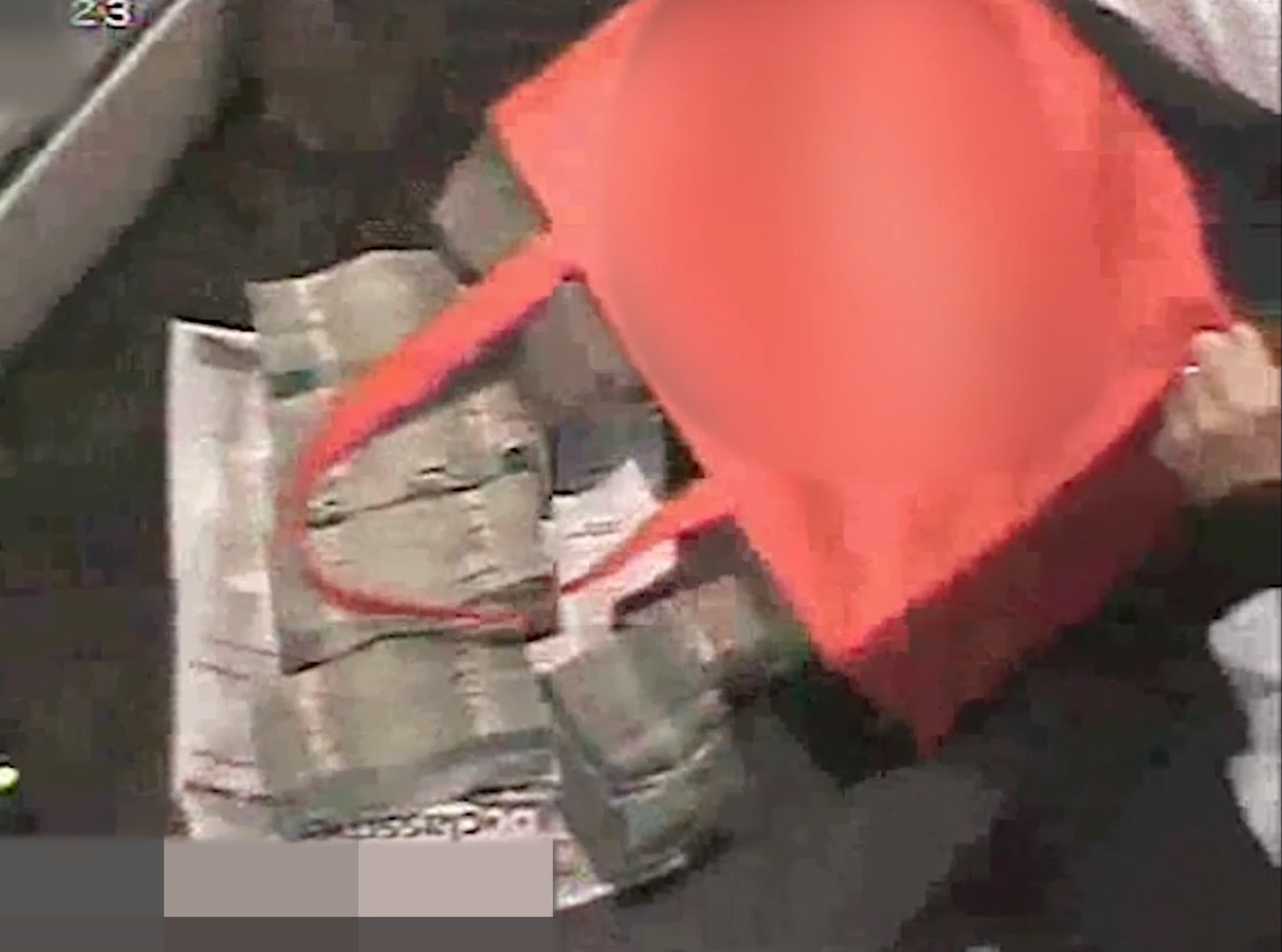

A bag of cash from a surveillance video at Starlight Casino, from the German Report in 2018. (BC Gov)

“In these incidents, patrons were able to continue to gamble at a casino, despite their information being incomplete or incorrectly entered,” said a BCLC briefing note obtained under the freedom of information law. ”Deloitte found three instances in which a patron was able to complete a [large cash transaction] without completing a reasonable measures form in full.”

The redacted report by Deloitte was about BCLC anti-money laundering activities is part of an annual review required under the federal proceeds of crime, money laundering and terrorist financing act.

Deloitte interviewed BCLC and casino staff and conducted walkthroughs from July 20, 2019 to Sept. 20, 2019 at five casinos and PlayNow.com, the BCLC online gambling site.

Deloitte also found eight BCLC employees had not completed required anti-money laundering training, though none of the employees were in the BCLC legal, compliance and security team.

BCLC’s anti-money laundering risk register methodology was incomplete and 10 of 26 anti-money laundering-related alerts were not acted upon in a timely manner, Deloitte found.

An Ernst and Young analysis of cheques issued from 2014 to 2016 at Grand Villa Casino found no systemic pattern of money-laundering. EY reviewed 658 cheques of $10,000 or more from table games. It released a similar review in spring 2019 about River Rock Casino Resort.

EY found three cheques issued were the result of staff error. In two cases, the casino issued verified win cheques for the incorrect amount due to errors in recording patron buy-in amounts.

(BCLC)

“In one instance, Grand Villa issued a return of funds cheque for $20,000 from the incorrect cash account,” said a BCLC briefing note. “However, Grand Villa followed all return of funds procedures pertaining to patron identification and transaction reporting.”

Meanwhile, BCLC quietly switched its online gambling contract from Paddy Power to Scientific Games Digital in May.

Ireland-based Paddy Power was contracted in 2012 and extended in 2019 to 2022.

Paddy Power merged with Betfair to form Flutter Entertainment, which acquired The Stars Group, parent of Poker Stars. Stars is not regulated in B.C.

A BCLC briefing note said the change should be seamless because of the vast majority of sporting events were cancelled since March.

“Despite COVID-19 related impacts to sports betting on PlayNow.com, the online gambling site is

experiencing unprecedented growth overall, driven particularly at this time by strong growth in eCasino products.”

In early February, theBreaker.news reported how BCLC increased the limit that gamblers can keep in their PlayNow.com account from $9,999 to $250,000 — an increase of 2,400%. They can also transfer up to $100,000 per week, a substantial 900% increase from the previous $9,999 limit. Online gambling workers were deemed essential service workers during the pandemic by the NDP government.

In April, BCLC also began to expand its GameSense Advisor program to support players by phone and online via chat on PlayNow.com.

Despite casinos closed due to the pandemic, BCLC is spending $1.6 million on a brand ad campaign on broadcast, digital and social media that began June 1 and runs through Aug. 30.

The “With Every Play, We All Benefit” animated ads promote how gambling profits contribute to healthcare, education and community programs. Ad agency is One Twenty Three West (123w) with Hamazaki Wong for ethnic creative. Mediacom is the ad buyer.

Support theBreaker.news for as low as $2 a month on Patreon. Find out how. Click here.