Bob Mackin

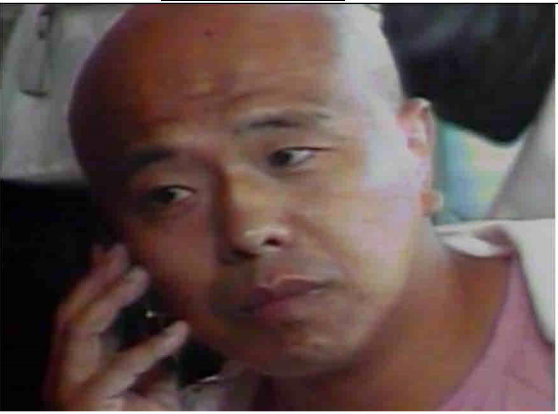

If there was a face of B.C.’s public inquiry into money laundering, it had to be Paul King Jin.

The 54-year-old didn’t make it onto China’s national boxing team for the Seoul 1988 Olympics, but immigrated to Quebec the following year, moved to Toronto and eventually owned a Richmond massage parlour and combat sports gym.

Paul King Jin, Sept. 4, 2019 at World Champion Club in Richmond (Facebook)

Jin’s name is prominently featured in the gambling and real estate sections of Justice Austin Cullen’s June 15-published, 1,800-page report. The survivor of a September 2020 Richmond restaurant shooting was not called to testify, but Cullen granted his lawyer participant status so he could cross-examined several witnesses, including whistleblower Ross Alderson, the former B.C. Lottery Corporation money laundering investigator.

During the three years of the inquiry, the NDP government filed civil forfeiture applications to seize Jin properties. But it also sent then-tourism minister Lisa Beare to Jin’s No. 5 Road World Champion Club gym for an August 2019 photo op and licensed his son’s security company at the gym in July 2020. (Blackcore Security and Investigations quietly closed and relinquished the licence in November 2020.)

Jin’s lawyer Greg DelBigio said he had no comment on Cullen’s final report. During closing arguments last October, DelBigio emphasized his client’s innocence, having not been charged in the RCMP’s E-Pirate probe of the Silver International underground bank.

“The only conclusion that may be drawn from this is that, despite the best efforts of the investigators, there was no evidence which would justify a prosecution of Mr. Jin for any suspicions or allegations in relation to those same issues which were investigated by this commission,” DelBigio told Cullen.

Cullen heard evidence that B.C. casinos received $376 million of suspicious cash from 2012 to 2015 — including $279 million in $20 bills. B.C. Lottery Corp. anti-money laundering manager Daryl Tottenham testified that Jin or his network facilitated a majority of that money and they even set-up shop in an 11th floor room at the River Rock Casino Resort’s hotel. Cullen also recalled how BCLC investigator Steve Beeksma, who formerly worked at Great Canadian Gaming, testified that Jin wasn’t charging interest to high-level borrowers and their debts were often repaid in China.

Paul King Jin (second from right) and Tourism Minister Lisa Beare (second from left) on Aug. 27 at World Champion Gym in Richmond (Mackin)

An RCMP forensic accounting found Jin received $27 million from Silver International between June and October of 2015 and police seized promissory notes from Jin properties for more than $26 million in loans. E-Pirate collapsed in 2018 and never made it to court because of inadvertent disclosure of an informant’s identity. One of the two accused, Jian Jun Zhu, 44, was murdered at a Richmond restaurant in September 2020. Richard Charles Reed, 23, is charged with second degree murder and Yuexi Lei, 37, is charged with accessory after the fact.

The commission analyzed Jin’s lengthy list of civil claims against borrowers. Cullen didn’t believe that he was simply loaning money to people buying and renovating houses.

“While it may be that some of the funds were used for that purpose, I find that the predominant purpose of these loans was to allow high-stakes gamblers to make large cash buy-ins at Lower Mainland casinos and that Mr. Jin described the loans as relating to the acquisition or renovation of real property to obtain a strategic advantage in the litigation process,” Cullen wrote.

Cullen’s report said that Jin first came to BCLC attention as a cash facilitator in 2012, though he was “constantly in the background” at casinos for years before then.

In September 2012, Jin was formally barred from all casinos for a year, but continued to make cash drop-offs at or near casinos. He was spotted on one occasion delivering a bag full of $150,000 in various denominations at Starlight Casino. Jin was banned again in November 2012 for five years, but continued to deliver cash and chips to patrons.

The review of Jin’s debt collection carried out by the commission illustrated the vulnerability of private lending to money laundering, prompting recommendations for better regulation.

River Rock Casino Resort in Richmond (Mackin)

Cullen believed the amounts claimed in court actions by Jin and associates from 2013 to 2018 were a small percentage of Jin’s overall private lending activity. Cullen said there was little evidence before him to prove the funds were derived from profit-oriented crime. But he noted that many of the defendants’ court filings said the loans were for casino gambling and that an affidavit sworn by Jin and his wife offered insight.

In one of the filings, the report said, Jin admitted he loaned a defendant $200,000 cash in November 2014 and that his wife subsequently provided $205,000 more, after regular banking hours.

“These factors suggest that Mr. Jin had the cash on hand and that lending cash to his customers was a regular part of his business model,” said Cullen’s report.

The report also contained an E-Pirate transcript of Jin’s interview by RCMP Cpl. Melvin Chizawsky, in which Jin confirmed he often used Silver International to exchange Chinese renminbi into Canadian dollars.

“I have previously concluded that most, if not all, of the cash being left at Silver International was derived from profit-oriented criminal activity such as drug trafficking. I have no trouble finding that a significant portion of that illicit cash was provided to Mr. Jin to supply his private lending activity,” Cullen wrote.

One of Cullen’s 101 recommendations is for the province to establish a money laundering intelligence and investigation squad that could watch out for private lenders who use corporate vehicles and nominees to skirt police and regulators.

“I am also highly concerned about the ability of a private lender to make use of the court process to enforce loan agreements in which illicit funds are advanced to the borrower as part of a money laundering scheme. Such use of the legal process tends to undermine public confidence in the courts.”

Support theBreaker.news for as low as $2 a month on Patreon. Find out how. Click here.