Bob Mackin

The same day the Vancouver Canucks eliminated the Nashville Predators, the club’s owners moved one step closer to taking control of a delayed ski resort project near Squamish.

Roberto (left), Luigi, Francesco and Paolo Aquilini and Michael Doyle at the November 2018 opening of Elisa Steakhouse (Elisa/Facebook)

On May 3, B.C. Supreme Court Justice Paul Walker approved receiver Ernst and Young’s application to accept the offer for Garibaldi at Squamish Inc. (GAS Inc.) from secured creditors Aquilini Development LP, Garibaldi Resort Management Co. Ltd. and 1413994 B.C. Ltd.

GAS Inc. defaulted on $65 million owing to the three Aquilini companies, prompting the September 2023 receivership petition.

Walker deemed the sale to the only bidder appropriate, fair and commercially reasonable because EY made sufficient efforts to obtain the best price and met other requirements set by the courts. He allowed the sale by reverse vesting order (RVO) which, according to Canadian Lawyer magazine, is the purchase of shares in a debtor company, so that the “bad assets – including liabilities and creditor claims – are removed, and the good assets stay in the company.”

“EY has demonstrated an evidence-based rationale to approve the RVO. Exceptional circumstances exist to warrant approval of the RVO,” Walker wrote. “They arise from the urgency to complete the construction pre-conditions (in order to preserve value to the Garibaldi entities and their stakeholders, including the Province) coupled with the lack of any meaningful response from the Province that would allow for an expeditious [traditional asset vesting order] transaction.”

The Squamish Nation has a 10% interest in the partnership, but did not oppose the transaction. The only opponent was the Province of B.C., which questioned whether the court had jurisdiction to approve the RVO, whether it was appropriate or even necessary.

“Although the province supports completion of the project in view of the economic benefits to the province (and others) and the fact that consultation with the Squamish Nation has already occurred, the province argues, as one of its grounds opposing the Transaction, that there is no jurisdiction under the BIA, either generally or in the context of this case, to approve a transaction incorporating an RVO.”

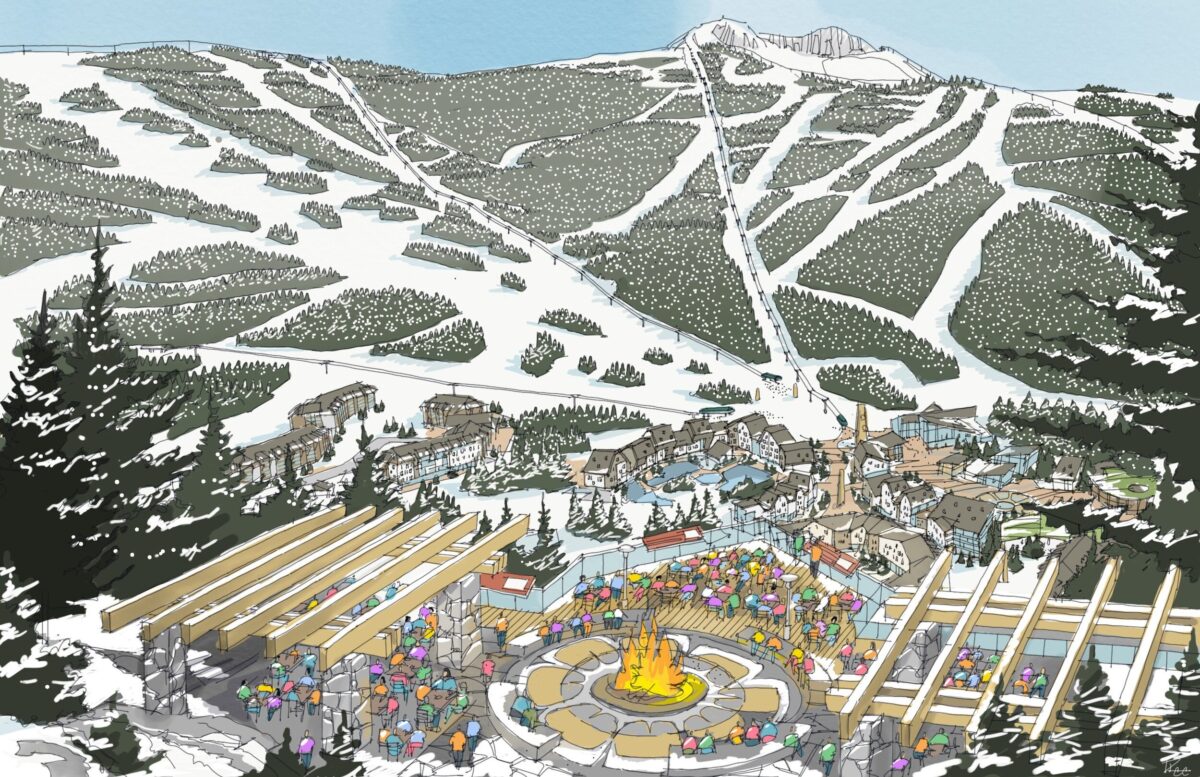

Artist’s conception of the delayed ski resort on Brohm Ridge near Squamish (Garibaldi at Squamish)

Walker said the insolvent Garibaldi entities owe more than $80 million and face deadlines to satisfy pre-construction conditions contained in the provincially issued environmental assessment certificate. Walker’s decision said the amount of the credit bid had been reduced by $20 million from the stalking horse bid offer.

“That amount, owed by the Garibaldi entities (as interest) under their security to the petitioners, will be a retained liability. Also retained will be any potential liabilities arising under the Environmental Management Act,” Walker wrote. “All other liabilities will be vested into [a newly created company].”

The project, on Squamish Nation territory, faces 40 pre-construction conditions, eight of which are deemed urgent. Work to satisfy the conditions would cost more than $5.5 million over the next 12 months. Conditions include old-growth management, archaeology plan, Brohm River management plan and a dam for a snowmaking reservoir.

When it was originally approved in 2016, the project was estimated to cost $3.5 billion with a 30-year, four-phase build resulting in 126 ski and snowboard runs, fed by 21 lifts and accommodation in 5,233 hotel, condo, townhouse and detached units. Garibaldi at Squamish faces a 2026 deadline to begin construction.

The two unsecured creditors are Northland Properties Ltd. and Garibaldi Resorts (2002) Ltd., owed $6.37 million and $13.8 million, respectively.

Northland Properties owns Revelstoke Mountain Resort, Grouse Mountain and the Dallas Stars. Founder and chairman Bob Gaglardi is also president of Garibaldi Resorts (2002) Ltd., the company whose secretary is Aquilini Investment Group founder Luigi Aquilini.

Support theBreaker.news for as low as $2 a month on Patreon. Find out how. Click here.