Bob Mackin

John Langdale isn’t a household name in British Columbia.

But two words from the Sydney professor’s speech last autumn are famous.

Langdale is an expert on transnational crime and financial crime at Macquarie University’s Department of Security Studies and Criminology. He gave a lecture to the New South Wales Police Force’s intelligence conference last Nov. 2, that was titled “Impact of Chinese Transnational Crime on Australia: Intelligence Perspectives.”

In his presentation, Langdale warned of various tactics employed by criminal gangs in Guangdong, China, to enable the export of money, drugs and counterfeit goods from China.

The speech described what he called the “Vancouver model.”

Macquarie University’s John Langdale.

Almost a month later, on Dec. 1, 2017 at the University of British Columbia law school, Attorney General David Eby told a Transparency International conference that he was advised “at least one international intelligence community” had called the particular style of money laundering unique to B.C. casinos the “Vancouver model.”

Eby did not identify the source, but a copy of Langdale’s presentation was emailed to him on Nov. 27 by Eby’s aide, George Smith. It was released last week to theBreaker under the freedom of information law.

In his 38-slide presentation, Langdale delivered four case studies to outline the threat to Australia, focusing on historic alliances between Chinese criminal gangs and Latin American and European criminals and a possible alliance between North Korea and Chinese criminal gangs.

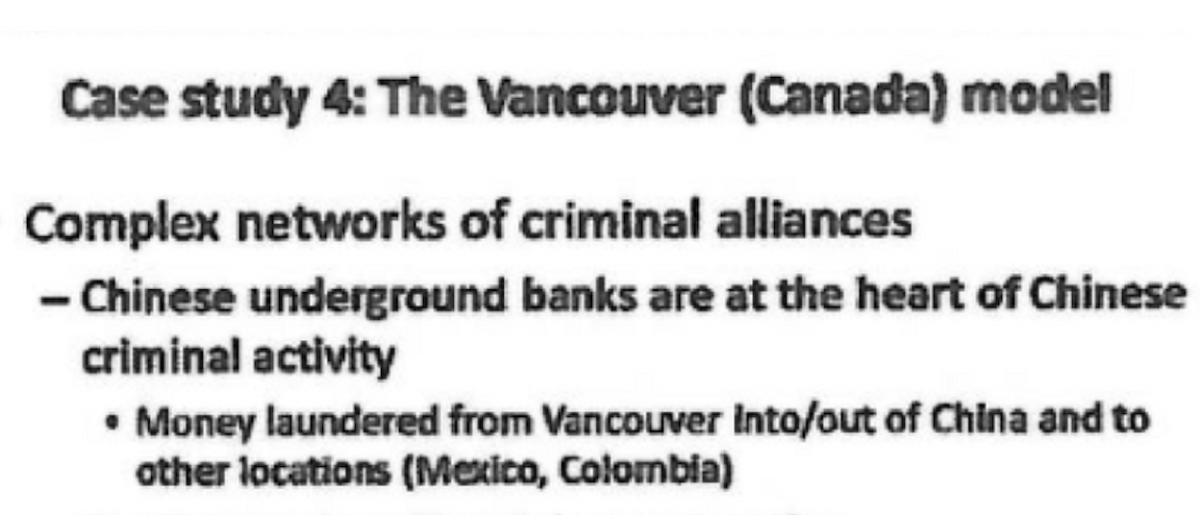

The final case study was what Langdale called the Vancouver model, which is comprised of “complex networks of criminal alliances.”

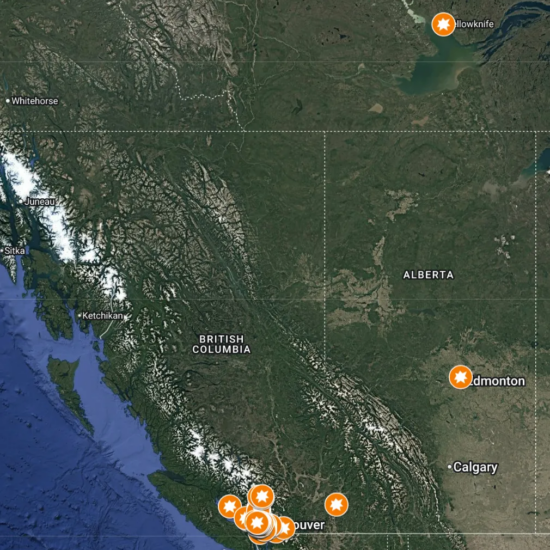

“Chinese underground banks are at the heart of Chinese criminal activity. Money [is] laundered from Vancouver into/out of China and to other locations (Mexico, Colombia),” reads a slide from Langdale’s presentation.

He further described how North American illegal drug networks are supplied by Chinese and Latin American gangs; the Chinese specialize in methamphetamines and precursor chemicals, while the Latin Americans are in the cocaine trade.

Capital flight from China, he wrote, is facilitated by high rollers using Canadian casinos, with help from junket operators, resulting in investment in Canadian real estate.

In an interview with theBreaker, Langdale said there is a lucrative industry for gambling tour operator companies to Macau, Philippines and Vancouver. Some of the companies are even listed on the Hong Kong stock exchange.

“I think of [junket operators] as a finance company, essentially, that will provide transport, services and accommodation, but ultimately they provide the money,” Langdale said. “So when the high roller shows up at the casino, the money is there to gamble. The junket operators use underground banks.”

If a gambler loses $1 million on the trip, he said, the only recourse for the operator is to send a criminal gang to collect the debt when the gambler returns home to China.

The July 2016 report to the BC Liberal government by MNP, which was finally released by the NDP government last September, described how high rollers visiting from China were using underground banks to access cash in bulk for gambling at River Rock Casino Resort in Richmond.

Langdale’s research focused on Guangdong, which is in a state of flux. The province of 100 million grew rapidly using low-wage migrant labour, but the region has shifted into high tech products and services, resulting in a rise in cybercrime.

British Columbia’s sister province in China is an epicentre of Pacific Rim crime, rife with trafficking in illegal drugs and counterfeit goods. It has a deep pool of both skilled labour and unskilled migrants and benefits from world class logistics networks, strong links to global Chinese diaspora, and proximity to the key centres of Hong Kong and Macau.

Hong Kong is a global banking and business hub where shell companies help wealthy and politically connected Chinese shield their fortunes. Macau boasts the world’s largest casino turnover, with a history of facilitating crime, money laundering and capital flight.

Langdale said the Vancouver model of 2017 is guaranteed to evolve, as authorities play catch-up with improved intelligence, and stronger laws and enforcement.

“What I talk about in the Vancouver model today might not be the same in a couple years time, they’ll move on to a different way of doing things,” he said. “By being flexible, they’re opportunistic, they’ll respond to opportunities like new markets, obviously illegal drugs are a key way. If regulations tighten up, as I’m sure they will in Vancouver, they’ll have to use other means to launder the money.”

UBC law professor and anti-money laundering expert Peter German tendered his review of money laundering in Metro Vancouver casinos to Eby on March 31. Its public release is imminent.

Some of German’s preliminary recommendations for better compliance and enforcement may have had an impact already. Eby told a House of Commons committee last month that there was only $200,000 in suspicious transactions in B.C. casinos in February, compared to $20 million in July 2015. German’s next task is to review money laundering in the Metro Vancouver real estate market. He has already recommended luxury auto dealers be required to file reports to authorities when customers make large cash payments for supercars.

One unknown is the impact on B.C., and the rest of the Pacific Rim, of Chinese president Xi Jinping’s indefinite rule, after the Chinese Communist Party recently scrapped term limits.

“He will try to keep the corruption crackdown going,” Langdale said. “He’s got huge problems, there is a lot of corruption in China. At the local government areas, some provinces are more corrupt than others, Guangdong would be among the more corrupt, it’s where the money is. There is an old Chinese adage, the mountains are high and the emperor is far away. It still applies.

“If you’re far away from Beijing, you can get away with quite a bit.”

Support theBreaker.news for as low as $2 a month on Patreon. Find out how. Click here.