Bob Mackin

Squamish Nation members will vote Dec. 10 on whether to let Westbank Corp. build a massive, multi-tower development around the south end of the Burrard Bridge that could generate as much as $12.7 billion in cashflow.

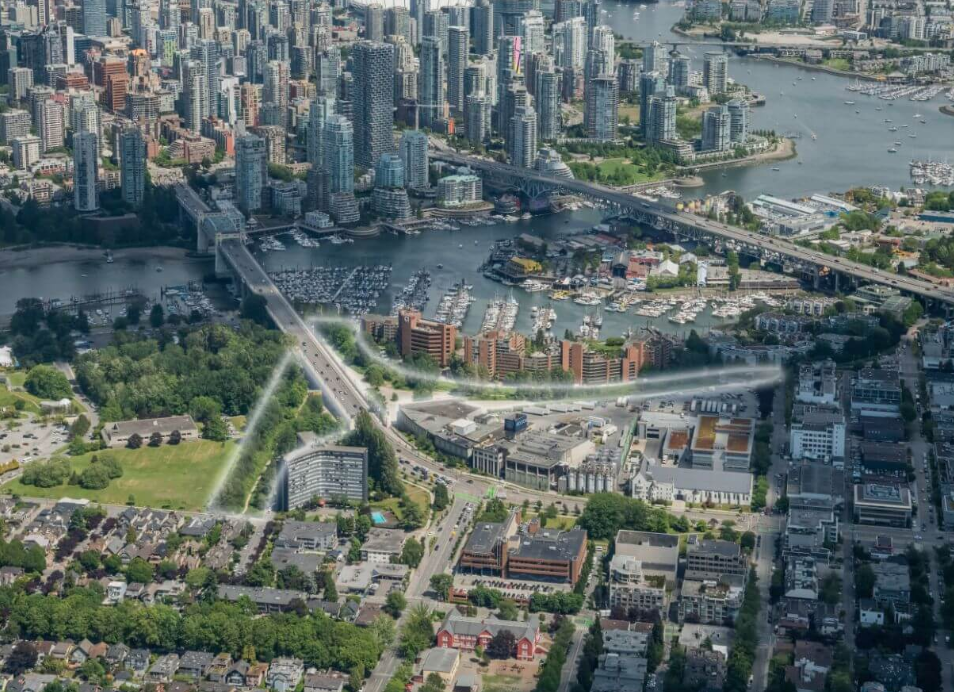

Architect’s rendering of the proposed Westbank development on Squamish Nation land near the Burrard Bridge (Senakw.com)

Last April, theBreaker.news was first to report that the North Vancouver-headquartered band inked a 50-50 partnership with Ian Gillespie’s company, which is famous for building luxury downtown towers, like the Shaw Tower, Fairmont Pacific Rim, Shangri-La and Telus Garden, and marketing condos in Hong Kong and Singapore.

Back then, the Squamish Nation said Westbank was proposing 3,000 units on the 11-acre Senakw reserve, which it regained in a 2002 court settlement. But the new plan foresees up to 6,000 units in as many as 11 buildings. By comparison, Westbank’s redevelopment of Oakridge mall is for 2,600 units in 10 buildings.

Squamish Nation has positioned the marquee development as a rental play, but an Oct. 24 information document provided to Squamish Nation members, and obtained by theBreaker.news, says up to 30% of the condos (or 1,800 units) could be for sale. (READ THE INFORMATION DOCUMENT BELOW.)

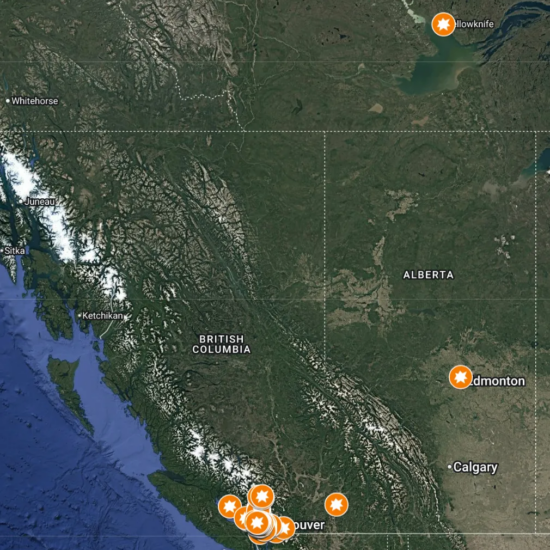

Squamish Nation reserve on both sides of the Burrard Bridge’s south end (Senakw.com)

That information document foresees 15 to 20 years of construction in phases. No start date is mentioned, but it is expected that the first construction phase will begin when all legal agreements are signed and site servicing and financing are in place. Construction of the second phase may begin while the first is underway. Subsequent phases would be subject to Westbank meeting benchmarks.

“While the nation will not receive fair market rent for the Senakw land, it is expected that the nation and the nation partner will receive, over the course of the project, significant profits and other benefits, as described in this information document, that will exceed the value of fair market rent,” the document states.

Westbank is required to pay a $60 per square foot nation amenity agreement, worth up to $180 million, that could be used for Squamish Nation community services, housing or infrastructure purposes. If they agree to build below market cost housing, the amenity charge would be discounted.

Westbank’s Ian Gillespie with Prime Minister Justin Trudeau in 2015 (Westbank)

Officially, the Dec. 10 vote is under the Indian Act and Indian Referendum Regulations because the Squamish Nation does not have a self-government treaty. The vote would designate three lots on Reserve No. 6, also known as Senakw, up for development and authorize business terms between the Squamish Nation and Westbank. The vote will also decide a nominal rent structure and maximum lease term up to 120 years. After the 120 years are up, the Nation would regain full use and possession of all of Senakw and all the buildings and infrastructure.

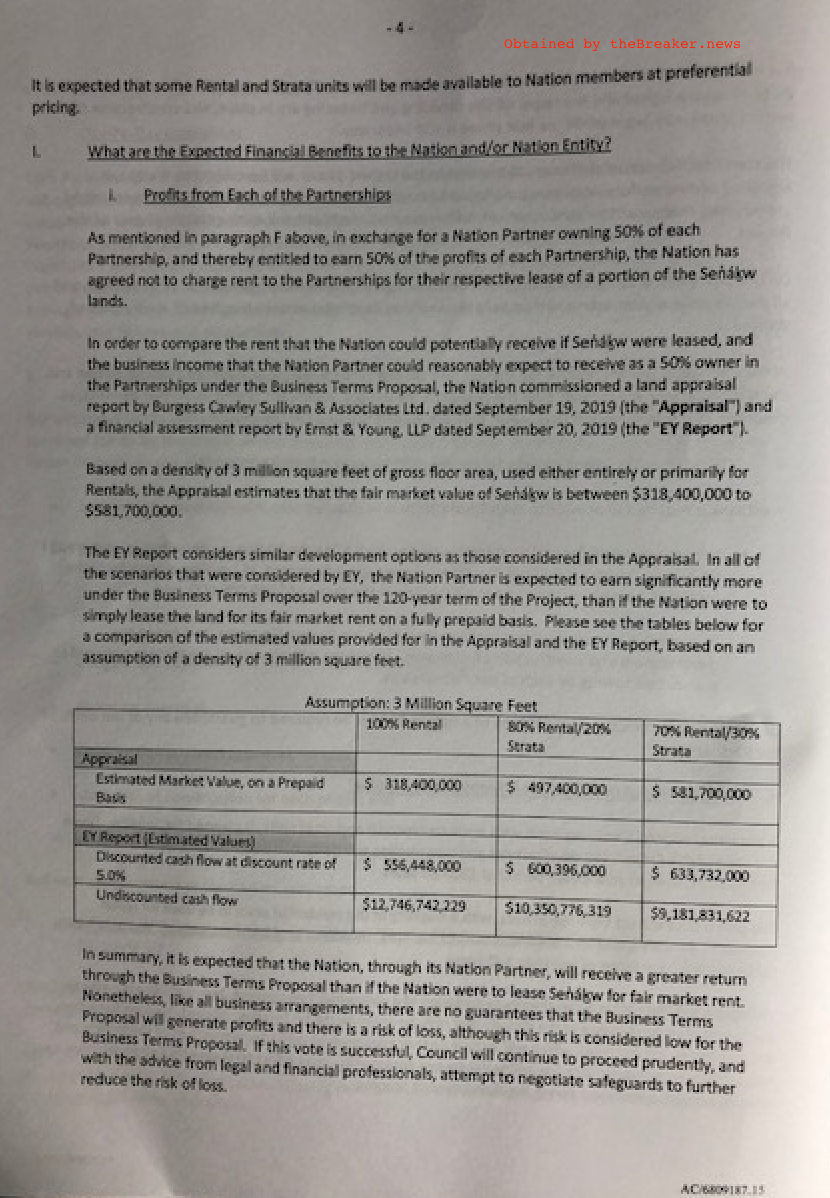

Squamish Nation hired Burgess Cawley Sullivan and Associates for a land appraisal and Ernst and Young for a financial assessment. For a 3 million square feet gross floor area, BCS estimated the fair market value of Senakw at $318.4 million (based on 100% rental) to $581.7 million (70% rental/30% strata). The Ernst and Young report estimated cashflow to range from $556.45 million to $12.7 billion, depending on the development formula. Ernst and Young was previously hired by the Squamish Nation to vet potential developers and concluded that Westbank could “generate highest and best use leasing opportunities at Senakw.” (READ THE ERNST AND YOUNG REPORT BELOW.)

Document obtained by theBreaker.news (Squamish Nation)

“It is expected that the nation through its nation partner, will receive a greater return through the business terms proposal than if the nation were to lease Senakw for fair market rent,” said the information for band members.

Westbank would be paid a project management fee equal to 3.5% of the approved hard and soft costs of each phase. All major decisions must be approved jointly by Westbank and representatives of the Nation, a Nation entity or a Nation partner.

Squamish Nation has launched a password-protected website, Senakw.com and scheduled members’ information sessions in: North Vancouver (Nov. 12, 14, 20 and 28), Tukwila, Wash. (Nov. 16); Squamish (Nov. 21 and 27); Duncan (Nov. 25); and a livestream on the Squamish Nation Facebook page (Nov. 29). The development does not require City of Vancouver approval.

This is not the first attempt to develop the land. Squamish Nation politicians said in 2010 they wanted to build a tower on the west side of the bridge and mid-rise office buildings on the east side. In recent years, the band council shifted its attention to partnering with the Tsleil-Waututh and Musqueam, with major backing from the Aquilini family, to acquire a portfolio of federal and provincial properties in Burnaby, Vancouver and West Vancouver. Projects on the former RCMP land and in Jericho are in the drawing board stage.

Support theBreaker.news for as low as $2 a month on Patreon. Find out how. Click here.

Information Document Business Terms Final Oct 24 2019 by Bob Mackin on Scribd

Schedule C to Designation Terms Executive Summary of EY Report by Bob Mackin on Scribd

Information Document Designation Terms Final Oct 24 2019 by Bob Mackin on Scribd