Bob Mackin

A British Columbia Supreme Court judge rejected a minority shareholder’s bid to block the sale of Richmond’s Duck Island.

In an Aug. 6 oral verdict, Justice Michael Brundrett dismissed an application by Samuel Cheung and 0908034 B.C. Ltd. for an injunction to prevent Morris Mao Hua Chen and his companies, Raegon Properties and Investments Ltd. and Morrison Homes Bridge Street Ltd., from transferring shares.

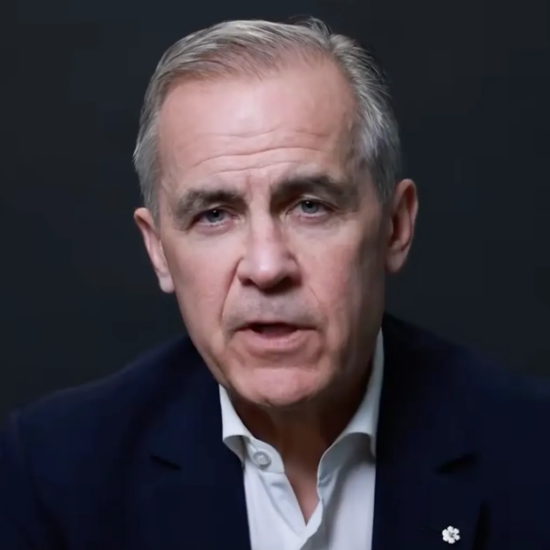

Morris Chen (Wealth One Bank Canada)

Chen chairs the North America Investment and Trade Promotion Association (aka North America Business Progressive Association) and is a member of the boards of Wealth One Bank Canada, an online bank that targets Chinese customers, and CIBT Education Group Inc., the TSX-listed owner of private career colleges and student housing properties.

Real estate agent Cheung has experience developing real estate, mainly in China.

Chen and his companies control 98% of Jingon International Development Partnership LLP and West Road Partnership, which owns the properties near River Rock Casino Resort. Cheung and his company hold the remaining 2%.

Duck Island is the site of the annual Richmond Night Market, which was cancelled this summer by the coronavirus pandemic. In 2012, Richmond Mayor Malcolm Brodie revealed that Jingon proposed building the $4 billion Vancouver International Plaza with hotels, offices and a trade and convention centre at Duck Island, which was absorbed by Lulu Island half a century ago.

Cheung filed a notice of claim in July, alleging Chen and his companies breached their partnership, fiduciary duties and common law duty of good faith and honest performance. Chen wanted a judge to dissolve the partnership agreements and award damages and costs.

The parties agreed to a standstill clause, but Chen gave notice that he wanted to sell his interests by an Aug. 7 closing date. The buyer was not identified in Brundrett’s judgment.

Brundrett’s ruling said Cheung and Chen have done business since 2006. In 2010, Cheung discussed developing Duck Island and West Road in Richmond. They agreed that Cheung would receive commission and a 2% stake in any partnership that arose.

Proposed new look for Duck Island (Morrison Group)

Cheung found Gui Fang Zhu to invest $40 million for a 49% interest in the partnership in 2011 under the Jingon name. Zhu is the wife of Xu Chang’an, who was a member of the Tianjin City Chinese People’s Political Consultative Committee.

The three Duck Island properties were assigned to Jingon. A similar arrangement came about for the West Road land.

Chen bought out Zhu for $80 million after litigation with Xu between 2015 and 2019, giving Chen 98% control over Jingon and West Road.

Chen-controlled companies entered into December 2019 mortgages secured by the Duck Island land. One for $22 million, the other $60 million.

“Mr. Chen did not discuss the mortgages with Mr. Cheung before taking them out,” said Brundrett. “I am told that the current assessed value of the Duck Island properties [18.41 acres] is more than $150 million, and it is common ground that their value would be many times that amount if successfully rezoned and developed. The assessed value of the West Road properties is in the range of $20 million.”

Chen offered $800,000 to buy Cheung’s shares in March 2020 but the offer was rejected and no counter-offer made.

“This is important because the buy-sell provision in the partnership agreement is a form of ‘shotgun clause’ that deems the lack of a counter-offer after seven days to constitute acceptance,” Brundrett said.

Duck Island (Morrison Group)

Cheung applied for an interim court order to preserve the status quo and protect his interests from what he called “unfair and oppressive conduct” until a Sept. 17 hearing.

The judge said Cheung’s application raised a serious question about whether the buy-sell clause was properly invoked.

“If the plaintiff is successful in its underlying action, the plaintiffs will likely end up with an award of damages commensurate with the nature of their interest in the partnership,” Brundrett said. “However, the plaintiffs have not established a risk of irreparable harm to their interests if the injunction is not granted.

“Overall, weighing the potential harm to the parties, I find that the balance of convenience does not favour restricting the defendants from exploring commercially viable options by imposing restrictions on the transfer of their interests, or imposing restrictions on their ability to further financially encumber the properties.”

Support theBreaker.news for as low as $2 a month on Patreon. Find out how. Click here.