Bob Mackin

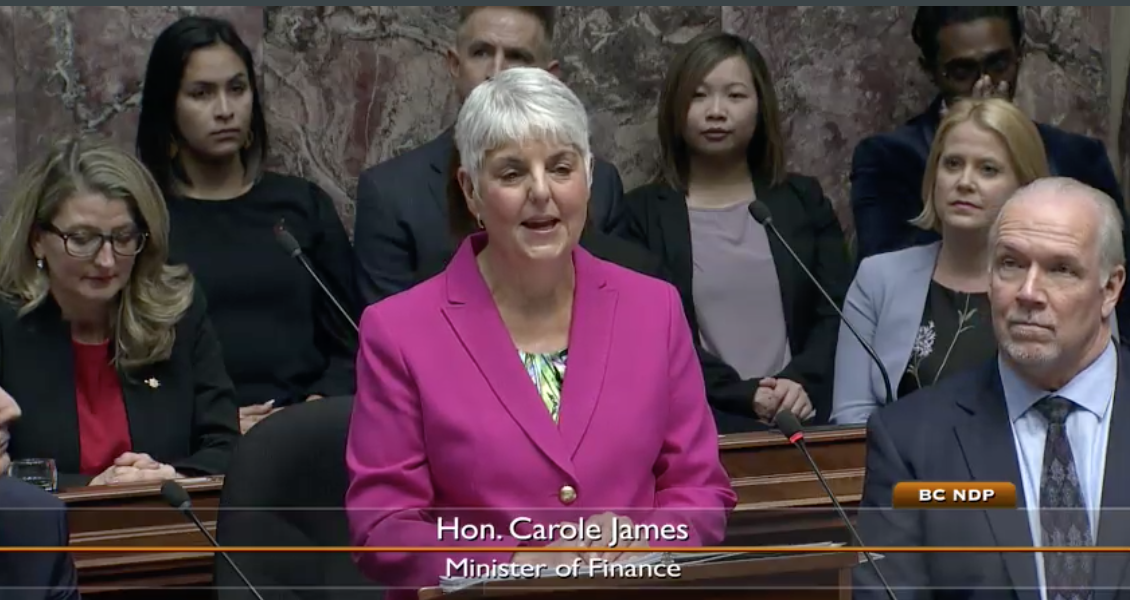

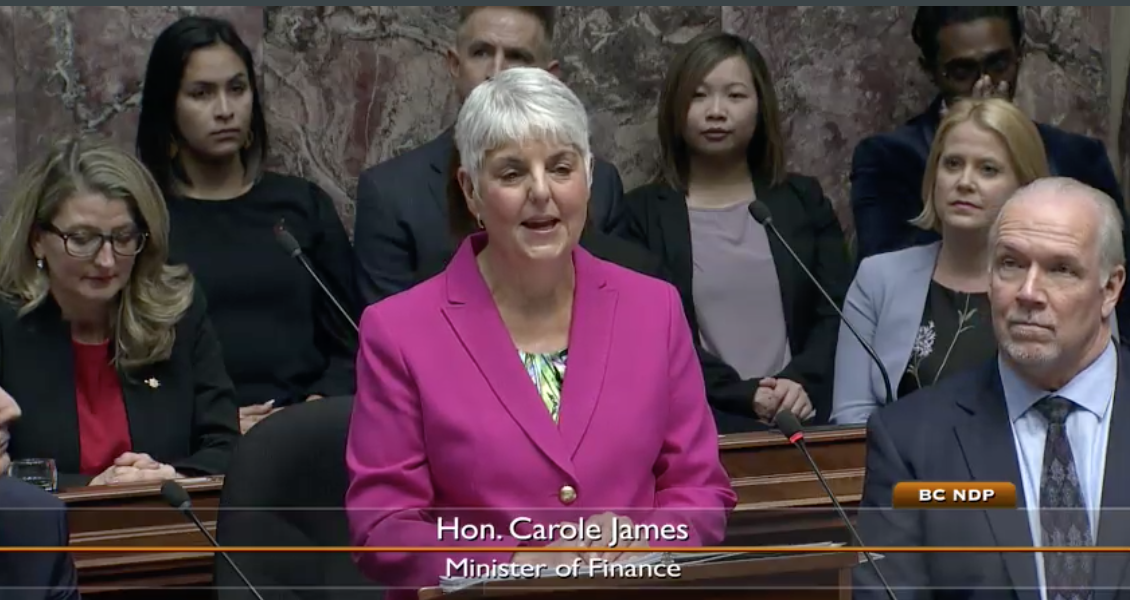

Finance minister Carole James is targeting pop drinkers after hopes for a windfall from pot smokers went up in smoke.

In the NDP government’s budget for 2020-2021, tabled Feb. 18 by James, the 7% provincial sales tax will apply to fizzy soft drinks that contain sugar, natural or artificial sweeteners beginning July 1. The government forecasts it will raise $27 million over nine months in the upcoming fiscal year and $37 million the next.

NDP Finance Minister Carole James on Feb. 18 (Hansard)

“The deterrence effects of this measure are expected to be most prevalent among frequent consumers,” states the budget and fiscal plan for 2020-21. “Males consume more soft drinks than females. Additionally, soft drink consumption is highest among individuals aged 14-18 and declines with age. The Canada Food Guide does not recommend consuming most beverages affected by this measure.”

Additionally, e-commerce companies doing more than $10,000 woth of business in a year in B.C. will be required to register with the government and collect the 7% PST. The government forecasts $11 million revenue beginning July 1, 2020 and hopes to reap another $16 million next year.

By comparison, the B.C. government forecasts $6 million in cannabis tax revenue by the time the fiscal year ends March 31. It blames the delayed rollout of cannabis stores and lower-than-anticipated demand for disappointing revenue. It hopes to raise $50 million next year and $70 million the year after. The federal government legalized pot in 2018, but many British Columbians have continued to purchase on the grey market.

The B.C. government is one of the province’s biggest purveyors of pop, through BC Ferries and B.C. Pavilion Corporation, which operates B.C. Place Stadium and the Vancouver Convention Centre. James was unable to say what kind of impact the tax measure might have on the two taxpayer-owned companies.

“You’ll continue to see sales of pop, and see reductions in both, that’s not going to happen overnight,” James said. “Ultimately we do see a reduction in the sales of sugary drinks and sweetened beverages.”

Meanwhile, the 7% tax on Canadian sellers of goods and Canadian and foreign sellers of software and telecommunications services was hidden under the heading “Registration Requirements Expanded” and also covers Canadian sellers of vaping products delivered to B.C. consumers.

“These requirements will result in provincial sales tax being collected by a greater number of businesses in the digital economy,” the document said.

Overall, James forecasts $60.06 billion in spending, which includes a $300 million contingency, and a $227 million surplus in what might be the last budget before an election. The next one is scheduled for October 2021, but British Columbians could go to the polls before the end of 2020 if the NDP’s minority government alliance with the Green Party ends sooner. Total debt is forecast at $76.4 billion, which is expected to grow to $87.6 billion by spring 2023.

The other main tax measure announced Feb. 18 is a 3.7% tax hike for those earning more than $220,000 a year. Half the anticipated $216 million revenue in the new fiscal year is expected from those earning $1 million or more.

As for the carbon tax, which applies to fuel sales and energy use, the government forecasts $1.95 billion in revenue in 2020-21, up from $1.69 billion last year.

The province’s biggest megaproject, BC Hydro’s Site C dam, has cost $4.7 billion through Dec. 31, 2019. Another $6 billion is budgeted, including a $780 million contingency.

The net loss at ICBC, the struggling provincial auto insurer and regulator, is forecast to shrink from $1.15 billion to just $91 million.

“The forecasted net loss for 2019/20 is significantly lower than the prior year, mainly as a result of the recent product reform, improvement in frequency and higher investment income, due to bond gains from trading activities, gains from disposition of real estate investment properties and gains on disposition of investments during transition to British Columbia Investment Management Corporation.”

Premium revenue rose by almost $500 million to $6.32 billion and investment income grew $213 million to $771 million.

The NDP government has emphasized two themes for much of its term, which began in July 2017: ICBC”s dumpster fire-like struggles and casino money laundering.

Oddly, the new budget cuts $500,000 from Road Safety BC to $16.76 million and reduces ICBC’s road improvements and traffic safety budget by $2 million to $32 million. Similarly, the budget for the Gaming Policy and Enforcement Branch stays below $19.5 million.

Before the budget, the NDP announced it would move in 2021 to a no-fault-style auto insurance system at ICBC, which is costing $92 million to begin the transition. The first-round of public hearings in the $11 million Cullen Commission into money laundering begin later this month.

What about the trade and tourism impacts on the B.C. economy of coronavirus?

“We’re not making any changes at this point, but we’re obviously monitoring it very closely,” James said.

The public service is expected to remain stable at 31,800 full-time equivalents; there are more than 430,000 people in the wider public sector, including Crowns and agencies, hospital, schools and other facilities. More than 330,000 are unionized.

Support theBreaker.news for as low as $2 a month on Patreon. Find out how. Click here.