Bob Mackin (Updated Jan. 27)

For much of his career atop Great Canadian Gaming Corp., Rod Baker depended on the public for highly profitable casino licences.

When the pandemic hit, and casinos were closed, he relied on the public again, by going cap in hand to the federal government for subsidy payments to prop up the company. Meanwhile, he stickhandled its $2.5 billion sale to a Wall Street private equity firm.

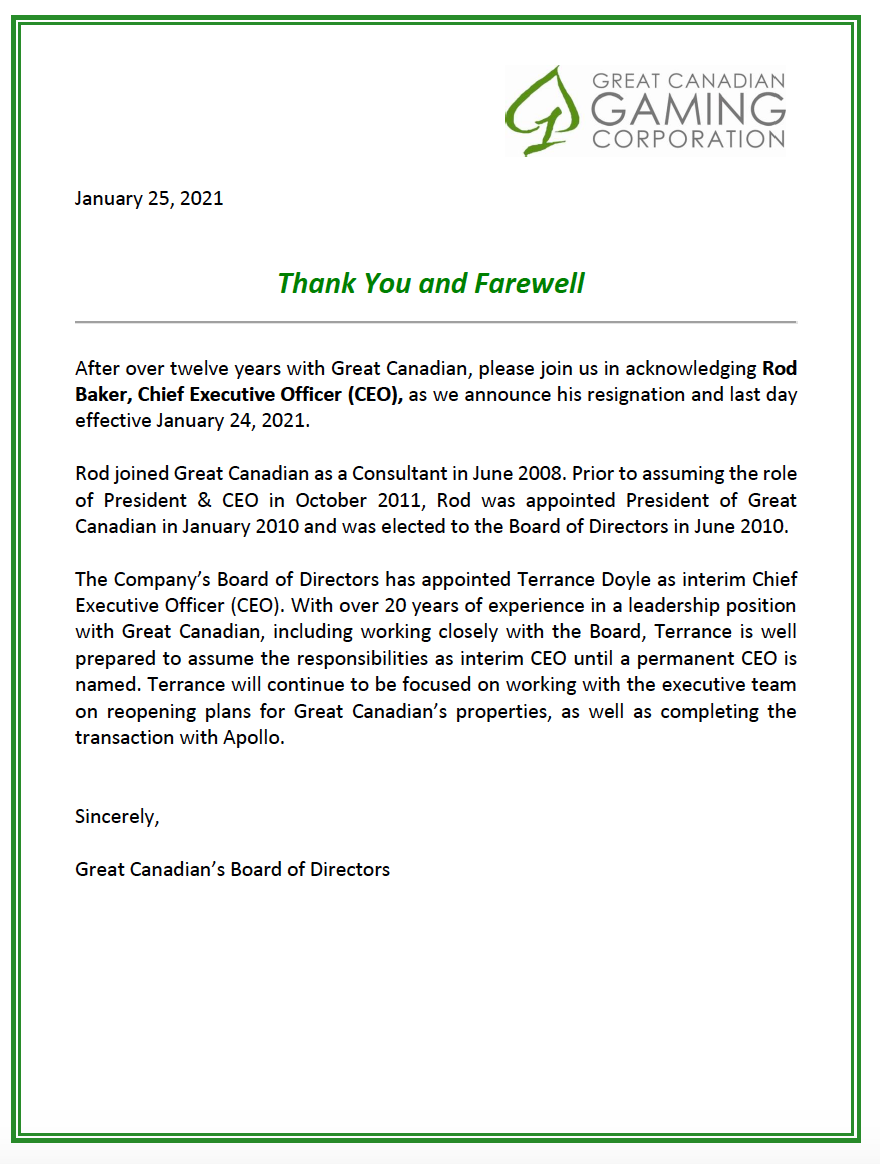

Rod Baker and Ekaterina Baker (Facebook)

Early in 2021, and in the most unlikely way, Baker finally lost a gamble.

The Yukon News revealed that the 55-year-old and his 32-year-old Fatman and Chick Fight starlet wife Ekaterina were caught jumping the coronavirus vaccine queue in a remote Yukon Territory community. Baker resigned in disgrace as CEO of Great Canadian Gaming on Jan. 24.

Locals in Beaver Creek, Canada’s westernmost community, thought something was off when a stranger claiming to work at a local motel lined up for the Moderna shot last week, rather than wait their turn for tentative summertime mass-vaccination dates in B.C.

Word traveled to Whitehorse faster than the Bakers could. Officials cited them $1,150 each on Jan. 21 for failing to quarantine and failing to follow their signed quarantine declaration. A stay of proceedings was entered Jan. 26 by prosecutor Kelly McGill, but the charges were re-issued and are pending.

“The penalty upon conviction for each offence is a fine not exceeding $500 or imprisonment for a term of up to 6 months, or to both a fine and imprisonment,” said Yukon Justice Ministry spokeswoman Fiona Azizaj.

“They should be ashamed of themselves,” B.C. Provincial Health Officer Dr. Bonnie Henry told reporters on Jan. 25. “They put a community at risk for their own benefit, and that to me is appalling.”

The Bakers will have to wait their turn in B.C. for their second shot in summer when people in their age brackets become eligible.

Financially, the fine is chump change for Rod Baker. Reputation-wise, it is devastating for someone who tried to avoid the spotlight.

Beaver Creek, Yukon Territory (Yukon Government)

Baker was the teflon boss for a decade of the company at the centre of British Columbia’s casino money laundering scandal.

When the sale was announced in November, shareholders scoffed at the original $39-a-share offer. The pot was sweetened to $45-a-share and a judge in Vancouver approved Apollo Global Management’s acquisition on the last day of 2020.

That was also the anniversary of Baker’s $34.8 million payday after selling 950,000 shares to end 2019. He exercised 500,000 stock options on the final day of 2020 and netted $11 million in his latest insider transaction.

The Bakers’ address on documents obtained from the Whitehorse court registry is a $2.6 million-assessed, 43rd floor luxury suite at the Shangri-La Hotel tower in downtown Vancouver.

Last September, Great Canadian reported to shareholders that the company received $11.6 million in payroll subsidies, which it preferred to call “government assistance” in corporate documents.

GCG’s internal “Thank You and Farewell” to Rod Baker

The December-launched Canada Emergency Wage Subsidy database lists Great Canadian Gaming Corp., Great Canadian Casinos (Casino Nanaimo), Great Canadian Gaming (New Brunswick) Ltd., Great Canadian Entertainment Centres and Hastings Entertainment Inc. (Hastings Racecourse and Casino) as recipients of the Trudeau Liberal job subsidy payments for companies that saw revenue fall 15% or more on a year-over-year basis.

Vice-president Chuck Keeling did not respond to a query on Jan. 25 about the precise amounts.

Baker was enthusiastic about the subsidies during an August call with stock analysts.

“We are very much appreciative of that support. It’s enabled us to mitigate our losses and to have more people back to work on things to get us back up and running sooner as opposed to later, so that we can reintroduce our thousands of other team members that unfortunately are not able to work right now,” Baker said. “So I think it’s a great initiative that’s helped us get through this period for sure.”

There was no indication that Baker suffered while the company received the subsidies.

A couple of weeks after that call, theBreaker.news learned of mass layoffs at the company and asked Keeling how deep the cutbacks went.

River Rock Casino Resort in Richmond (Mackin)

“As a matter of policy, we don’t comment on personnel matters,” Keeling said on Aug. 25.

Baker could be held accountable in another forum. The Cullen Commission on Money Laundering in B.C. has not announced whether he will be called as a witness. The company’s River Rock Casino Resort became notorious for loan sharks delivering overflowing bags of bundled $20 bills in the hundreds of thousands of dollars to whale gamblers visiting from China. Witnesses have testified that police were discouraged from patrolling the casino and workers feared for their lives.

Baker took over as CEO after the death of founder Ross McLeod in 2011. Chief compliance officer Terrance Doyle is the interim chief executive after Baker’s resignation.

Baker’s name is on 17 GCG donations worth $12,050 to the BC NDP from 2011 to 2015, including more than $7,400 in 2012, according to the Elections BC database.

Support theBreaker.news for as low as $2 a month on Patreon. Find out how. Click here.