Bob Mackin

An online petition opposing the NDP government’s speculation tax was tabled in the B.C. Legislature on April 25, but rejected by the Office of the Clerk, theBreaker has learned.

Kelowna West BC Liberal MLA Ben Stewart submitted the petition, which he called “Scrap the Speculation Tax.” He told the Legislature that it had “acquired and assembled over 17,000 signatures on it.”

“My constituents and everyone who has signed this petition are urging the government to rethink their controversial speculation tax,” Stewart told fellow lawmakers.

BC Liberal MLA Ben Stewart (Hansard TV)

The measure was announced in Finance Minister Carole James’s February budget to target foreign speculators in Metro Vancouver, Fraser Valley, Capital Region, Nanaimo and Central Okanagan with taxes up to 2% of the value of vacant or underused houses. The NDP bowed to public pressure in late March and excluded several vacation spots, such as the Gulf Islands, Juan de Fuca and Bowen Island.

But BC Liberal strongholds Kelowna and West Kelowna remain in the taxable zone.

Stewart confirmed, by email, that the petition was actually the Change.org petition called Stop BC’s Speculation Tax. theBreaker had asked Stewart for the name of the organizer, but Stewart did not provide it. He instead said that he would “pass on” theBreaker’s request to the organizer, who he said lives in West Kelowna.

theBreaker also asked the Office of the Clerk for the name of the originating petitioner, but was surprised to learn the petition had been rejected.

“The petition tabled by Mr. Stewart did not conform to the Standing Orders of the Legislative Assembly and will not form part of the official records of the House, therefore, we cannot make public any details of the petition,” said Rebecca Staffanson, the house documents manager. “The petition will be returned to Mr. Stewart.”

Staffanson did not elaborate.

The only relevant clauses in the Standing Orders state that a petition “must contain a clear, concise, accurate and temperate statement of the facts for which the intervention of the House is requested and the signature of all the petitioners. Members presenting petitions shall be answerable that they do not contain impertinent or improper matter.”

Colleen Hardwick, CEO of Vancouver citizen engagement company PlaceSpeak, told theBreaker that the Clerk was correct in turning down the Change.org petition.

“While it’s interesting, it won’t stand up to scrutiny because of the lack of authentication of the process,” Hardwick said.

Colleen Hardwick (PlaceSpeak)

Online petition websites like Change.org do not confirm the true identity of participants. “As a result, the integrity of the data will not stand up to scrutiny.”

“You have no idea they’re real people,” she said, adding that the “signatories” may have no connection to the affected jurisdiction or the issue. They may also be bots.

“These petition sites, even though they appear to be free, they aren’t. They have revenue streams that they’ve developed by making their lists available to clients.”

British Columbia’s Legislature does not yet have a recognized electronic petition system, as exists in the House of Commons. Federal e-petitions identify the citizen that initiated the petition and the Member of Parliament who must act as sponsor. Approved petitions are published online for 120 days and must receive at least 500 signatories from residents or citizens of Canada in order to be tabled in the House of Commons and wait for an official response from the government.

For instance, the web page for Petition E-1527, which wants the government to denounce, study and eliminate birth tourism in Canada, shows that it was initiated by Richmond citizen Kerry Starchuk and sponsored by Richmond-Steveston East Liberal MP Joe Peschisolido.

Each supporter of an official e-petition to the House of Commons is required to provide his or her name, country, province or territory and postal code (if within Canada), telephone number and email address for confirmation.

Lobbyist Anne McMullin (UDI)

In 2014, while in opposition, the NDP’s Jane Shin proposed the Electronic Petitions Act to allow a similar electronic petition regime in the B.C. Legislature. Being a private member’s bill, it died on the order paper.

The originator of the anti-speculation tax petition on Change.org petition purports to be an Alberta resident who has owned vacation property in B.C. since 2006. A Gmail address is listed on the site, but the person who responded to theBreaker’s message declined to provide his or her name or do an interview. There is also a corresponding Twitter account which is also anonymous.

“I’m not trying to be mysterious,” said the response to theBreaker. “I’m just trying to protect my sanity and safety.”

The initiator of the petition claimed to have been the target of unspecified threats and answered in the affirmative when asked if a complaint had been made to the police. theBreaker subsequently asked for the name of the police force and a case file number as proof, but received no response.

The petition is also listed on the ScrapTheSpeculationTax.ca website that was registered by the public relations and lobbying firm Hill + Knowlton, a company that contributed $72,380 to the BC Liberals from 2005 to 2012. H+K vice-president Steve Vander Wal did not respond to theBreaker. Vander Wal worked from 2002 to 2006 as an aide in the BC Liberal government, including a year as then-Education Minister Christy Clark’s assistant.

The privacy policy page on ScrapTheSpeculationTax.ca describes all the ways that visitors’ personal information is received and collected. There is no name, office address or phone number listed for the campaign itself, only a “contact” email address.

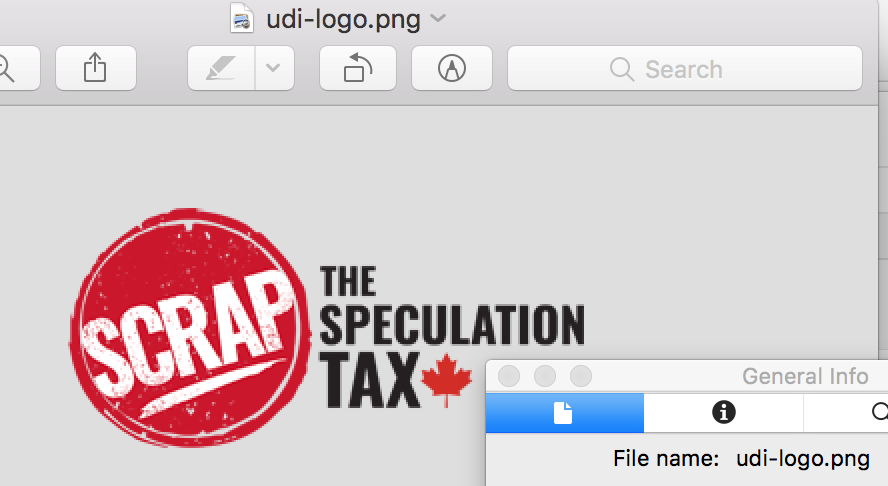

UDI logo from ScrapTheSpeculationTax.ca

The Urban Development Institute’s Pacific, Capital and Okanagan regional offices are listed on the website as members of the coalition supporting the campaign. Cheryl Ziola, spokeswoman for the real estate developers’ lobby, said: “The campaign engaged with Hill + Knowlton to provide communication support and assist with the technical aspects of getting the website up and running.”

Ziola did not fulfil theBreaker’s request to provide the name of the head of the coalition, the name of the client directing the campaign, or the organizer of the Change.org petition. When theBreaker moved the embedded logo from ScrapTheSpeculationTax.ca, the file name was revealed to be “udi-logo.png.” Ziola did not respond to theBreaker brought this to her attention in an email.

UDI CEO Anne McMullin did not respond for comment.

School tax revolt brewing

Meanwhile, the BC Liberals are setting their sights on another controversial NDP tax proposed in February’s budget. A protest is planned against the so-called Additional School Tax at a May 1 public meeting to be hosted by NDP Attorney General David Eby in his Vancouver-Point Grey riding.

The NDP plans to slap a 0.2% tax on the value of properties between $3 million and $4 million and 0.4% on the value above $4 million to fund schools. Those properties worth $3 million or more would only pay the tax on the amount that exceeds $3 million. Deferrals would be allowed for seniors and families with children at home.

Anti-school tax petition on Change.org

“When, and if, people fortunate enough to own a home in this price range decide to sell, they will benefit from a great windfall,” Eby wrote in a March letter to constituents. “This is a windfall that I know a number of us in this community – including a number of you who have written to me about this tax – agree is the product of a pernicious and corrosive housing affordability crisis that has badly hurt the sustainability of our community, and Vancouver as a city.”

Shaughnessy Heights Property Owners’ Association president Nicole Clement sent English and Chinese letters on March 27 to Premier John Horgan, calling the tax “unfair, arbitrary and counterproductive” because it would hit hard the seniors who bought their homes decades ago, but saw the values recently skyrocket through no fault of their own.

Eby’s attempt to replace the meeting at St. James Community Hall with a telephone town hall was unsuccessful. He had claimed there was interest outside the riding, but bent to pressure and decided to carry-on with the in-person event.

theBreaker learned that Westside opponents of the tax increase were scheduled to discuss strategies on a teleconference with BC Liberal leader Andrew Wilkinson on April 27. BC Liberal director of operations Kavi Bal also offered the group assistance from the party headquarters for project management, advice, media messaging and training. Bal, who studied for a real estate trading licence at UBC in 2010-2011, worked in 2014 to 2016 for Kinder Morgan’s communications department before joining the BC Liberal government caucus office.

It is expected the anti-tax protesters will draw attention to Eby’s riding office manager Dulcy Anderson whose partner is the oft-quoted University of B.C. business professor Tom Davidoff.

In early 2016, Davidoff was among a group of nine economists who proposed the B.C. Housing Affordability Fund with revenue from a 1.5% surcharge on foreign owners of vacant properties or those with “limited participation in the Canadian economy.” Six months later, the BC Liberal government slapped a 15% tax on Metro Vancouver house purchases by foreigners. It caused a brief decline in the market, which quickly recovered.

This anti-school tax campaign also features a Change.org petition, titled Say No to New Provincial Surtax on Property. Like the one mentioned above, it is also anonymous.

SHPOA’s MaryAnn Cummings, a retired lawyer, claimed in an email to theBreaker that SHPOA is behind the Change.org petition, which is in English and Chinese.

Said the petition’s preamble: “The NDP government has deceptively misnamed their new surtax on private property as a school tax. But it is plainly a wealth tax. And once they have smuggled it in, the categories of wealth will expand and the tax rates will rise.”

Support theBreaker.news for as low as $2 a month on Patreon. Find out how. Click here.