Bob Mackin

British Columbia’s public sector pension investor is listed in the Paradise Papers, the database of offshore investments leaked to a German newspaper and published by the International Consortium of Investigative Journalists.

B.C. Investment Management Corporation, which goes by the brand bcIMC, reported $135.5 billion in assets under management for the year ended March 31, 2017.

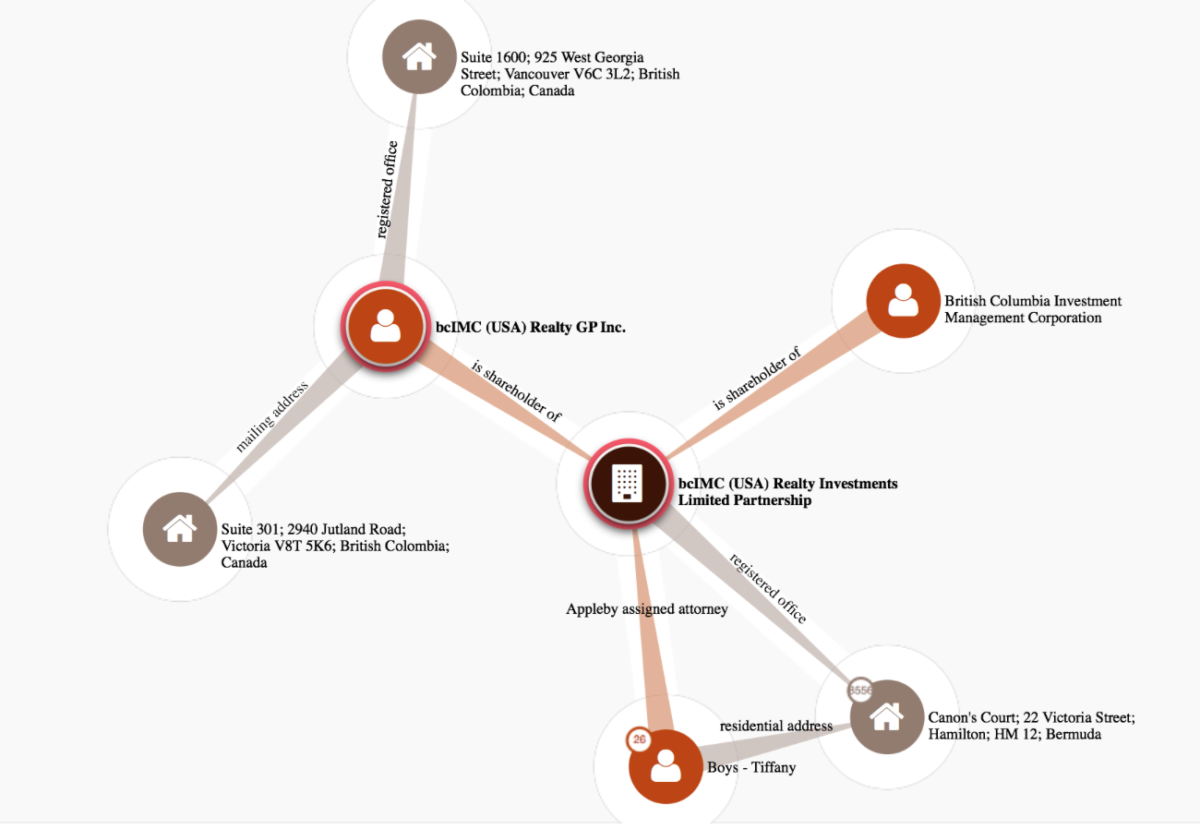

bcIMC and several related companies are in the database, including a bcIMC company registered in Bermuda at the tax haven’s now famous Appleby law firm.

The database, which was published Nov. 17, shows bcIMC (USA) Realty Investments LP was incorporated July 23, 2013 at a Canon’s Court address in Hamilton, Bermuda.

Before that, however, three bcIMC entites were shareholders of China Homes Limited, a company incorporated in Bermuda on Oct. 6, 1997 that closed Dec. 30, 2009. Its auditor was the Shanghai office of PricewaterhouseCoopers.

China Homes shareholders included bcIMC International Real Estate (2002) Investment Corp., bcIMC International Real Estate (2002A) Investment Corp., and bcIMC (WCB AF) Investment Real Estate Investment Corp., all with registered offices at the Vancouver law firm Lawson Lundell.

For a brief period — from March 15, 2002 to Nov. 13, 2002 — bcIMC’s 2014-retired CEO Douglas Pearce and vice-president of real estate

The 2014-retired Douglas Pearce (bcIMC)

Charles Swanson were directors of China Homes. The ICIJ database listed Pearce’s Brentwood Bay residence and the bcIMC office address.

Lawson Lundell is also the firm where BC Liberal leadership candidate Michael Lee was a partner from 2004 until he was elected to the Legislature last May in Vancouver Langara. Lee originally joined the firm in 1997 as an associate. His name appears on a B.C. Securities Commission form for an $849.6 million bcIMC Realty Corporation share offering in June 2015.

China Homes Limited does not appear in the most-recent edition of bcIMC’s investment inventory.

There are, however, 69 entities with China in their names. They amount to share values totalling $993.4 million. Another eight include Beijing in their names, totalling almost $50 million in share value. Many of the investments are in state-owned-enterprises.

Among the biggest of bcIMC’s China holdings are China Mobile Ltd. (15.49 million shares worth $223.3 million at the time of the inventory), China Construction Bank (133 million shares worth $110.3 million), China Merchants Bank (22.5 million shares worth $61.2 million), Bank of China (113 million shares worth $60.7 million) and PetroChina (63.75 million shares worth $54.9 million).

Contacted by theBreaker, bcIMC refused to comment. bcIMC chair Peter Milburn and Finance Minister Carole James did not respond.

Appleby has claimed to be the victim of a professional hacker. In a Nov. 5 statement on its website, it says it has committed no wrongdoing. “We are a law firm which advises clients on legitimate and lawful ways to conduct their business.”