Bob Mackin

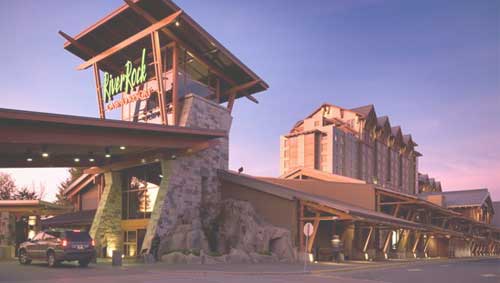

A 2016 report to British Columbia’s Gaming Policy and Enforcement Branch said gamblers from China used underground banks to bring large volumes of potentially dirty money to play at River Rock Casino Resort in Richmond.

The anti-money laundering report was commissioned by the previous BC Liberal government and dated July 26, 2016, but not released until Sept. 22 by the NDP government.

MNP was hired in September 2015 after the Gaming Policy and Enforcement Branch compiled a document that identified $13.5 million in $20 bills were accepted at River Rock in July 2015. That is 675,000 $20 bills. Stacked end-to-end, that would be 102.87 kilometres, the “as the crow flies” distance between River Rock and Whistler, the ski resort town that inspired River Rock’s design.

Information provided to MNP indicated that unsourced cash from unknown persons or persons believed to be connected to illicit activity “was dropped off at the casino or just off casino property for patrons at unusual times, generally late at night.”

“Law enforcement intelligence has indicated that this currency may be the direct proceeds of crime,” the report said. “The majority of this cash is being presented by persons commonly referred to as high roller Asian VIP clients. Single cash buy-ins in excess of $500,000 with no known source of funds have been accepted at [River Rock].”

The report said that VIP players used underground banks to get around cash transfer restrictions.

“Interviews have confirmed that players are indeed wealthy non-residents or business persons with interests both in Vancouver and China, coming to Vancouver to gamble. While the patron may be bona fide, the unsourced cash being accepted by the casino may be associated with criminal activity and poses significant regulatory, business and reputation risk.”

The report said that funding arrangements were confirmed through interviews by BCLC investigators with targeted patrons.

“The patron advises they are provided with a contact in Vancouver, either locally or prior to arriving in Vancouver. They contact the person via phone for cash delivery. The funds are later repaid through cash holdings in China. This transaction flow forms an underground or unregistered Hawala type operation using unsourced cash into the casino.” (Hawala is an Arabic term referring to international money transfer that is often used to launder money.)

The report said that River Rock staff fostered “a culture accepting of large bulk cash transactions,” but said there is lax, disorganized detection.

“BCLC’s current systems and technology do not allow analytics or system alerts for activity which is deemed to be suspicious or excessive,” the report said. “Staffing levels do not allow for deep dive investigations to be completed in a timely manner.”

River Rock accepted 675,000 $20 bills in July 2015 (Bank of Canada)

The report also said there is limited open source information available about Chinese nationals, which comprise the majority of the identified high risk demographic at River Rock.

“As most of the VIP patrons are Asian and many are recent immigrants to Canada or Chinese nationals there is limited Canadian open source information on which to base risk assessment determinations.”

“Report should’ve been made public” in summer 2016: Eby

In a prepared statement, Attorney General David Eby, whose portfolio includes oversight of B.C.’s gambling industry, said he received briefings after he was appointed and was provided the report.

“This report makes a series of serious recommendations for reform, which should have been made public at the time the report was complete,” Eby said. “I am making that report public today.”

Eby said he would soon announce an independent expert review of whether there is “unaddressed or inadequately addressed” money laundering in Lower Mainland casinos.

Attorney General Eby (Mackin)

In spring 2016, under then-gambling minister Mike de Jong, GPEB and the Solicitor General launched the Joint Illegal Gaming Investigation Team, a unit of the Coordinated Forces Special Enforcement Unit of B.C. It was the long-awaited replacement for the Integrated Illegal Gaming Enforcement Team, disbanded in 2009 by then-gambling minister Rich Coleman. Coleman is now interim leader of the BC Liberals after Christy Clark quit in August.

Last June, the organized crime fighting agency announced several arrests related to a major illegal gambling and money laundering investigation. Charges have not been announced. The government is trying to seize a mansion on Richmond farmland that was allegedly used as an illegal casino.

For the report, MNP’s Gregory Draper and Hayley Howe interviewed 23 employees and management of both River Rock and BCLC and analyzed data for reportable cash transactions provided by BCLC for Sept. 1, 2013 to Aug. 31, 2015.

MNP said there were 41,187 large cash transactions during the sample period, but only 1,194 suspicious cash transactions and 1,209 BCLC prohibition bans for potential money laundering. MNP found 385 of the large cash transaction reports were missing a mandatory field, such as the address or occupation.

From interviews and observations at the casino, the report said, “it is determined that source of funds and/or source of wealth information is not gathered for high risk, high volume cash players.”

The report said a statistical error found significant over-reporting of non-cash transactions to FINTRAC, the federal Financial Transactions and Reports Analysis Centre. MNP was unable to determine the actual number and amounts of large cash transactions. “Due to the complexity of the reporting issue, it is not possible to segregate and remove duplicate transactions.”

The report explained that BCLC has a top 100 players by volume list and a conditions list. The latter relates to “known associates of high risk players identified by law enforcement to be involved in the provision of large volumes of unsourced bulk cash to VIP patrons.”

Coleman (Mackin)

At the time of the review, 36 patrons on the conditions list also appeared on the top 100 list.

MNP found high turnover in management at River Rock and that an organizational chart from Nov. 26, 2015 said the manager of player relations and director of surveillance did not have a direct reporting relationship to senior managment. A vice-president of compliance position reporting to the president and CEO also did not exist on the chart.

River Rock also employs VIP hosts that cater to high rollers. They report to the marketing manager. They are responsible for managing client experience “which includes managing the amounts of complementary items and services given to players (commonly referred to as player comps), and providing custom gaming experiences with the intention of maximizing patron play.”

It took until almost 5 p.m. for River Rock parent Great Canadian Gaming to comment on the report. In a statement published Canada Newswire, the Richmond-headquartered company said it “strictly adheres to all regulatory requirements and maintains the highest standards of reporting” at its properties.

“We welcome the Minister’s review of the industry and our operations, and along with direction from GPEB and BCLC, we will adopt any further revisions to the regulatory structure should they direct BC casino operators to do so,” the statement said.

River Rock hosted a BC Liberal fundraiser starring then-Premier Christy Clark and international trade minister Teresa Wat in November 2016, where the party netted more than $124,000.

Elections BC’s database shows $114,704.65 in donations to the Liberals from Great Canadian. The NDP tabled a bill Sept. 18 to ban corporate and union donations. The bill includes a system of per-vote subsidies and expense reimbursements for parties, coupled with a $1,200-a-year individual cap.

The report was released a week before Paragon Gaming closes its Edgewater Casino at the Plaza of Nations and moves its licence across the street to Parq Vancouver, beside B.C. Place Stadium. The Sept. 29 opening comes on the eve of China’s National Day Golden Week, a time when visits from China to Vancouver naturally increase.

theBreaker exclusively reported how Paragon convinced the BC Liberal government to allow supersized tables to skirt a City of Vancouver-imposed 600 slot machine and 75 table limit.

Edgewater reported more than $5.2 million in $20 bill transactions between March and June 2014, according to CBC.

MNP Report by BobMackin on Scribd