Bob Mackin

The expert review of money laundering at Lower Mainland casinos isn’t restricted to what goes on around poker tables and one-armed bandits.

When Attorney General David Eby appeared before a House of Commons finance committee on March 27, he tabled a summary of Peter German’s report, which is due this week.

The University of B.C. law professor — a former RCMP deputy commissioner for Western Canada — urges new reporting requirements for a variety of sectors and a reorganization of the agency that tracks financial transactions.

B.C. Attorney General Eby in Ottawa, March 27.

In his summary, German called FinTRAC “an outlier” among the world’s financial intelligence units. Some 100,000 businesses and financial institutions must report large cash transactions and suspicious cash transactions to FinTRAC. Casinos must also report cash disbursements. FinTRAC analyzes millions of reports received annually and often shares intelligence with police and other agencies, but it does not work hand-in-hand with law enforcement.

“Law enforcement is not permitted to work within its offices. This is largely due to privacy and Charter concerns,” German wrote. “By contract, Fincen, the FIU in the United States, is staffed by law enforcement and other specialists. To a certain extent, Canadian police and FinTRAC work with blinders on, not knowing who has or needs what information until a proactive disclosure or a request for information is made.”

German also wrote that it is ironic that notaries public fall under FinTRAC reporting requirements, but lawyers do not.

“The absence of reporting by lawyers is a significant impediment to police investigations involving the movement of money through real estate and other financial sectors,” German wrote.

“Canada is an outlier here as well. Other common law jurisdictions, including the United Kingdom, have robust provisions in place which require financial reporting by lawyers. Quite frankly, consultation has occurred for years. There is a real need for legislation which can withstand a Charter challenge and requires the reporting of monies held in lawyer trust accounts.”

German’s summary said the prevalence of money laundering in the horse racing sector should be examined, and luxury items, such as supercars, should be subject to reporting.

“Vancouver has been described as the number one super car city in North America. Also, auto dealers in Greater Vancouver are among the highest new and used luxury car dealers in Canada, by sales volume,” German wrote. “In essence, an individual can walk into a luxury auto dealership and purchase a high-end vehicle with $400,000 cash. The only obstacle will be dealership policies.”

He also urged greater regulation of money service businesses. Although they must register with FinTRAC, only those in Quebec fall under provincial licensing.

“Many MSBs are unregistered and exist as a fixture within the underground economy. They tend to be the modern embodiment of underground banking and serve to move money around the world without the need for actual transmission. In place of electronic transfer, they rely on a settling of accounts at both ends of a transaction, or app to app, as it is sometimes called.”

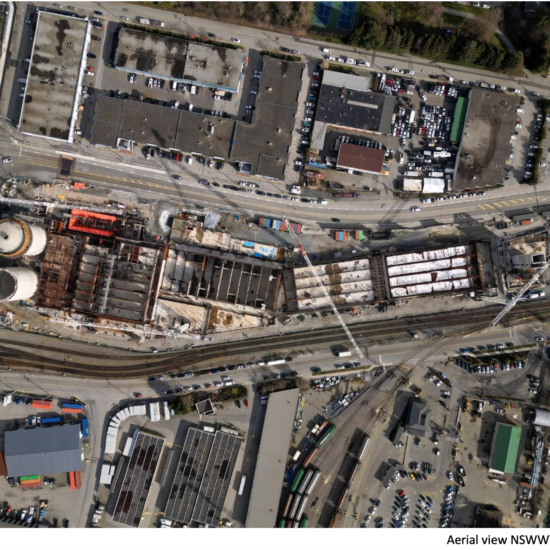

And, if German’s recommendations are acted upon, there could be renewed oversight for mortgage and title insurers, land registries and non-federally regulated mortgage lenders. The buck starts and stops with land and construction.

“It has been said that, ‘everything in B.C. comes back to real estate.’ It has also been suggested that you can see a ‘rat move through all of it,’ meaning the real estate market, mortgages, insurance, and so forth.”

Support theBreaker.news for as low as $2 a month on Patreon. Find out how. Click here.