Bob Mackin

The $1.25 billion First-Time Home Buyer Incentive in the Trudeau Liberals’ pre-election budget is based on a failed British Columbia scheme that was sharply criticized by the head of the federal housing agency.

The March 19-announced mortgage helper program offers qualified first-time home buyers a 10% shared equity mortgage for a newly built home or a 5% shared equity mortgage for an existing home. The buyer would repay the incentive at re-sale.

CMHC CEO Evan Siddall (CMHC)

The B.C. Home Owner Mortgage and Equity (BC HOME) Partnership was tailored by the BC Liberals to quell public anger after foreign speculators inflated prices in B.C.’s biggest real estate markets. The BC Liberals announced their $700 million, three-year program six months before the 2017 provincial election. They offered loans to first-time home buyers of up to $37,500 with no interest and no payments due in the first five years, for houses and condos up to $750,000.

BC HOME was slammed after the December 2016 announcement by none other than Canada Mortgage and Housing Corp. CEO Evan Siddall, who is now in charge of the federal First-Time Home Buyer Incentive.

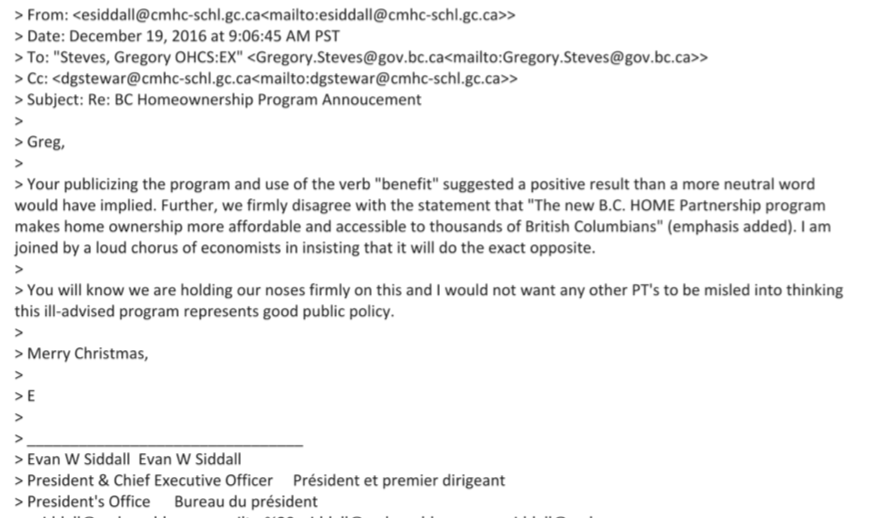

“Programs that support demand in supply constrained markets, like Vancouver, serve primarily to increase prices and make the affordability problem worse,” Siddall wrote to B.C. officials in email released to The Tyee under the freedom of information laws two days after the May 2017 B.C. election.

One of Siddall’s email messages panning BC HOME (BC Gov)

In another email, Siddall told a B.C. housing ministry bureaucrat: “You will know we are holding our noses firmly on this and I would not want any other [provincial or territorial government] to be misled into thinking this ill-advised program represents good public policy.”

theBreaker.news wanted Siddall to comment on the similarities and differences between the 2016 B.C. and 2019 federal programs, but was told by CMHC spokesman Charles Sauriol that he is not allowed to comment for the time being.

Finance Minister Bill Morneau’s chief of staff is Ben Chin, who was the top communications bureaucrat in Premier Christy Clark’s office. Chin also helped develop and launch the ill-fated B.C. program, but he did not respond to a request for comment from theBreaker.news.

Under the CMHC program, the budget said, “a borrower purchases a $400,000 home with a 5% down payment and a 5% CMHC shared equity mortgage ($20,000), the size of the borrower’s insured mortgage would be reduced from $380,000 to $360,000, helping to lower the borrower’s monthly mortgage bill.”

Rich Coleman selling mortgages in January 2017 (BC Gov)

The 10% rate for newly built homes is intended to stimulate construction, “particularly in our largest cities,” the budget said.

The BC Liberals said they hoped 42,000 British Columbians would be approved for BC HOME. But, after its first year, only 3,000 had applied. The minority NDP government, formed in July 2017 with support of the Green Party, cancelled the program in March 2018.

When theBreaker.news asked for a copy of the business case and cost-benefit analysis for BC HOME, the BC Liberal government sent an invoice for $1,140 because it claimed it would take 41 hours to find relevant documents about the 2016-devised scheme. When the NDP government came to power, it said the reports were covered by cabinet confidentiality.

Siddall frequently downplayed the impact of foreign investors, primarily from China, as the Vancouver market bubble grew. A new Statistics Canada report, however, says that almost one in five condos built in 2016 and 2017 in B.C. is owned by a non-resident and that 6.2% of all B.C. properties have one or more non-resident owners.

Support theBreaker.news for as low as $2 a month on Patreon. Find out how. Click here.