Bob Mackin

The Richmond company reeling from headlines about suspected money laundering by high rollers from China at its flagship casino wants a judge to stop the B.C. NDP government from releasing more documents to the media unless it is consulted first.

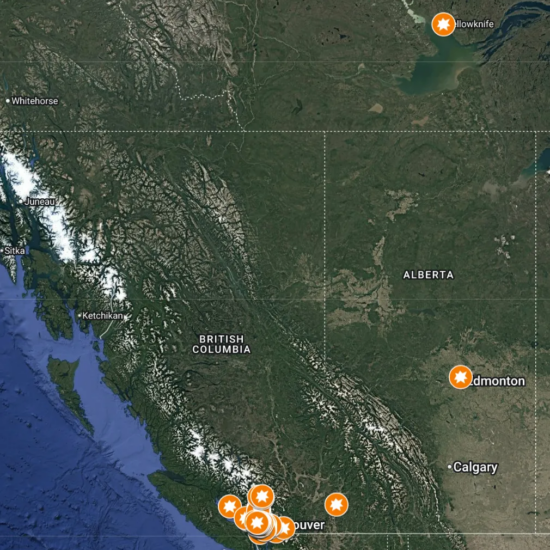

Richmond casino stung by money laundering headlines (GCG)

Lawyers for Great Canadian Gaming Corp. notified the Ministry of the Attorney General and Office of the Information and Privacy Commissioner that they will appear Nov. 14 at the Law Courts in Vancouver to ask for a court order.

Great Canadian’s Nov. 9 petition to B.C. Supreme Court says the government plans to release the second phase of documents to a reporter on Nov. 14. Great Canadian contends the government has a duty under the Freedom of Information and Protection of Privacy Act to consult it before any documents are disclosed.

“GCGC will suffer irreparable harm if the phase two disclosure is released without being provided with an opportunity to make the representation it is statutorily entitled to make,” said the court filing by lawyer Louis Zivot. “Once phase two disclosure is released to the public, the disclosure of information harmful to GCGC’s business interests cannot be undone.”

Documents released Oct. 6 to a reporter, and published two weeks later on the government’s FOI website, intensified public scrutiny of Great Canadian’s River Rock Casino Resort in Richmond. Postmedia’s Sam Cooper reported that a Gaming Policy and Enforcement Branch memo released in the first phase said 135 high rollers from the real estate industry accounted for $53.1 million of cash buy-ins at River Rock in 2015 and that the head of the agency, John Mazure, deemed money laundering at casinos a “viable threat to public safety.”

theBreaker was first to report on a July 2016 MNP investigation of suspected money laundering at River Rock that was finally released Sept. 22. MNP found that $13.5 million in $20 bills were accepted at River Rock in July 2015 and some gamblers made single cash buy-ins in excess of $500,000 with no known source of funds. The previous BC Liberal goverment suppressed the report before the May election. NDP Attorney General David Eby appointed anti-money laundering expert Peter German, a University of B.C. law professor and former head of the RCMP in Western Canada, to investigate.

The Great Canadian court petition says it was given no notice that the MNP report and the other documents would be disclosed, nor did it get the chance to explain why certain confidential information about its business operations should have been censored from those documents. It said the ministry had reason to believe the information would be excepted from disclosure under section 21, the “disclosure harmful to business interest of a third party” clause of the public disclosure law.

The petition says Great Canadian lawyers wrote to the ministry on Oct. 23, asking for no further disclosures until the company is allowed to review the records and make submissions. It claimed GPEB said the ministry would consult it if and when all three parts of section 21 apply: whether the records reveal trade secrets or commercial information; whether information was supplied in confidence; and whether disclosure would reasonably be expected to harm a third-party’s competition or negotiations.

Great Canadian claimed a ministry analyst told it that further phases may be released without consulting Great Canadian, so the company complained on Oct. 31 to the Office of the Information and Privacy Commissioner. It said a delegate of the commissioner initially advised that the ministry was ordered to suspend further disclosure, pending an OIPC investigation. A different delegate, on Nov. 6, said the commissioner would not prevent the ministry from releasing the second phase of records.

Great Canadian argues that OIPC erred by breaching the rules of natural justice and procedural fairnesss by refusing to order the ministry to make no further disclosures until the completion of its investigation.

The dispute between Great Canadian and the government appears to have caused a slowdown in disclosing related files sought by theBreaker. B.C. Lottery Corporation and the Attorney General’s ministry delayed the release of internal documents until Jan. 5. The Finance ministry, which was responsible for gambling marketing and regulation before the NDP, referred a request for quarterly anti-money laundering reports to BCLC, which said it would respond or invoke another delay by Dec. 21.

Great Canadian Gaming CEO Rod Baker (GCG)

Jessica Gillies, the Finance ministry’s FOI manager, refused to tell theBreaker whether officials found the reports in the ministry’s custody. Eby spokeswoman Megan Harris said they did not.

The same day that Great Canadian filed the court petition, it told shareholders that it earned $26.9 million on $159.6 million revenue during the quarter ended Sept. 30.

Great Canadian CEO Rod Baker sought to ease the concerns of stock analysts in a Nov. 9 conference call that was dominated by questions about the money laundering scandal. Baker denied the company is under investigation and maintained that it follows all laws wherever it operates. He said business at River Rock has not been impacted by the money laundering headlines, but neither has the controversy gone unnoticed.

“We have guests and other stakeholders that have been asking questions, and fair enough on them, if they’re reading things like this,” Baker told analysts. “And we’ve properly informed our team members to address those questions in a thoughtful manner, as we have done, I think in a very diligent and transparent fashion through our extensive release on Oct. 23.”

River Rock is undergoing renovations to add 140 slot machines and new food and beverage facilities. The number of slot machines was temporarily reduced between 100 and 200 during the quarter. While wagering increased at River Rock during the quarter, table hold fell.

“Our guests are happier this quarter than our shareholders, for sure,” Baker said. “We’ve seen these kind of fluctuations quarter-to-quarter and we’re not particularly happy about it, other than I just said the guest side.”

Great Canadian’s stock price hit $35.15 on the Toronto Stock Exchange on Sept. 15 after the Ontario government chose it and Brookfield Business Partners the previous month to operate three casinos in Greater Toronto, including one at the Woodbine race track.

On Nov. 10, the day after the quarterly report, Great Canadian stock closed at $29.71.

Ontario’s Progressive Conservatives wanted the governing Liberals to delay the deal with Great Canadian pending the results of German’s investigation.

A spokesman for the Alcohol and Gaming Commission of Ontario said it is in contact with GPEB in the wake of the B.C. headlines.

“The AGCO is conducting its own review to determine what reporting or other obligations the AGCO may require from Great Canadian Gaming,” said AGCO’s Ray Kanhert. “As well, the Ontario Provincial Police (OPP) Bureau within the AGCO is working with the RCMP for information it may have to share.”

Support theBreaker.news for as low as $2 a month on Patreon. Find out how. Click here.

Great Canadian Gaming FOI Petition by BobMackin on Scribd

GPEB Money Laundering Response_Package_FIN-2017-71581 by BobMackin on Scribd