Bob Mackin

British Columbia needs a new gambling regulator because the current one is dysfunctional, according to a report about money laundering in Metro Vancouver casinos by one of Canada’s leading anti-money laundering experts.

“The present regulatory system in B.C. does not work in terms of compliance and enforcement of [Anti-Money Laundering],” Peter German wrote in his June 27-published report, under the catchy title Dirty Money. “The foundational structure of the Gaming Control Act does not provide for a regulatory relationship between [Gaming Policy and Enforcement Branch] and [B.C. Lottery Corporation]… the regulator is embedded within the bureaucracy of government and does not have the necessary independence to act effectively.”

At a news conference in Vancouver on June 27, German said the new regulator should be a standalone Crown corporation and it needs to be augmented by a “specialized gaming police force” with round-the-clock presence at casinos.

German (left) and Eby on June 27 (Mackin)

German conducted 160 interviews during his six-month review, which he stressed was not a fault-finding mission, rather an examination of structure and process: “The failure was not of one entity or person, but the system.”

Lower Mainland casinos, German wrote, “unwittingly served as laundromats for the proceeds of organized crime. This represents a collective system failure, which brought the gaming industry into disrepute in the eyes of British Columbians.”

Years of denial, coupled with “alternate hypotheses and acrimony between entities,” he wrote, caused the “perfect storm” that climaxed in July 2015.

That is when an RCMP officer advised a B.C. Lottery Corporation investigator that police had been looking for a minnow, but found a whale — in reference to an expanding investigation involving a money service bureau, casino and proceeds of crime. GPEB investigators found that $13.5 million had passed through casino cash cages, mostly in $20 bills, the preferred currency of drug traffickers.

Late last September, Attorney General David Eby ordered the review from German, a former RCMP deputy commissioner, now law professor at the University of B.C. and the author of a leading anti-money laundering textbook. Eby said the previous BC Liberal government “turned a blind eye” to money laundering in B.C. casinos, in the mistaken belief it was a victimless crime.

“Nobody said no, nobody said do not accept this money unless you know where it came from,” Eby said.

German said the “epicentre of activity was at the River Rock, but no large casino was untouched.”

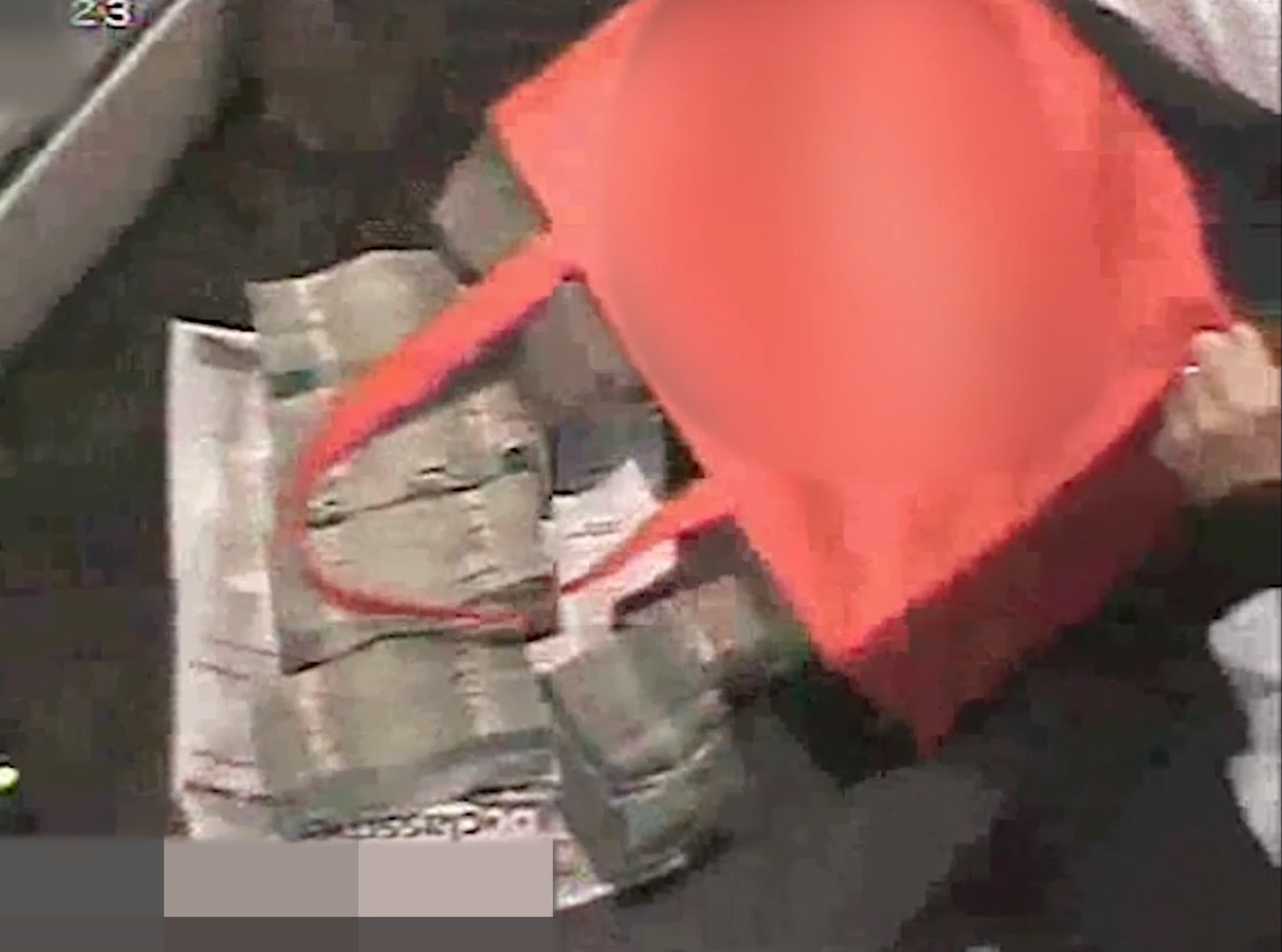

Indeed, as proven in a surveillance video that Eby narrated during the news conference. The clip showed highlights of large cash transactions at Starlight Casino, the Gateway-owned gambling haven on the far east side of Lulu Island, in an area governed by New Westminster.

“Who was doing this? Essentially, domestic and international organized crime, through intermediaries, was both loaning money to high rollers and hiring its own ‘smurfs’ to gamble,” German said. “What did they do? The gamblers, some of whom were dupes, turned small denomination bills into a more useful denomination or instrument.”

German said high-end money laundering gained intensity after 2010 and estimated that well over $100 million has been laundered through B.C. casinos. In April 2009, then-Solicitor General Rich Coleman shut down the Illegal Gaming Enforcement Team, after it had warned of organized crime infiltrating B.C. casinos. German said that Coleman cooperated with his review, but he did not see the need to interview the previous minister responsible for gambling, Mike de Jong, or his deputy, Athana Mentzelopoulos.

“[Money laundering] is a serious crime with serious consequences,” Eby said. “It is tied to the opioid crisis that has taken thousands of people from their families, it is linked to the real estate market and housing prices that have made life unaffordable for British Columbians.”

Police involvement, public scrutiny by investigative journalists and the actions of the gambling industry, German wrote, “dramatically reduced the quantity of suspicious money entering casinos from its high point in 2015.”

“We must ensure, however, that the problem does not resurface in the future.”

Confusion and chaos

German found that as early as 2012, some GPEB and BCLC employees recognized that small-time loan-sharking evolved into large-scale money laundering.

BCLC’s anti-money laundering efforts, he wrote, are under-resourced and BCLC was left in the role of “pseudo-AML regulator of its own franchises, the casino operators. GPEB was also frustrated by the reporting structure that existed for many years within the Ministry of Finance.”

The region’s casino operators, Great Canadian Gaming, Gateway Casinos and Paragon Gaming, serve as the front-line defence against dirty money in casinos. They receive cash, track movements of gamblers, and must complete and forward transaction reports to BCLC and GPEB.

A bag of cash from a surveillance video at Starlight Casino (BC Gov)

German’s report acknowledged the role of gamblers from China, but said many high limit gamblers who used dirty money were dupes and others were simply trying to remove their money from China, in order to make a life in Canada.

German wrote that this is not an Asian problem, but it is about those who buy illegal drugs, counterfeit products and stolen property and others who operate in the underground economy to avoid taxes.

“Who is buying the drugs? It’s actually people in this province that are buying the drugs,” German said. “It is easy to point the finger elsewhere abroad, and so forth, but we also have to realize illegal drug sales occur right here and that money gets laundered right here.”

Will any heads roll?

In 2007, the BCLC board fired then-CEO Vic Poleschuk after a damning report by the Office of the Ombudsperson into lottery ticket retailers who had won big prizes. In this case, Eby laid the blame for the systemic failure at casinos squarely on the previous BC Liberal government, not the senior management of BCLC or GPEB who were tasked with implementing policy.

“In my opinion, the responsibility lies with government, and the [BC Liberal] government has been removed,” Eby said.

Jim Lightbody remains CEO of BCLC. Eby said GPEB Assistant Deputy Minister John Mazure’s departure was a personnel matter not related to German’s report. Career bureaucrat Mazure’s resume includes stops at treasury board, the environmental assessment office and the government’s pension department.

Eby cited time and cost for not holding a public inquiry.

“The downside of trying to move quickly on this is the loss of some accountability, the loss of the ability to say this person violated this policy, this person violated that law,” Eby said. “The upside of it is, from British Columbians’ perspective, is that we can act quickly to get dirty money out of B.C. casinos and move on to the next piece because we can’t let organized crime get ahead of us.”

“The next piece” is for German to examine the role of money laundering in real estate, luxury cars and even horse racing.

In total, German made 48 recommendations, nine of which are completed or underway, including weekly meetings by a suspicious transaction analysis team, ending BCLC undercover operations, except in conjunction with the regulator and/or police, and spending no more money on the malfunctioning SAS anti-money laundering software.

Eby said the rest of the recommendations are either being implemented or under review.

“In all cases, we will be moving as quickly as possible to slam the door shut on dirty money in B.C. casinos and cut off funding to organized crime in our province,” he said. “It won’t be easy to reverse a decade and a half of neglect, but we are not waiting to get started. The era of inaction and denial is over.”

Support theBreaker.news for as low as $2 a month on Patreon. Find out how. Click here.