Bob Mackin

Twenty-five years after his government bowed to public pressure and withdrew a proposed surtax on expensive houses, a former NDP Premier is suggesting Premier John Horgan do the same.

In an interview with theBreaker, Mike Harcourt said the additional school tax in finance minister Carole James’s February budget would cause hardship for widows and pensioners.

“I hope they have a second look at it, because a lot of people on the Westside are not speculators, they’re not people that are flipping properties,” said Harcourt, B.C.’s premier from 1991 to 1996. “They’ve been living in their properties for a long time and bought, in a lot of cases, 30 to 40 years ago, when they were a lot less valuable.”

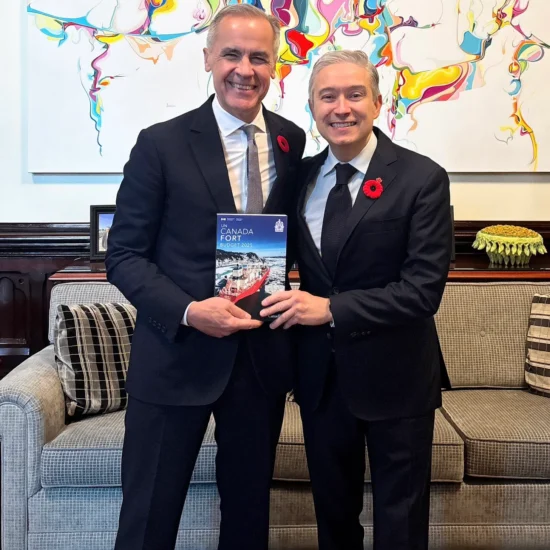

Mike Harcourt, B.C.’s 30th premier (True Leaf)

Harcourt, 75, owns a house in Vancouver near the stretch of Point Grey Road that was closed for a bike lane and nicknamed the Golden Mile. The 2012-built house was assessed last year at $3.391 million. Based on the NDP governmenet’s proposed 0.2% levy on the value of property over $3 million, he would pay $782 in school taxes, in addition to the civic levy. Last year, $3,245.99 of Harcourt’s $8,690.78 civic tax bill went to schools.

“There’s already the expensive properties on the Westside that have already been carrying a pretty substantial part of the school tax, particularly over the last decade or so,” Harcourt said. “It seems to be a tax on a tax.”

For those owning property worth $4 million and up, the surtax would be 0.4%. Tax deferrals would be available for seniors and families with children at home.

James estimated the measure would bring $250 million to the treasury over three years, but it has put Vancouver-Point Grey NDP MLA and Attorney General David Eby on the defensive

“When, and if, people fortunate enough to own a home in this price range decide to sell, they will benefit from a great windfall,” Eby wrote in a March letter to constituents. “This is a windfall that I know a number of us in this community – including a number of you who have written to me about this tax – agree is the product of a pernicious and corrosive housing affordability crisis that has badly hurt the sustainability of our community, and Vancouver as a city.”

Attorney General David Eby (BC Gov)

Eby cited safety reasons when he cancelled a May 1 public meeting at the St. James Community Hall after ads by two real estate agencies and an open letter from BC Liberal leader Andrew Wilkinson encouraged opponents go to the hall, whether they have tickets or not. theBreaker has seen evidence that the anti-tax campaign is orchestrated at BC Liberal headquarters by the party’s operations director, Kavi Bal.

In the 1993 budget, Harcourt-appointed finance minister Glen Clark proposed an additional tax to fund schools, beginning at $5 for each $1,000 assessed value on a house worth $500,000.

It sparked a week-long tax revolt, as letters and phone calls from angry taxpayers flooded the riding offices of Harcourt and fellow Westside NDP MLAs Darlene Marzari and Tom Perry. Under the measure, Harcourt faced a $695 bill on his $639,000-assessed house. Out of an abundance of caution, he left it to Clark to axe the tax.

A headline on a Globe and Mail story said it all: “B.C. backs down on plan for heavy property surtax; too many house rich, cash poor.”

“The people who are not rich who were captured by this, that was never our intent,” Clark told the Vancouver Sun. “And I certainly apologize for the problems it’s caused them over the past week.”

Fast forward to 2018, and the Westside and West Vancouver have become magnets for wealthy Chinese real estate investors and sites of some of Canada’s most-expensive mansions. Harcourt said measures are already in place to dampen demand, such as the tax on vacant houses and foreign buyers. He said the best solution is to increase supply.

“A tremendous expansion of supply of affordable housing in particular,” Harcourt said. “I hope the government succeeds with its goal of 11,000 new affordable housing units a year, mostly rental, all multifamily townhouse and apartments and some sort of starter home program for younger families. That’s what we need to do is have a substantial increase in supply, not just the measures to dampen down on demand or to do the tax on a tax.”

Support theBreaker.news for as low as $2 a month on Patreon. Find out how. Click here.