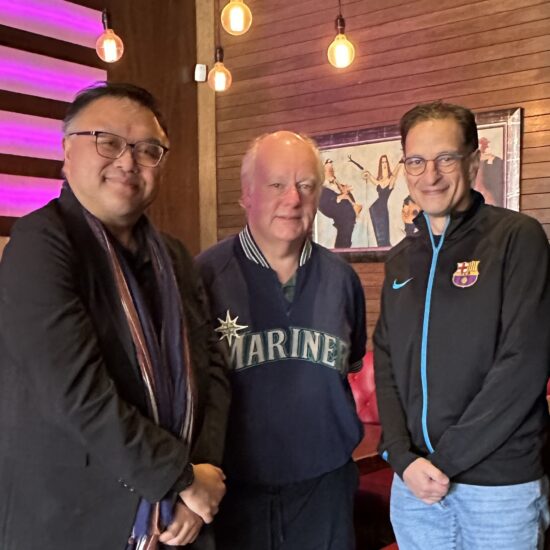

More details of Vancouver Mayor Ken Sim’s motion to make Vancouver “Bitcoin-friendly,” like Seoul, South Korea, Zug, Switzerland and El Salvador.

Vancouver Mayor Ken Sim (Mackin)

“It would be irresponsible for the City of Vancouver to not look at the merits of adding Bitcoin to the City’s strategic assets to preserve the city’s financial stability,” Sim wrote in his lengthy motion to the Dec. 11 meeting.

What Sim doesn’t mention is what appears on his 2024 Statement of Disclosure: his investments in Purpose Bitcoin ETF, the “world’s first Bitcoin exchange traded fund”; Coinbase Global cryptocurrency exchange platform; and Bitcoin miner MGT Capital.

The final report of B.C.’s public inquiry into money laundering warned that cryptocurrency is a crime magnet in need of provincial regulation.

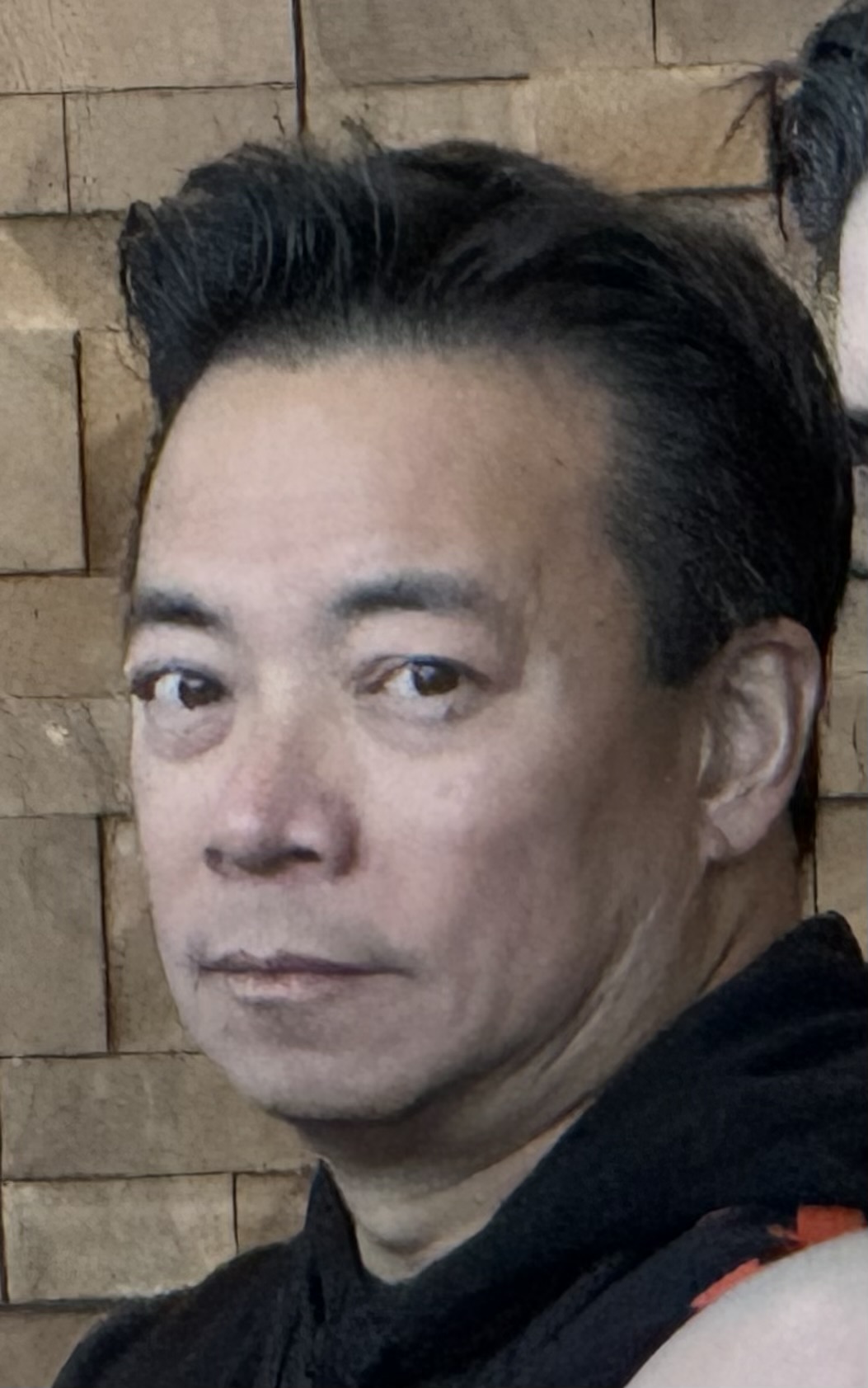

Following are highlights of what Commissioner Austin Cullen wrote in his June 2022 report to the NDP cabinet.

Popularity

Bitcoin is the most popular and well-known cryptocurrency. Although more than 7,700 cryptocurrencies exist, over 62% of cryptocurrency transactions are done in bitcoin. Its popularity is due mostly to its accessibility: it was the first widely accepted and used cryptocurrency and is the most widely featured, accepted, and exchanged, rendering it more accessible for new users. People sometimes use the term “Bitcoin” when generically referring to cryptocurrency, and much of the focus in the evidence before me was on Bitcoin rather than cryptocurrencies generally.

Oversight needed

Cryptocurrency is a new and rapidly evolving technology that is already being exploited for money laundering and other forms of criminality. Because of its newness, many – including government, regulators, and law enforcement – lack the expertise to investigate crime that makes use of it. These features make cryptocurrency vulnerable to exploitation by money launderers.

The regulation of cryptocurrency is very new – the Proceeds of Crime (Money Laundering) and Terrorist Financing Act has only captured it since 2020. That is a good first step. But given the significant risks in this sector, the Province should also regulate virtual asset service providers. The Province will need to determine who is best suited to do this, whether it be B.C. Financial Services Authority, the B.C. Securities Commission, or another body. It is crucial for government, regulators, and law enforcement to develop in-house expertise on cryptocurrency.

Justice Austin Cullen (Mackin)

Crime categories

It is convenient to consider crime involving cryptocurrencies in four broad categories. First, and of most obvious importance to this Commission, is the use of cryptocurrency in money laundering. Second, cryptocurrency has been used to engage in financial transactions and activities associated with the commission of crimes such as scams, ransomware, and activities on the dark web. Third, cryptocurrency can be used to support terrorist activity. Finally, crimes occur on the cryptocurrency platform itself, such as theft or fraud.

Not so bad

However, it is important to keep in mind that there are many legitimate users of cryptocurrency and that, by some estimates, the criminality associated with virtual assets appears to be a fairly low percentage. Regulation must strike a careful balance to take care not to stifle innovation in this area or penalize legitimate users, while also addressing key risks that arise.

NEW: Subscribe to theBreaker.news on Substack. Find out how: Click here.