Bob Mackin

The centrepiece of the BC Liberals’ affordable housing platform has fallen far short of expectations.

Last Dec. 15, Premier Christy Clark announced the B.C. Home Owner Mortgage and Equity Partnership scheme, offering loans up to $37,500 for first-time buyers of houses worth up to $750,000. The 25-year loans are interest-free and payment-free for the first five years. The government said the $703 million program would benefit 42,000 buyers over three years.

Documents released under the freedom of information law to theBreaker on May 9, provincial election day, said the government expected to issue 2,778 loans worth $47 million by March 31.

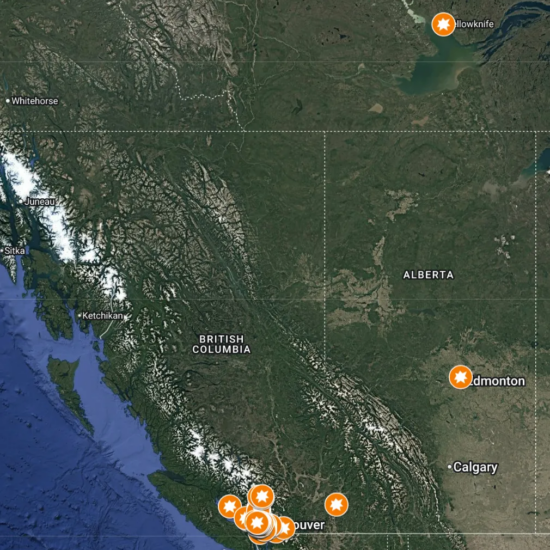

An April 7 news release by BC Housing, the Crown corporation administering the program, said that only 352 first-time buyers since the program’s Jan. 16 launch would receive a combined $5.3 million in loans on closing of their purchases. Another 645 applicants had been pre-approved. (Neither BC Housing nor the Housing Ministry responded with information updates to theBreaker by deadline on May 18.)

Coleman at a mortgage store on Jan. 16. (BC Gov)

The December 2016 technical briefing document also contemplated issuing 11,110 loans worth $185 million in the 2017-2018 fiscal year. By March 31, 2020, the government expected the average loan amount would be $16,685.

theBreaker asked the Rich Coleman-controlled Housing Ministry on Feb. 24 for a report that explains and justifies the program cost and the loan terms. The government responded March 27, claiming that it needed an extra 30 business days, until May 10. The records were sent to theBreaker just before 11 a.m. on election day.

The Tyee’s Andrew MacLeod reported that the government sent him December-requested documents about BC HOME on May 11, two days after the election. Those documents included correspondence from Canada Mortgage and Housing Corporation CEO Evan Siddall, who said the program stunk.

“You will know we are holding our noses firmly on this and I would not want any other [provinces and territories] to be misled into thinking this ill-advised program represents good public policy,” Siddall wrote.

The program was originally called Downpayment Assistance Program, but rebranded as Home Purchase Assistance Program and Home Ownership Partners in Equity before the Dec. 15 BC HOME unveiling. It was heavily marketed in the government’s controversial $15 million Our Opportunity Is Here pre-election advertising campaign.

The documents also showed that the number of units built by BC Housing has fallen since Clark took over the premiership from Gordon Campbell in March 2011.

Between 2006 and 2011, BC Housing built 9,508 units through 309 projects, costing $2.025 billion. That fell to 7,226 units at 198 projects, worth $1.626 billion, under Clark.

theBreaker previously reported that a Coleman aide gave someone outside government a sneak peek into the BC HOME program last July. But the person’s name was censored from an email.

After Clark and Coleman announced the program in a glitzy pre-Christmas news conference, dozens of angry citizens complained to Clark’s office by email. The citizens threatened to vote NDP if Clark didn’t cancel the state-subsidized, subprime mortgage program.

Unversity of B.C. economist Tom Davidoff said BC HOME wouldn’t solve the affordable housing crisis, but would instead inflate prices at the low-end of the market and saddle young buyers with more debt.

BC Home – Mackin FOI by BobMackin on Scribd