Bob Mackin

Pemberton Music Festival may be remembered more for being a money pit than for its mosh pit.

The owner of a temporary power company owed $55,000 from the bankrupt festival said he is afraid the taxman will be the only one paid.

“I think there will be nothing left, there is no assets to cover the liability,” said Production Power’s Lewis Neilson after a meeting of creditors on June 6. “They owe about $13 million, they have potentially $3 million, there is a $10 million hole that just won’t be filled. I expect that none of the unsecrured credtiors will get any money, [Canada Revenue Agency] will get most of the money.”

At the Robson Square meeting, Ernst and Young vice-president Kevin Brennan delivered a sobering report on the festival’s financial woes. The two secured creditors, owed $3.5 million, agreed to waive their claims, after helping fund almost $50 million in losses over three years before tickets went on sale for the cancelled 2017 version.

Site of Pemby Fest creditors meeting (Mackin)

Neilson said those who spent a combined $8.2 million on tickets for the cancelled July 13-16 festival should really be first in line, because they paid in good faith and don’t deserve to be victims of others’ mismanagement. He said New Orleans-based promoter Huka perennially overpaid for imported labour and equipment and would take until the February following the mid-July festival to pay invoices to local suppliers.

“We assumed they were taking the further year’s ticket sales to pay off the prior year’s debt, so eventually it just has to catch up with you,” Neilson told reporters. “It’s a pyramid scheme.”

The Ernst and Young report blamed the festival’s demise on four factors: sluggish 2017 ticket sales, the weakened Canadian dollar, failure to find additional funding, and increased difficulty in sourcing talent in 2017.

Live Nation staged the original Pemberton Music Festival once in 2008. In late 2013, Huka and a local investment group, Janspec Holdings, agreed to resurrect the festival for 2014, with Huka originally forecasting a US$2.4 million profit. Janspec’s holdings include the festival venue, Sunstone Ranch, and directors include Langley’s Amanda Girling and White Rock’s Jeremy Turner. They are heirs to the fortune of their late father, Clifford Turner, a co-founder of the British-based Linpac packaging empire.

Slow ticket sales forced a forecast revision by the end of May 2014 to a US$6.9 million loss. The festival, headlined by Nine Inch Nails, Deadmau5 and Soundgarden, drew 17,700 per day, and eventually lost C$16.9 million.

“The Canadian investors notified Huka of their dissatisfaction and demanded significant changes to the PMF oversight and its ownership structure,” said the report.

The 2015 festival initially estimated a US$4 million loss. The month before, Huka told the Canadian investors they needed an additional US$4.5 million and C$2 million; they advanced US$3 million and C$2 million. The festival, headlined by Kendrick Lamar, Black Keys and Missy Elliot, drew 25,151 per day and lost C$16.8 million.

“With continued losses funded exclusively by the Canadian investors, their further involvement with the PMF was uncertain,” the report said. “On Oct. 29, 2015, Huka assured the Canadian investors that the PMF brand was growing, that the 2016 PMF would, at minimum, break-even financially and that Huka was making progress in discussions with other potential investors.”

In March 2016, the Canadian investors loaned US$3.1 million to Huka. Before mid-April, 25,000 tickets were sold, but sales of camping passes were halted because Huka failed to gain government permits. Pass sales finally resumed in June. The Canadian investors loaned another C$1 million to Huka in early July and were faced with Huka’s threat to cancel the festival at the 11th hour.

“Only July 13, 2016, the day prior to the 2016 PMF and, with approximately 20,000 campers already on festival grounds, the Canadina investors were informed by Huka that the 2016 PMF would have to be cancelled if an additional US$3.6 million was not immediately paid to cover cost overruns.”

Janspec agreed to the loan demand in exchange for promissory notes. The Pearl Jam, Snoop Dogg and Killers-headlined festival lost C$14 million. The Canadian investors loaned Huka another C$2 million after the festival to pay outstanding invoices.

Losses mounted, changes demanded

Janspec sought advice from a Canadian producer, who was not identified, in October 2016. They met with “two highly recognized producers” about reorganizing the 2017 festival, but neither would participate if Huka and its principals remained involved.

In early 2017, Huka balked at Janspec’s offer to buy out Huka’s interest in the festival. Two offers to buy interest in Huka and the festival were withdrawn.

At the end of March, Huka budgeted C$28 million to produce the 2017 festival, based on 40,000 attendees per day. The producer consulting with the Canadian investors submitted a C$23 million budget, based on 45,000 attendees.

Ticket presales began Feb. 23, but Janspec told Huka, in writing, that they would not continue if Huka was to continue its role and alleged that Huka breached the land licensing deal. The parties went into mediation for three weeks in April, which led to a Huka subsidiary, Twisted Tree, being replaced by a numbered company, 1115666 B.C. Ltd., as the general partner.

Girling, Burnaby mining company executive Jim Dales and Huka representative Stephane Lescure were the three directors.

Between April 19 and 28, C$4.1 million was released by TicketFly Inc. to Huka, to pay $3.2 million in deposits for performers, vendors and producer fees. Public ticket sales resumed May 2.

The Canadian investors told the trustee that Huka made unfulfilled promises to bring in a new investor, and that Huka made US$3.45 million in producer fees, but “the Canadian investors had received no funds in return on their investment.”

Janspec’s Wilcox (Mackin)

The B.C. numbered company’s directors voted for bankruptcy on the evening of May 16. In the morning of May 18, Ernst and Young filed with the Office of the Superintendent of Bankruptcy.

Dales attended the meeting, but did not answer any creditors’ questions or stop to speak with reporters outside. Likewise for Janspec vice-president Nyal Wilcox, who left with a “no comment.” After the meeting, theBreaker visited the Janspec office on the seventh floor of John Robson Place on Robson Street. Girling was seen in the office by a reporter, but she did not respond to a question about the money owed to ticketholders. Wilcox blocked theBreaker’s camera, asked a reporter to leave immediately and locked the door.

theBreaker’s phone calls to Huka founder A.J. Niland and CEO Evan Harrison were not returned.

Brennan’s report said there is interest in reviving the festival, but “there are a myriad of complex issues to hosting an event such as the PMF, including the required governmetnal and other approvals.

“The trustee cautions the public and ticketholders that, nothwithstanding media reports that parties are seeking to host the previously cancelled festival, the likelihood of a successful event for 2017 is highly unlikely,” the report said.

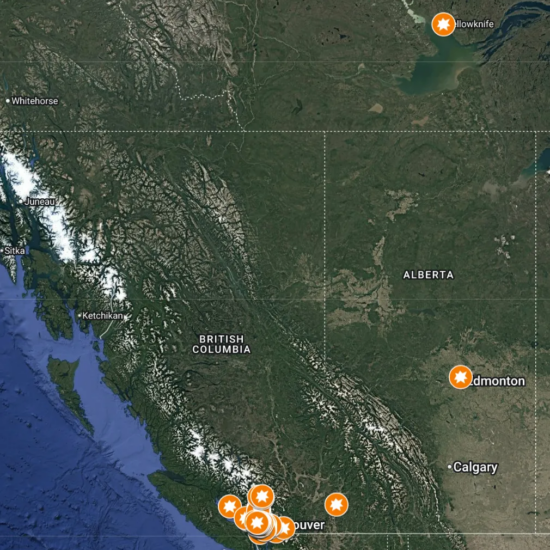

Joseph Spears, a Horseshoe Bay businessman with 2 Narrows Productions, is putting together a group aiming to salvage the festival this summer. He wants to make it a charity event under the Canada 150 banner. Spears said he hopes it can happen on the festival site in Pemberton on the original July 13-16 dates, but he said alternate dates and venues are being considered. Spears’ group includes Neilson and Los Angeles-based James Thomas Productions. He said he is in touch with representatives of the trustee and Janspec, but declined to discuss details because of a confidentiality agreement.

“I’m pretty confident that we can sort all of this out and move forward,” Spears said. “As you clean up the past, we’re looking forward, we’re not looking behind. We’re looking onto the horizon, seeing Mount Currie rise and so will the festival.”