Bob Mackin

Developers are laughing at Premier John Horgan, because the NDP’s speculation tax does nothing to address demand by domestic and foreign property flippers.

That is according to an email sent to the Premier’s office from someone who claimed to be a developer and supporter of David Eby’s 2017 re-election. The sender’s name was censored by the government for privacy.

“Sadly, this new budget did nothing but open champagne bottles through the development community all day and night. Why? Because you are continuing to allow the ‘same old, same old,’” read the Feb. 21 email released to theBreaker under freedom of information.

“Developers are laughing at you,” the person wrote, because they will continue to sell suites and homes in bulk to local and offshore property flippers “known as ‘whales’ in the development community.”

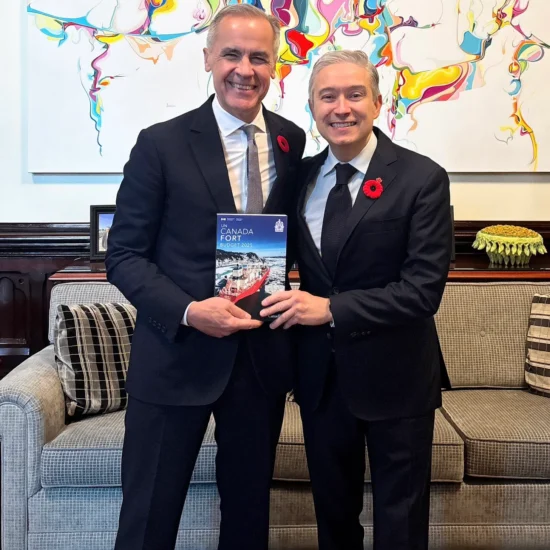

Premier John Horgan and Wang Chen, a member of the Chinese Communist Party’s Politburo (Rich Lam photo)

The correspondent proposed restricting sales of all residential properties — including pre-sale and re-sale condos, townhomes and houses in the City of Vancouver — to Canadian-resident, owner-occupiers. “Developers and realtors will cry foul as they will go from stratospheric profits to extremely high profits. By removing the global (and local) investor/speculator, you will be doing what you were elected to do — serve your taxpaying citizens who are looking to purchase homes!”

The email was among 39 pages released to theBreaker on June 12 about post-budget reaction from citizens to the increase and expansion of the foreign home buyers’ tax and the introduction of a real estate speculation tax.

Email from residents of Vernon, Sunshine Coast and Penticton seeking relief from a bubbling real estate market complained their areas weren’t included.

“I hope you will continue with the momentum, and close loopholes such as bare trusts which allow foreign buyers to avoid disclosing their nationality and other money laundering in our markets,” reads a Feb. 23, 8:16 a.m. email. “Drain the swamp!”

“Speculators, flippers, drug money, etc etc – use the whole province as a PIGGY BANK – why not impose these real estate rules province-wide?” wrote someone at 2:59 p.m. on Feb. 23. “Why the discrimination? Our children, grandchildren will never be able to purchase a house, destined to live as renters, deal with landlords — so sad!!!’

The sender of a Feb. 22, 12:15 p.m. message proposed channeling foreign capital into low-cost housing. A Feb. 23, 11:32 a.m. writer claimed to have voted NDP and did not support the foreign buyers’ tax increase, calling it racist to single-out people from other countries and punish them with a high tax rate. “Not everyone from another country is laundering money here, many are honest.”

Five emails decried the lack of tax or regulation on Richmond farmland.

“I live in Richmond and have been watching with horror as Richmond Mayor and Council have ignored the majority of Richmond citizens in favour of developers and corrupt realtors who have ruined our most precious resource,” reads one of them, sent Feb. 22, 7:54 p.m. “With all due respect, you seemed to go out of your way (to) exclude farmland. Why did you fail to protect farmland?”

A dozen emails expressed concern about the imposition of a speculation tax on recreational properties.

Said a Feb. 23, 3:09 p.m. email: “The B.C. government’s latest attack of non-residents who already pay 30% more property tax than B.C. residents and use less services have been included in your government’s efforts to control an out of control housing market in Vancouver fuelled by what now the B.C. government admit is money coming from foreign buyers with no traceable income. The collateral damage to the government’s misguided policy is us.”

The writer of a Feb. 21 email said his or her family moved from B.C. to the U.S. for employment opportunities.

“We still own our Vancouver home. We want to keep our Vancouver home as a vacation home so we can stay there when we visit family and friends in B.C or when we have a ski trip to Cypress or Whistler. Did we do anything wrong that warrants the punishment of the 2% speculation tax? There is nothing speculative about our ownership of the home. We worked hard, paid $10,000s of tax, saved enough down payment and bought our first home. So for expat Canadians like us, the only option is to just sell the house and never come back for a visit? (The strata has bylaw forbidding rental so even if we wanted to rent we cannot.)”

A retired septuagenarian couple living in a Kelowna townhouse, who spend 120 days a year in a West Vancouver condo, feared prohibitive costs.

Finance Minister Carole James (BC Gov)

“We are highly stressed by this possibility as we cannot possibly afford to pay the massive annual tax that would be assessed to us. It would force us to have to sell…. we have always paid our fair share, but this additional $12,000 or more annual tax is not acceptable to us.”

On March 27, Finance Minister Carole James softened the blow, by limiting the areas where tax will be charged and exempting properties worth less than $400,000, if owned by a British Columbian. Resort areas like Harrison Hot Springs and the Gulf Islands are not covered anymore. Whistler was not among the areas targeted in the first place.

The Urban Development Institute launched a campaign, by multinational lobbying firm Hill and Knowlton, to oppose the measures. It includes an anonymous-organized online petition, that was rejected by the Legislature’s clerk, and an anonymous-organized Facebook page.

British Columbians who own more than one house that is not rented for at least half the year are subject to a 0.5% rate. Rates for out-of-province owners are 1% and foreign owners 2%.

theBreaker filed the application on March 8. It was supposed to be due April 23, but delayed by the government to June 5 to consult with an unnamed third party or public body. The records were released June 12, a week later than the revised deadline.

Jinny Sims, the minister in charge of the government’s FOI office, was ordered last July with orders by Horgan to “improve response and processing times” for FOI requests.

Support theBreaker.news for as low as $2 a month on Patreon. Find out how. Click here.

OOP 2018 81669 Real Estate Taxes by BobMackin on Scribd