Bob Mackin

Surrey Centre Liberal MP Randeep Sarai met last October with an executive from a credit union that is not only seeking to expand nationwide, but is the same credit union that sued Sarai and his business partners for defaulting on a loan.

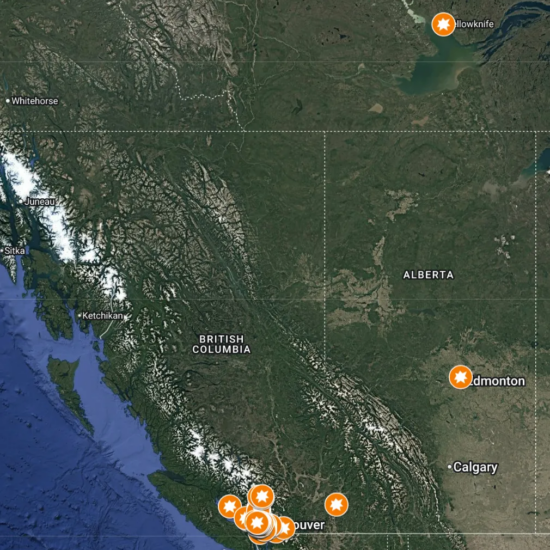

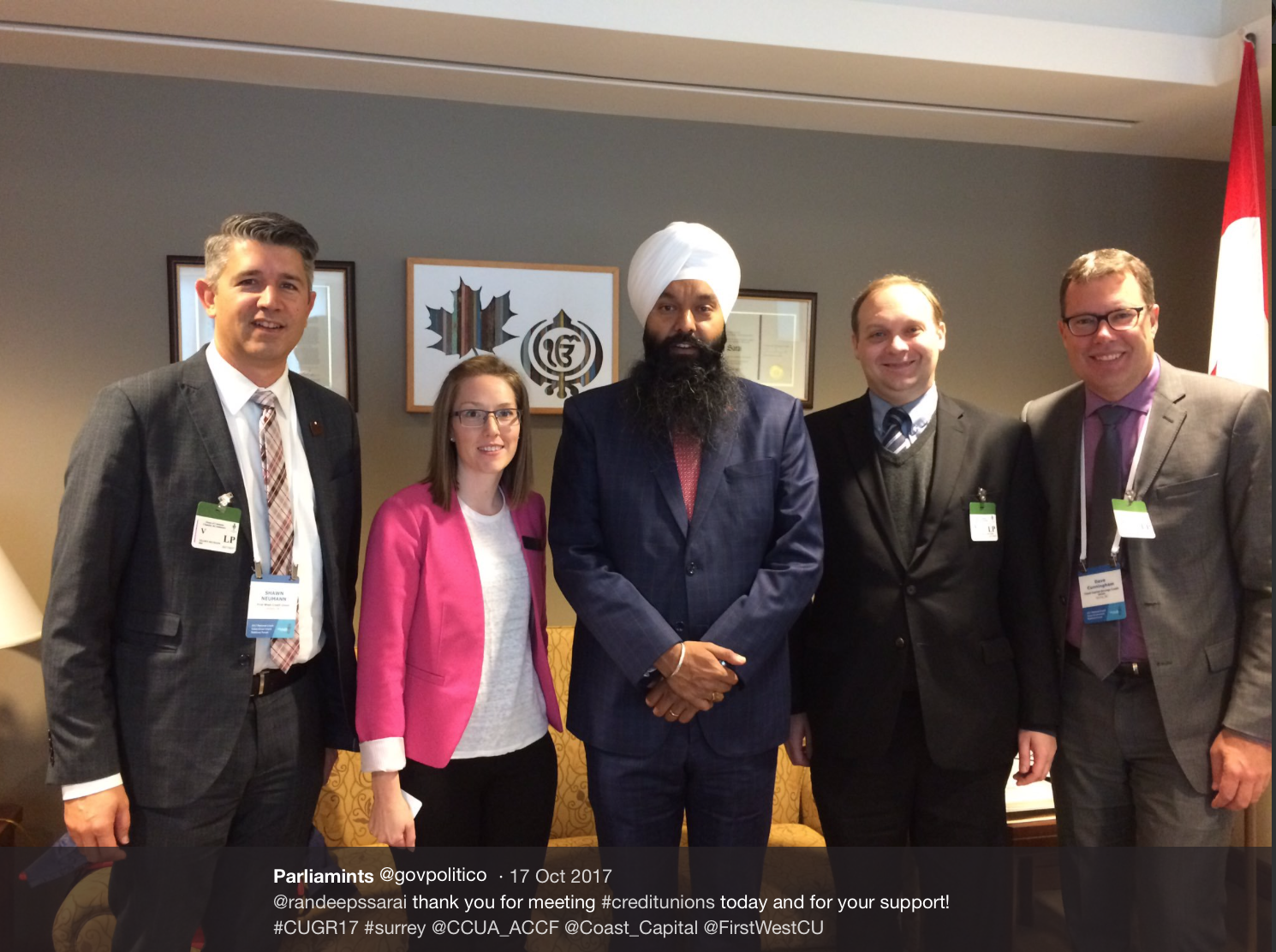

The federal lobbyist registry shows Coast Capital Savings Credit Union CEO Don Coulter reported communicating with Sarai on Oct. 17, 2017. The credit union, Canada’s biggest by membership, is headquartered in Sarai’s Surrey Centre riding.

An Oct. 17, 2017 photograph on Twitter shows Sarai in his office with several people, including Coast Capital vice-president of communications Dave Cunningham. Coulter is not in the photograph. The reason for the meeting was the annual “Hike the Hill” National Credit Union Government Relations Forum. McDonald said Coulter was not at the meeting, but reports to the lobbying commissioner must be filed in the name of the most senior executive.

Coulter left in January to join Saskatoon-based Concentra Bank as its CEO, yet Coast Capital has not updated its federal lobbying registration.

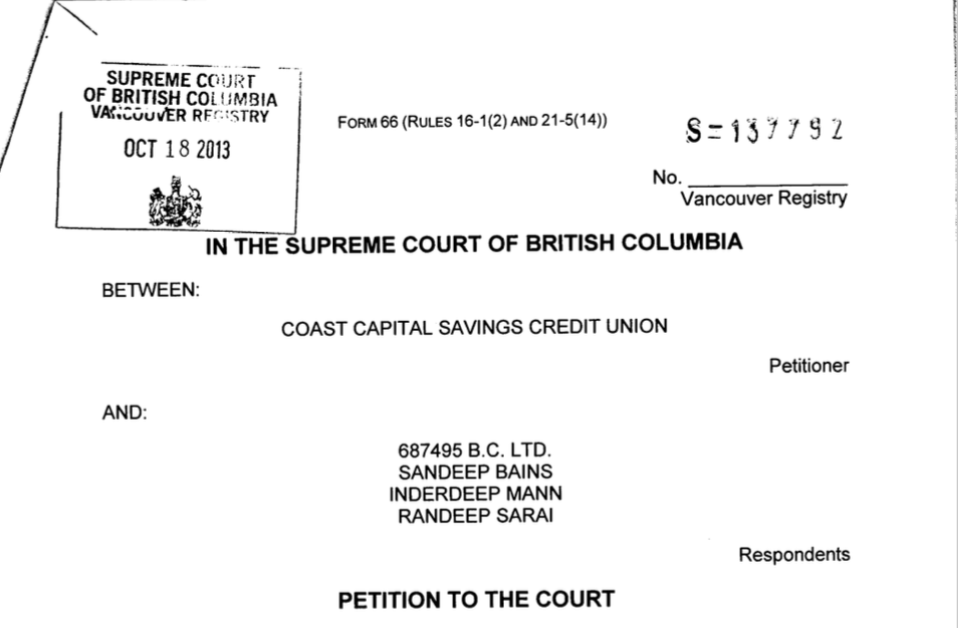

The lawsuit, filed two years before Sarai was elected, was still active at the time of the meeting that Cunningham attended.

Coast Capital named Sarai, his numbered company 687495 B.C. Ltd., and two other men, Sandeep Bains and Inderdeep Mann, in a petition to B.C. Supreme Court on Oct. 18, 2013. The credit union sought repayment of $1,521,511.28 plus interest relating to a 2007 loan.

Liberal MP Randeep Sarai (centre) with credit union reps, including Coast Capital VP Dave Cunningham (right). (Twitter)

In 2012, Sarai and company wanted to redevelop a 0.79 acre parking lot on 2785 Gladwin Road in Abbotsford into a five-storey commercial building. The lot, which remains vacant, was assessed at $1.514 million last year. Sarai’s real estate holding company, 687495 B.C. Ltd., remains the first owner name on title.

The Nov. 22, 2013 response to the petition, via lawyer Rajdeep Deol, denied Sarai and company owed $1,521,511.28 as of Oct. 7, 2013

“The fact is that all payments due pursuant to the mortgage were paid by the respondents on a timely basis but the petition respondents’ refinancing has been delayed,” said the respondents’ court filing.

A Jan. 23, 2014 court order set $1,492,468.54, plus $238.14 per diem, as the redemption amount. The Court Services Online database shows no other activity on the case until a Feb. 8, 2018 acknowledgement of payment.

Sarai did not return email or phone calls from theBreaker. McDonald did not respond to questions about the lawsuit.

In his conflict of interest disclosure, Sarai reported income in the last 12 months from referral fees from a real estate license with Planet Group Realty of Surrey. Planet Group was in the news Feb. 16 when one of its agents, Kam Rai, was shot to death in broad daylight in Vancouver’s posh Shaughnessy.

In his conflict of interest disclosure, Sarai reported income in the last 12 months from referral fees from a real estate license with Planet Group Realty of Surrey. Planet Group was in the news Feb. 16 when one of its agents, Kam Rai, was shot to death in broad daylight in Vancouver’s posh Shaughnessy.

Sarai is also sole owner of Grand Fairway Development Inc., a land development company which holds significant interest in the 1041672 B.C. Ltd. holding company.

McDonald said Coast Capital has applied to the Office of the Superintendent of Financial Institutions for federal licensing. If OSFI recommends approval, Finance Minister Bill Morneau would have the final say. Last summer, Coast Capital’s application was approved by B.C.’s Financial Institutions Commission and Credit Union Deposit Insurance Corporation.

Sarai quit Feb. 27 as head of the Liberal Party’s Pacific sub-caucus after photographs emerged of ex-convict Jaspal Atwal at a cocktail party in India with Prime Minister Justin Trudeau’s wife Sophie. Sarai initially took responsibility for Atwal’s appearance, but later told the Surrey Now Leader that he didn’t invite Atwal, a former Sikh separatist terrorist who was jailed for attempting to murder a visiting Indian cabinet minister in 1986.

Sarai told the local newspaper that he simply forwarded names of anyone who had contacted his office with interest in attending the Prime Minister’s events in India.

Support theBreaker.news for as low as $2 a month on Patreon. Find out how. Click here.