Bob Mackin

The Trudeau Liberal-appointed chair of a federally-owned coal port attended a Stanford University seminar after the government decided to sell the Crown corporation.

theBreaker.news learned that Ridley Terminals Inc. (RTI) chair Michael McPhie traveled to the prestigious Palo Alto, Calif. university for a course earlier this month that a source said cost RTI $15,000.

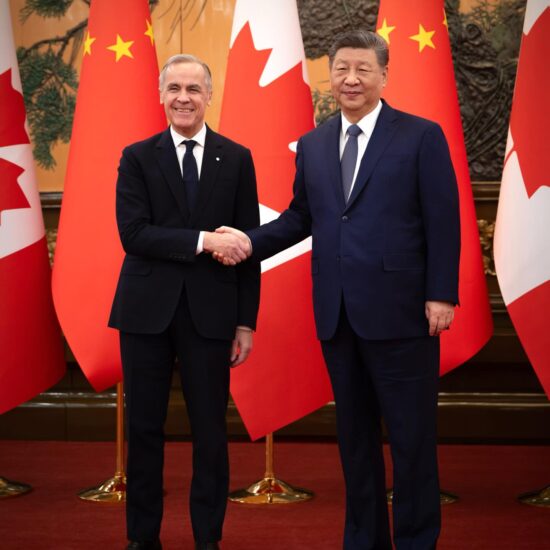

Ridley Terminals chair Michael McPhie at Stanford (Facebook)

“Ridley Terminals board directors are expected to commit to ongoing professional development as recommended by the board,” read a prepared statement sent to theBreaker.news by corporate affairs manager Michelle Bryant-Gravelle. “The board approves expenditures for the professional development of its directors so they can keep up with evolving governance and management best practices. The professional development course in which the chair is enrolled was initiated more than six months ago and was board-approved.”

A photo on McPhie’s Facebook page shows him on the Stanford campus. “Gorgeous campus and looking forward to a week of learning with a bunch of people way smarter than me,” he wrote on July 7. In another photo, McPhie posed among the university’s collection of work by Auguste Rodin, creator of The Thinker. “@Stanford for a few days. A good place to think!”

theBreaker.news contacted McPhie, who repeated the prepared statement.

When he was asked to confirm the $15,000 cost, McPhie said. “I’m sorry, I’m not responding to those questions about costs. We have provided a full statement. That’s all I have to say at this moment.”

What did McPhie learn at Stanford?

“I’m not answering anything further,” McPhie said. “What part of that answer do you not understand? I’m not beholden to you to give you anything.”

RTI, a federal Crown corporation since 1991, is under Transport Canada. McPhie began a five-year term as chair in September 2017 as the replacement for Byng Giraud, an appointee of the previous Conservative government. He is paid a per diem in the $220 to $260 range and annual fees of $5,700 to $6,700. McPhie chaired IDM Mining from 2014 to April of this year. The former CEO of the Mining Association of B.C. is the founder of Falkirk Environmental. From 2005 to 2011, he donated $6,834 to the federal Liberals, according to Elections Canada.

Ridley Terminals near Prince Rupert (RTI)

Last November, the Trudeau Liberal government announced it was looking for a buyer. On July 12, it announced Riverstone Holdings and AMCI Group would pay $350 million for 90% of RTI shares, with the remainder going to the Lax Kwalaams and Metlakatla first nations.

“He has a responsibility, given his outside sources of income, to say why taxpayers are being left with 100% of the cost,” said IntegrityBC’s Dermod Travis. “What benefit to Ridley Terminals now, in light of the situation, given he would’ve been aware of what would transpire before he left.”

McPhie submitted no travel expenses for the first half of 2019. Last year, McPhie charged $8,716.95 for two trips to meetings with unspecified “stakeholders” in Ottawa and $4,408.43 on two trips to Prince Rupert.

The Prince Rupert bulk handling metallurgical and thermal coal and petroleum coke export terminal netted $47 million on $117.7 million revenue last year.

RTI spent a total $267,000 on travel, hospitality and conferences in 2018, a $105,000 boost from the previous year. Training-related travel increased by $50,000 from just $5,000 “with increased training provided to board members and employees,” said the RTI expense report.

A February 2018 special examination report by the Auditor General found “significant deficiencies in [RTI] governance, strategic planning, performance measurement and reporting, risk management, and human resource systems and practices. The board did not meet its key responsibilities and failed to oversee the management of the Corporation.”

The special examination tested a period from mid-September 2016 to the end of June 2017.

Support theBreaker.news for as low as $2 a month on Patreon. Find out how. Click here.