Bob Mackin

Richmond city hall documents show that the man authorities believe is a central figure in laundering money through B.C. casinos ran a rub and tug parlour in the penthouse of a Richmond hotel.

Paul King Jin, according to a 2014 B.C. Lottery Corporation suspicious transaction report obtained by the Vancouver Sun, was identified as “one of the main cash facilitators in the Lower Mainland for casino VIP patrons.” He had been banned for five years from B.C. casinos, but was linked to the Silver International currency exchange in Richmond that police raided in October 2015.

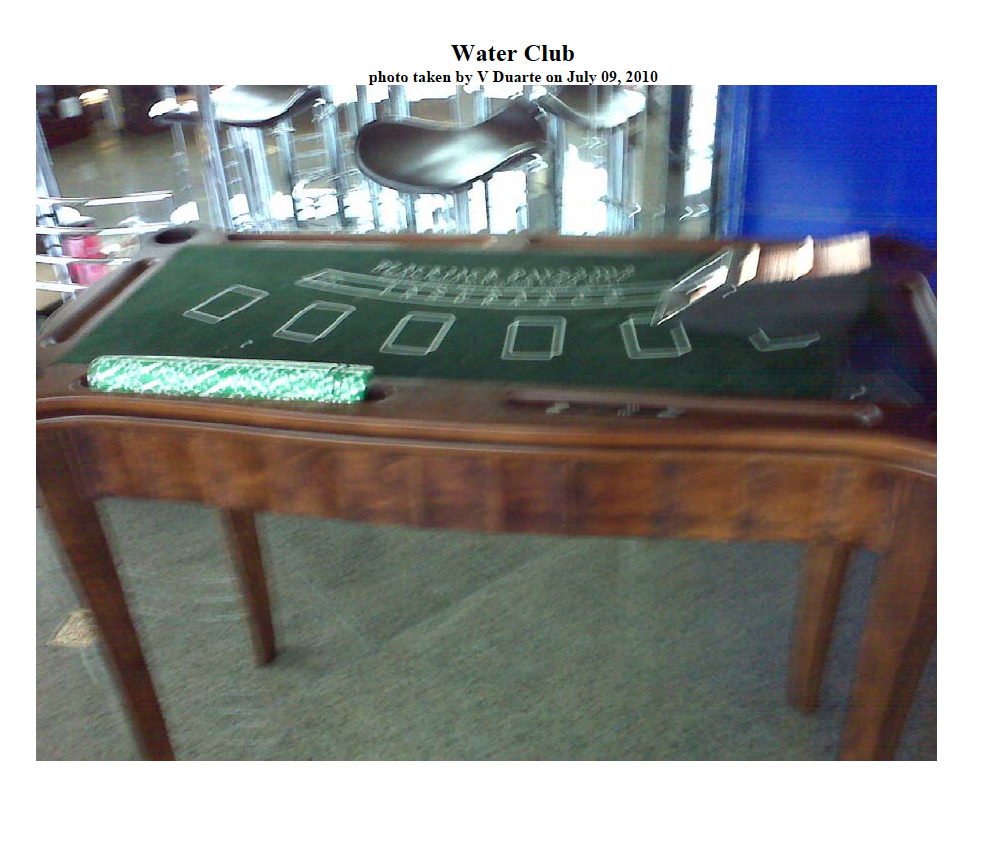

Gambling table found in the Richmond rub and tug parlour operated by Paul Jin (City of Richmond)

In December 2011, after a litany of bylaw infractions, Richmond city council cancelled the business licence for the massage parlour that Jin operated, Watercube Vancouver Health Club Ltd., doing business as The Water Club, at the Radisson Hotel. Since 2009, there had been numerous complaints of operating after midnight, unregistered employees, smoking of cigarettes and marijuana, gambling and prostitution on site. RCMP also believed it to be a known hangout for gang associates.

Water Club took over in 2009 from Body Rub Studio that had been operating since 1996. The report said the adult oriented use licence for a body rub studio in Richmond is based on a $3,353 fee plus $116 for each body rub employee registered at the business.

Documents obtained by theBreaker include a police report from Sept. 29, 2010 when Constables Zentner and Lu attended at 2:02 a.m.

“Const. Zentner opened the door and observed two occupants, a male and female both found nude inside the room,” said the incident report. “The female was identified as an employee of Water Club but not licensed or registered as a body rub employee at Water Club and should not have been in a room with any client providing massage services.”

A Nov. 8, 2009 email from Const. Gabor Egri to city hall inspector Victor Duarte recounted Egri’s Nov. 7, 2009 investigation of a complaint of alleged prostitution.

Egri wrote that he found a male and female in a room, engaged in a sex act. They were startled and the woman proceeded to quickly put on a short black skirt and top, grab something and wrap it in a towel. The male, a pilot for an airline, gave an audio statement to Egri. “One thing led to another” and they had intercourse, but the pilot claimed no money was exchanged between the two, according to Egri’s notes.

“Prior to members leaving, front desk staff requested (censored name) pay $100 cash plus ‘tip’ for the one hour massage,” said Egri’s report.”(Censored) initially wanted to pay with American Express but was refused. (Censored) paid $100 US in cash.”

A Jan. 12, 2011 report to a licence review meeting said that city hall believed the evidence was clear, on a balance of probability, that Water Club and a related company Tin Tin Beauty Spa intended to conduct activity not permitted under any licence category and were trying to create an umbrella company to shield the Water Club from any potential discipline.

“In an agreement reached with the City of Richmond, Jin et al agreed to cancel the licence of Tin Tin Beauty Spa and the city agreed not to take further action against Water Club for the incident of Nov. 7, 2009,” the report said.

By early 2011, however, Jin’s name was not on the corporate registry for Watercube Vancouver Health Club Ltd. Instead, it listed the directors as Kong Qing Gao of Vancouver, Gui Zhen Hao of Qingdao, China, Gong Ping Jia of Richmond, Shi Guo Jia of Qingdao, China and Wei Qing Zhang of Guangzhou, China.

Prior to the 60-day suspension, Jin’s lawyer, Jason Tarnow, wrote Jan. 12, 2011 to city hall that the company employed 30-40 people and paid $20,000 monthly rent.

“No sexual activity is allowed at the club. Employees are instructed to follow the requirements of the bylaw regarding their clothing. They are not allowed to be naked, as (censored) was. After finding out about this incident (censored) was immediately terminated. She was not allowed back in the premises by Mr. Jin. As to the late hours, Mr. Jin has faced lots of pressure from friends and clients to allow people in the premises late at night. It does not happen anymore.”

“The RCMP have been inside these premises at least 10 times since the last inspection as noted by Mr. Duarte. Mr. Jin is attempting to run a legitimate business. There are no new allegations. All employees are properly licensed. There is no smoking in the premises. Many no smoking signs are up. No sexual activity is allowed. Any employee caught doing same is terminated.”

More bylaw infractions followed. City council held a special meeting Dec. 19, 2011 and voted to revoke Water Club’s business licence.

A July 2016 BC Liberal government-commissioned report by MNP, finally released by NDP Attorney General David Eby on Sept. 22, pinpointed money laundering at River Rock linked to underground banks and organized crime connected to China. On Sept. 28, Eby named former RCMP Asst. Comm. Peter German to investigate money laundering at Lower Mainland casinos. German wrote the legal textbook, Proceeds of Crime and Money Laundering, and is an international anti-corruption expert.

From water to land

Since the end of Water Club, Jin has made a splash in real estate.

Court Services Online shows that Jin is a party in 21 civil court cases since 2013 — 16 as the plaintiff. A search of the land titles registry found he is associated with six properties, four of which carry a certificate of pending litigation, and the other two judgments.

Jin sued Daqing Wang about a property on Vine Maple Drive near Crescent Park in Surrey that is now worth $5.751 million, Tian Yong Zhang over a $1.56 million property on 4th Avenue in Richmond, and Youting Shen over a $1.607 million property on Capella Drive in Richmond.

The tables were turned on Nov. 24, 2016. Jin was named with 10 others and a numbered company as respondents in a B.C. Supreme Court foreclosure action filed by Accountable Mortgage Investment Corp. The subject property was a house at 2751 Highview Place in West Vancouver, which was assessed at $8.215 million last year. CIBC, which also issued a loan for the property, filed a separate action. The registered property owner, Jia Gui Gao, defaulted on the mortgage and was personally served by Accountable at the Venetian Hotel in Macau.

West Vancouver mansion with links to Jin. (Wendy Tian)

“The total amounts secured against the lands is approximately $28.8 million,” said Accountable’s petition.

The eighth place mortgage, expressed to secure $8 million, was held by Jin. The court filings said Jin and Gao had a falling out.

“On or about Aug. 17, 2015 the respondent Paul King Jin filed a notice of civil claim against the respondent owner Mr. Gao seeking judgment in the amount of $2.3 million on account of money advanced by Mr. Jin to Mr. Gao for real estate development when in fact the money advanced was spent on ‘gambling and women’.”

The land was listed in December 2015 at $11.8 million, reduced to $10.8 million in May 2016 and $9.6 million in October 2016. Finally, in June 2017, the court approved an $8.7 million offer to purchase by an executive from a mobile phone retailer with no connection to any of the above cases.

Besides Jin and Gao, the others named as respondents were: Wei Zhang, Ying Zhang, Ze Peng Tong, Mingsheng Huang, Zhi Bang Li, Wei Sze Fu, Yen Tat, Thomas Ha, Donna Ha, and 1003030 B.C. Ltd.

Court documents say Jin left Canada for China on March 7 of this year and that his last-known address was a recently built, four-bedroom, five bathroom house at 8100 Fairbrook Crescent in Richmond’s Seafair neighbourhood.