Bob Mackin (Updated Oct. 25)

A whistleblower who sparked B.C.’s public inquiry into money laundering says the lawyer for B.C. Lottery Corporation’s chief executive officer contradicted evidence from Peter German’s 2018 Dirty Money report.

Ex-BCLC anti-money laundering director Ross Alderson (LinkedIn)

During an Oct. 18 application hearing before the public inquiry’s head, B.C. Supreme Court Justice Austin Cullen, Jim Lightbody’s lawyer Robin McFee quoted German’s Failed Strategy chapter. In that chapter, German mentioned an unnamed BCLC investigator said that “no transaction was refused before 2015” and that a senior official within the Crown corporation told him in 2012 that his job was “not to investigate money laundering” at casinos.

“He pointed out that nobody was investigating money laundering despite copies of suspicious transaction reports being provided to [Gaming Policy and Enforcement Branch] and to the RCMP. In his view, nobody showed any interest in the issue,” German wrote.

McFee told Cullen: “Now, that’s an important aspect of evidence that Mr. German relies upon that, one expects, will come before you as the commissioner. Mr. Lightbody — the buck stopped with him. He takes great issue with that. He says that’s incorrect.”

BCLC CEO Jim Lightbody

Ross Alderson was the BCLC anti-money laundering director until fall of 2017. When he went public last January on CTV’s W5, Alderson described a 2012 incident of refining at River Rock Casino, in which a gambler came in with $100,000 in $20 bills and left with $100,000 in $100 bills. Alderson reported the incident to his superiors.

“I escalated that to senior management and I was told categorically that it was not my job to investigate money laundering,” Alderson said on W5.

Alderson declined an interview, but provided a written statement to theBreaker.news.

“I am somewhat perplexed by the statement by Mr. McFee regarding comments made to me stemming from a meeting in 2012 being incorrect,” Alderson wrote. “Particularly, as his client was neither present at the meeting, nor likely had any knowledge of it until this year. In addition there are multiple references in the Dirty Money report including an interview with the previous BCLC chairman of the board and BCLC director of compliance where they both state that BCLC’s role is not to investigate money laundering.”

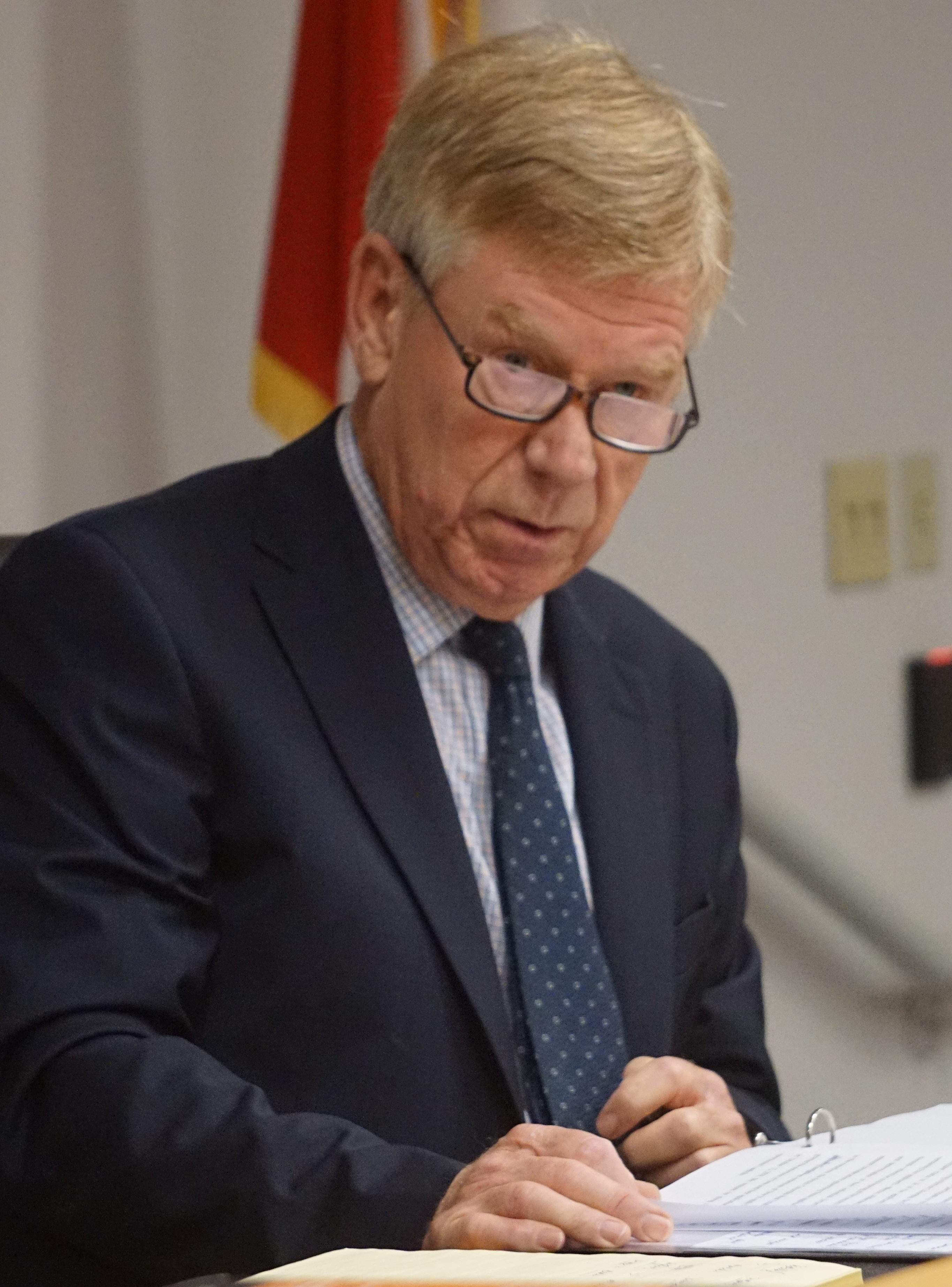

Robin McFee (Mackin)

In 2015, BCLC began to stop gamblers from buying-in with cash unless they could disclose the source of their funds. Since April 2015, 600 players have been added to a cash conditions list. An internal report by Alderson in September of 2015 warned that high rollers from China were engaged in transnational money laundering at B.C. casinos.

On Oct. 25, Cullen granted Lightbody’s application for participant status in the inquiry, which means Lightbody’s lawyer can cross-examine other witnesses. Cullen specifically cited the same section of German’s report as an example of potential for conflict between BCLC’s corporate interests and Lightbody’s personal or reputational interests.

Lightbody, he wrote, “may be subject personally to adverse comment or criticism arising from an adverse assessment of BCLC’s corporate actions.”

In the same ruling, Cullen denied an application from Fred Pinnock, who was commander of the RCMP’s Integrated Illegal Gaming Enforcement Team from 2005 to 2008. Pinnock’s application said the inquiry would not exist without him and other whistleblowers. He had warned that casinos were becoming a haven for organized crime, but the BC Liberal government disbanded the team anyway in 2009. He said his unsuccessful efforts to expand the mandate of IIGET harmed his working relationships with the RCMP and Gaming Policy and Enforcement Branch, and led to his early retirement.

“Mr. Pinnock submits that he was right and that others within the RCMP, BCLC, government and GPEB knew or were willfully blind about this. In that sense, he submits his reputational interests may be engaged as the Inquiry may vindicate him,” Cullen wrote.

Cullen decided Pinnock did not meet criteria for participant status because the thrust of his submission was that “he was attempting to overcome the apathy of those charged with the relevant responsibility; not that he was a part of it.”

Former BCLC and Great Canadian Gaming security executive Rob Kroeker is the only individual other than Lightbody that has been granted participant status so far. The application by BCLC casinos and security vice-president Brad Desmarais is adjourned until November. Alderson withdrew his application, but is expected to be a witness. Sixteen government, corporate and society entities already have standing.

Justice Austin Cullen (Mackin)

At the Oct. 18 hearing, Pinnock’s lawyer, Paul Jaffe, referred to delays in accessing documents under the freedom of information law.

“It’s interesting that for four years, efforts have been made for the Lottery Corp. and Fintrac to provide disclosure of documents relative to the observations of Mr. Pinnock and his concerns about organized crime in the gaming venues,” Jaffe said. “And for years those efforts have been unsuccessful.”

Jaffe suggested Cullen could have jurisdiction to “fast-track the FOI process and make an order” for material to be disclosed.

Although the chair of the BCLC board is considered head of the public body for the purpose of the FOI law, the BCLC executive who decides day-to-day on which documents are released to FOI requesters is the CEO.

Until he went on cancer leave in September, that was Lightbody.

Support theBreaker.news for as low as $2 a month on Patreon. Find out how. Click here.