Bob Mackin

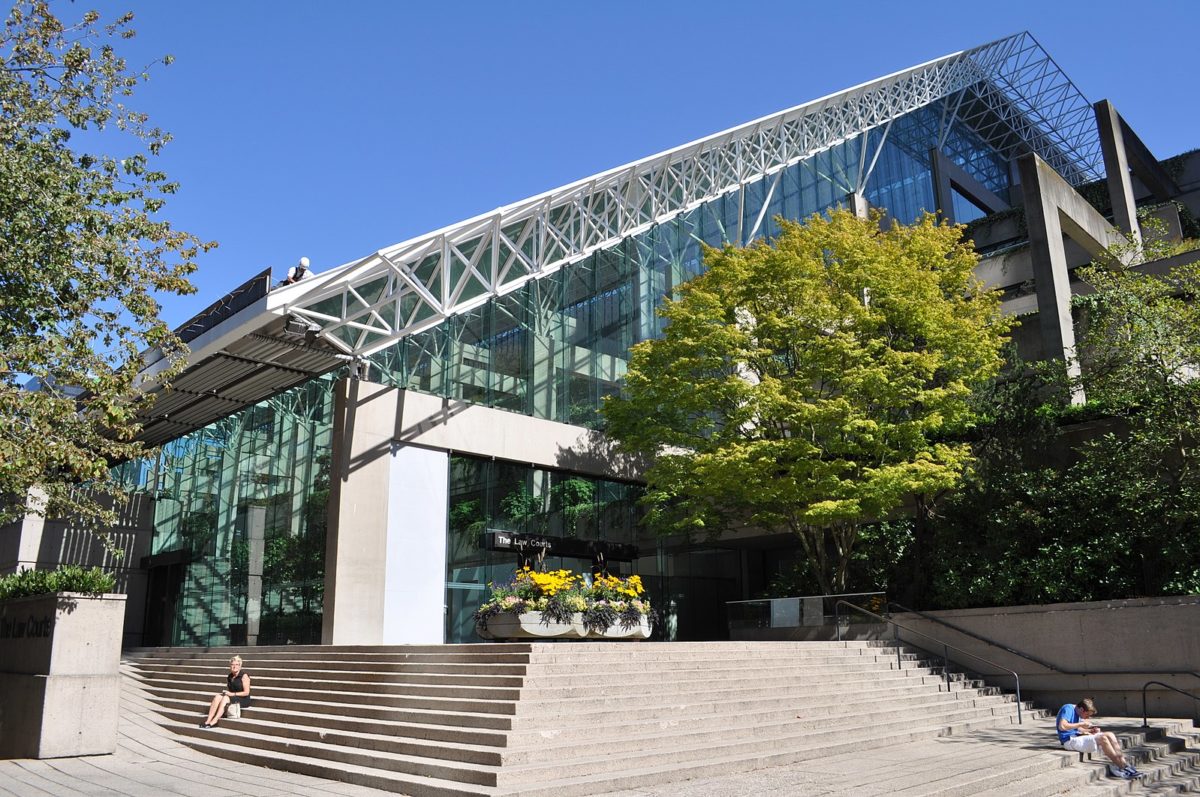

A real estate investor originally from China is appealing a $1.5 million property tax bill in B.C. Supreme Court.

According to a June 21 petition to the court, Guozhang Wang immigrated to Canada with his family in 2010 and sold his lumber business to his in-laws, Guofang Zhao and his wife Dan Huang for 8 million renminbi. Guofang and Dan did not have 8 million RMB, so they agreed to repay without interest and and without a deadline. They asked for an additional 12.4 million RMB in August 2015, but began repaying when the business improved, including $1.8 million in March 2017.

Vancouver homeowner disputing foreign buyer’s tax on Shaughnessy House (Samuel Cheng)

Wang had already bought four westside properties in 2011, rented them and sold them in 2013 and 2014.

In November 2016, Wang bought a house at 5584 Churchill St. for $8.62 million, but could not find a lender for a $4.31 million mortgage. His CIBC mortgage broker suggested he find a guarantor. So Dan became a 1% title holder through a January 2017 contract purchase addendum.

Wang paid the foreign buyer tax on Dan’s 1% interest, but was assessed $1,529,600, which includes $1,280,070 in foreign buyers’ tax.

In March of this year, the Finance Ministry confirmed the assessment on assumption that the loan repayment in March 2017 was for the acquisition of the Churchill property, deeming Dan had acquired beneficial interest.

The petition argues that Dan does not have a beneficial interest in the property.

“Dan and Guofang do not have any involvement in a real estate business in China or in Canada,” said the petition. “Dan and Guofang have not even visited Canada, aside from one transitory stay of one day (on a YVR layover). The only reason why Dan is on title is because she acted as the guarantor for the petitioner’s mortgage and at CIBC’s request, as added to the title.”

The eight-bedroom, five-bathroom house at the centre of the tax dispute was listed for sale at $11.8 million.

None of the allegations has been proven in court.

Support theBreaker.news for as low as $2 a month on Patreon. Find out how. Click here.