Bob Mackin

The B.C. government has intervened in the receivership of the delayed Garibaldi at Squamish ski resort and says the B.C. Supreme Court has no jurisdiction to grant a reverse vesting order (RVO) to enable the sale.

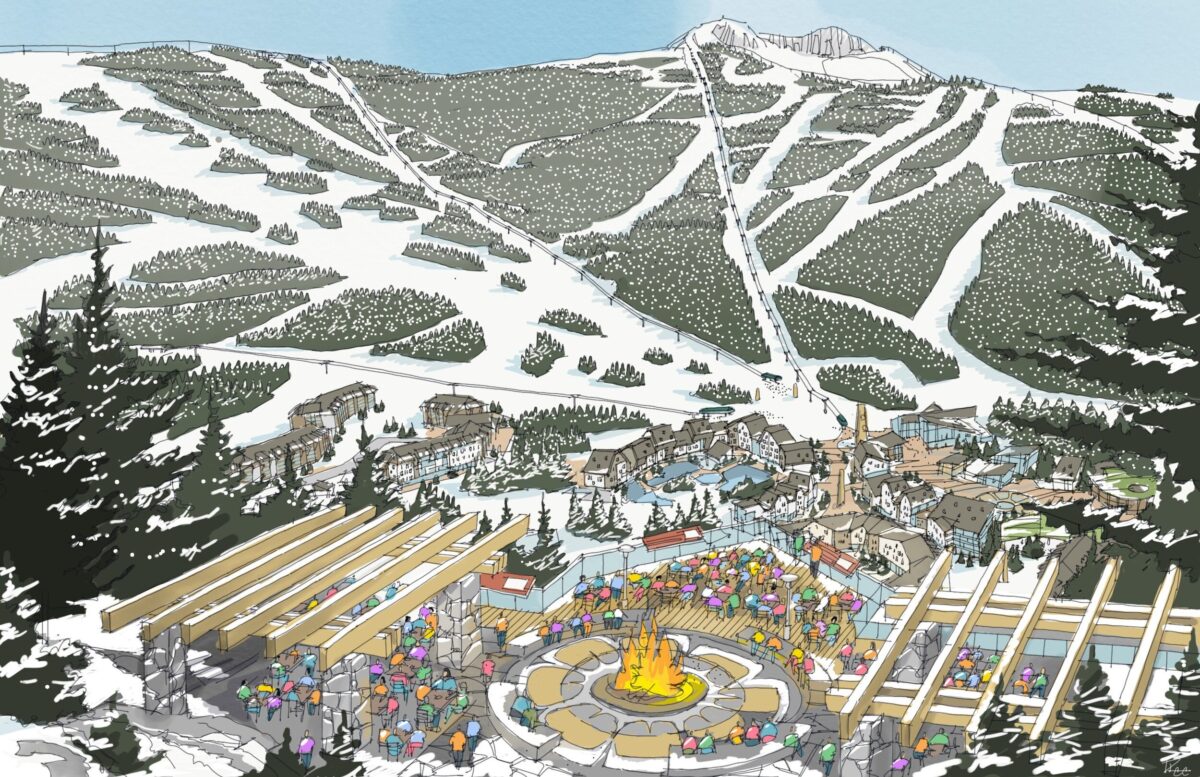

Artist’s conception of the delayed ski resort on Brohm Ridge near Squamish (Garibaldi at Squamish)

In January, secured creditors Aquilini Development LP, Garibaldi Resort Management Co. Ltd. and 1413994 B.C. Ltd. offered $80.41 million for Garibaldi at Squamish Inc. (GAS Inc.) and Garibaldi at Squamish LP (GAS LP). The bid includes almost $73.5 million in GAS debt. The so-called stalking horse offer, designed to set a floor price, was the only one tendered to court-appointed receiver Ernst and Young (EY).

GAS Inc. defaulted on $65 million owing to the three Aquilini companies, prompting the September 2023 receivership petition.

In March, EY applied for court approval of the sale by RVO. A November 2022 article in Canadian Lawyer magazine explained that an RVO is a purchase of shares in a debtor company, so that the “bad assets – including liabilities and creditor claims – are removed, and the good assets stay in the company.”

On April 19, lawyers from the Dennis James Aitken firm, representing the provincial government, filed their opposition to a deal which would see all GAS liabilities moved to a new company that would then be bankrupted.

“The Garibaldi RVO circumvents the authority of the Minister of Water, Land and Resource Stewardship to approve a disposition of the licence of occupation, with or without additional requirements as conditions precedent, pursuant to the Land Act,” said the province’s filing. “The Garibaldi RVO seeks, wrongly, to nullify these provisions and the province’s constitutional obligation to consult with affected First Nations, including the Squamish Nation.”

If the court grants the order, the province wants an amendment to limit the release provisions to ensure preservation of potential claims for environmental remediation.

Justice Paul Walker heard April 22 that the Squamish Nation is not objecting to the application or transaction.

EY said there was no other offer for the companies, which face a January 2026 deadline to begin construction under the provincial environmental assessment certificate (EAC).

GAS Inc. was created in 2001 to transform 2,800 hectares of previously logged forest on Brohm Ridge into a four-season resort with accommodations and amenities. GAS does not own any physical assets. Its primary asset is an interim agreement with the province that gives GAS the right to pursue construction and development. It generates no income, instead relying on third-party funding.

EY determined the RVO is the best and only way forward. It said proceedings under the Bankruptcy and Insolvency Act are not a “viable path forward for the project, Garibaldi and Garibaldi’s stakeholders” and the Companies’ Creditors Arrangement Act is not “practical or reasonable in the circumstances.”

Roberto (left), Luigi, Francesco and Paolo Aquilini and Michael Doyle at the November 2018 opening of Elisa Steakhouse (Elisa/Facebook)

“Given the unique nature of this interim agreement, its interdependence on the EAC, and the corresponding considerable expenses, and the tight timeline to satisfy the pre-construction conditions, it is difficult to ascertain a value for the assets of Garibaldi,” said EY’s April 10 filing. “The interim agreement grants an intangible opportunity to build the project, at the significant cost and risk of the purchasers.”

The 2016-granted EAC was extended in 2021 with a deadline to begin construction in January 2026. Work has not begun and there is no allowance for another extension, meaning it would require a fresh application to proceed.

The project, on Squamish Nation territory, faces 40 pre-construction conditions, eight of which are deemed urgent. They include old-growth management, archaeology plan, Brohm River management plan and a dam for a snowmaking reservoir. Work to satisfy the conditions would cost more than $5 million over the next 12 months.

When it was approved in 2016, GAS was estimated to cost $3.5 billion with a 30-year, four-phase build resulting in 126 ski and snowboard runs, fed by 21 lifts and accommodation in 5,233 hotel, condo, townhouse and detached units.

Disagreements between factions connected to the families that own the Vancouver Canucks (Aquilini) and Dallas Stars (Gaglardi) have held the project back.

The two unsecured creditors are Northland Properties Ltd. and Garibaldi Resorts (2002) Ltd., who are owed $6.37 million and $13.8 million, respectively.

Northland Properties owns Revelstoke Mountain Resort and Grouse Mountain. Founder and chairman Bob Gaglardi is also president of Garibaldi Resorts (2002) Ltd., the company whose secretary is Aquilini Investment Group founder Luigi Aquilini.

Support theBreaker.news for as low as $2 a month on Patreon. Find out how. Click here.