Bob Mackin

Told ya so.

For the last two years, TransLink’s board of directors, executives, Mayors Council and the provincial government (BC Liberal, then NDP) hid massive cost increases from the public for their next rapid transit megaprojects.

Instead of providing quarterly or annual updates on the task of refining the costs, the dollar figures for the Broadway Subway and Surrey LRT were steadfastly censored from every document released to me under freedom of information. Not to mention thousands of pages of reports by engineers and designers that were withheld in their entirety. Whenever I asked, anyone involved in the operation, whether elected or appointed, the weasel words began to flow. The cost estimates weren’t “finalized” or they hadn’t been “approved,” they said. But at no time did anyone say the numbers were what they used to be.

Sany Zein (left) and Kevin Desmond (Mackin)

Chief financial officer Cathy McLay was first to blame high real estate costs and the low Canadian loonie, compared to the U.S. greenback, when I asked her at a March 2016 news conference. McLay, also the acting CEO, knew the numbers were climbing, and she knew by how much. Either she chose silence or was following orders. Just like her permanent replacement, Kevin Desmond. As recently as March 16, when asked about the costs by another reporter, Desmond replied: “Project business cases are still, um, at the province.” Yes, Desmond did say “um.”

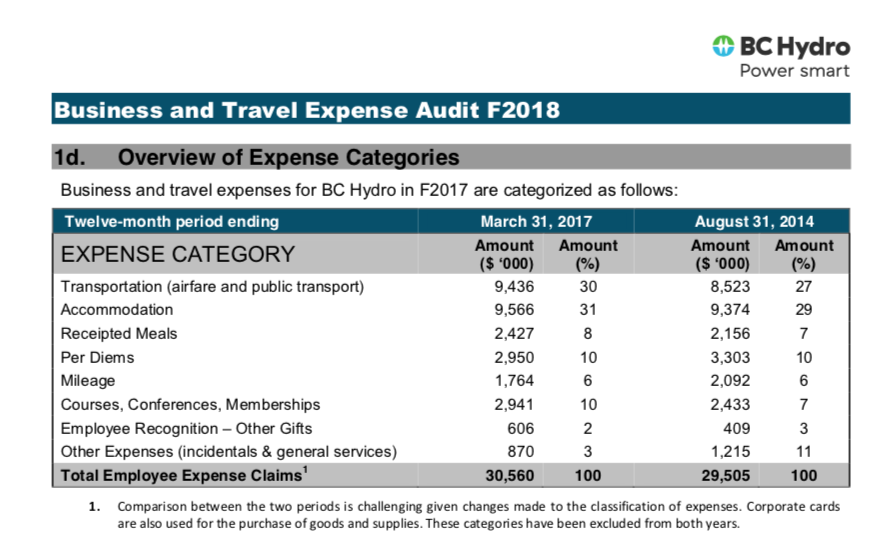

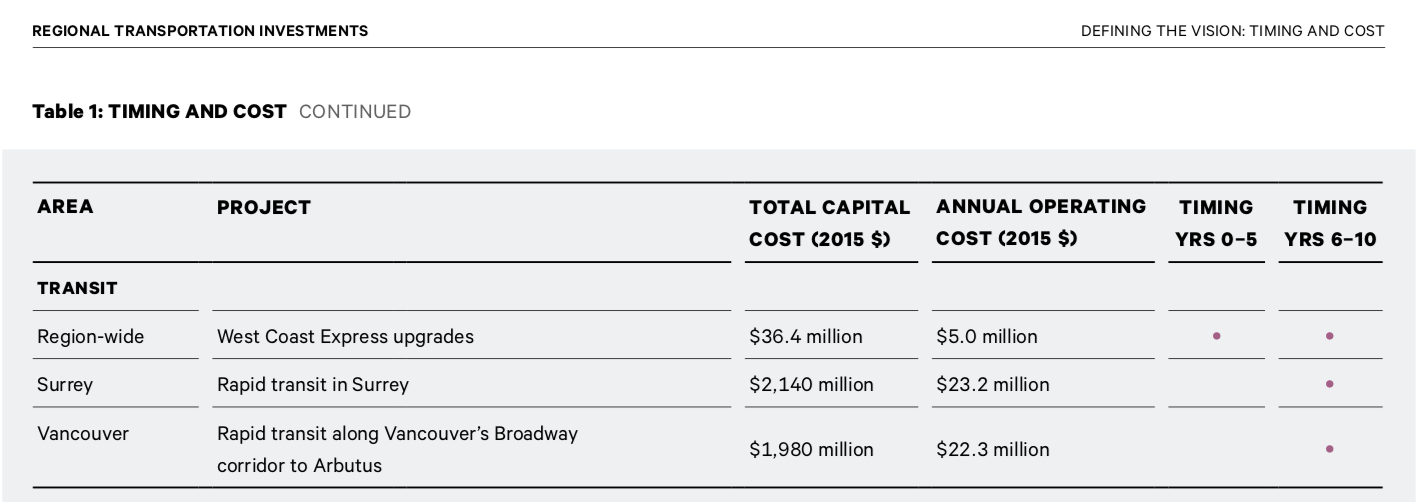

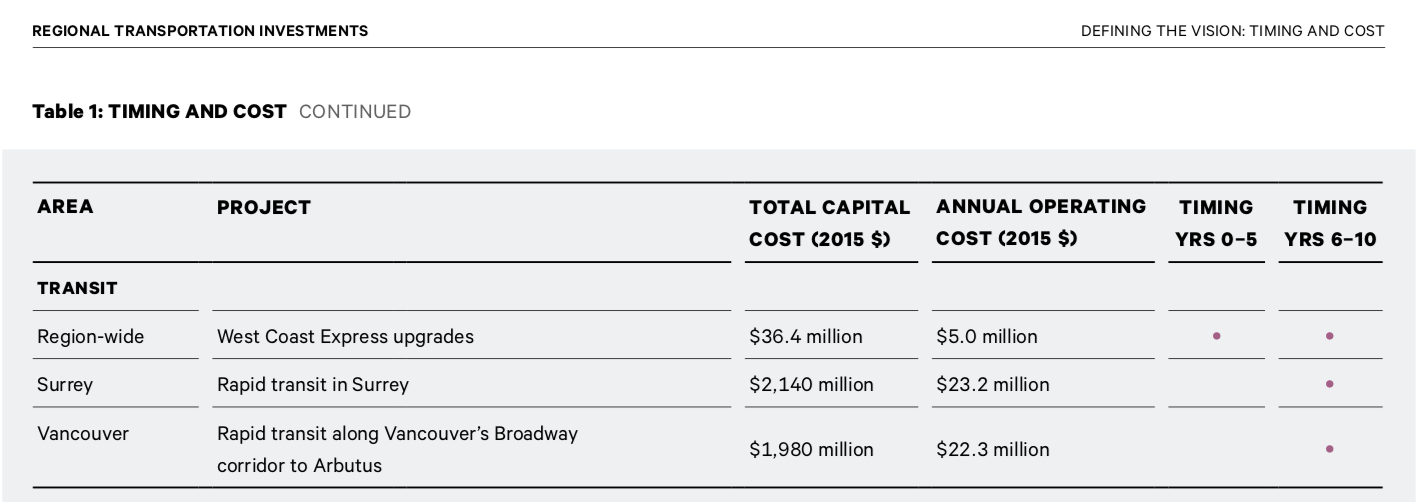

When the Mayors’ Council released its “Vision” in 2014, the Broadway Subway was estimated to cost $1.98 billion. Now it’s $2.83 billion.

Likewise for the Surrey-Newton-Guildford LRT. Was: $920 million. Now: $1.65 billion.

The difference is $1.58 billion. The way TransLink counts, under a “year of expenditure” cost formula, it’s $1.17 billion.

Any way you count it, the costs skyrocketed so much, that there is no guarantee the 2014-estimated, $1.22 billion Surrey-Langley LRT line will be built.

All three rapid transit megaprojects were estimated at $4.12 billion in 2014. Mayors got closed door updates on costs from TransLink-contracted experts in 2016 and 2017, but the public had to wait until the last day of April in 2018 when it found out that two projects will cost almost $4.5 billion.

With construction set to begin in 2020, higher costs are inevitable en route to scheduled completion in 2024 (Surrey) and 2025 (Broadway).

Just in case you’re wondering, Desmond wouldn’t comment on the new estimate for the Surrey-Langley line, because it needs more studying, he said. Not to mention more taxpayer funding.

All of this, after the Port Mann and Golden Ears toll-slaying NDP government stepped-in and took over the $1.3 billion Pattullo Bridge replacement in February. That project ballooned by almost $300 million since 2014.

TransLink had been sitting on the rapid transit numbers for quite a while and had the good fortune of being overshadowed on April 30. The media briefing at TransLink’s New Westminster headquarters coincided with a bigger, flashier photo op in downtown Vancouver, where Prime Minister Justin Trudeau announced Seattle-based online retail juggernaut Amazon would open an office in the old Canada Post mail-sorting plant on Georgia Street.

TransLink said the federal government has committed $2.01 billion and the province $2.55 billion for its $7.3 billion, Phase Two plan. TransLink needs to raise $2.71 billion to pay for its share. So brace yourself for higher transit fares, higher property taxes and higher parking lot taxes.

Fares will increase 10 to 15 cents per ticket in 2020 and 2021 and monthly passes will cost 50 cents to a dollar extra. Average households will be hit with another $5.50 in property taxes and the sales tax on parking will rise 3%. That would be 12 cents per hour at a parkade that charges $5 an hour. A regional development fee is also in the works, so new condominium buyers will feel the pain.

Afforda-bull?

When it revealed the numbers April 30, TransLink also kicked-off a fast-track public consultation program. The agency will set-up “pop-up” displays at malls and farmers markets around the Lower Mainland until May 11. There will also be limited time for citizens to “pop-off” before the June 28 meeting to express their opinion.

By comparison, in 2015, the public had two-and-a-half months to vote by mail in a plebiscite on a sales tax increase to fund TransLink expansion. Almost 62% of voters rejected the proposal. Opinion polls indicated the public lacked trust in TransLink.

Mayors’ Council 2014 “Vision” and the original cost estimates.

So Desmond and company have their collective foot on the pedal, intent on leaving overtaxed citizens at the station. TransLink wants the early summer rubber stamp to avoid becoming an issue in the fall’s local government elections and next year’s federal election. All the price hikes don’t correspond with the NDP’s mantra of making life more affordable for British Columbians. Higher BC Hydro bills, higher ICBC rates, higher TransLink costs. There is only one place to go.

An April 2, 2017 email from Sany Zein, TransLink’s infrastructure management and engineering vice-president, to Desmond indicates that the cost will continue to be a moving target and likely to go higher.

“The project inflation numbers are higher than recent GDP growth and higher than general recent inflationary growth; so some level of ‘hot market’ inflation is accounted for,” according to documents obtained under freedom of information. “The contingency percentages have been getting lower as the design definition improves. If interest during construction and internal labour charges are excluded from the gross total, the contingency value would represent a higher percentage.”

Megaproject cost underestimation is not unusual, according to a 2002 Journal of American Planning Association article co-authored by Bent Flyvberg, an Oxford University business professor and megaproject analyst.

“Based on the available evidence, we conclude that rail promoters appear to be particularly prone to cost underestimation, followed by promoters of fixed links… The average difference between actual and estimated costs for rail projects is substantially and significantly higher than that for roads… The average inaccuracy for rail projects is more than twice that for roads, resulting in average cost escalations for rail more than double that for roads.”

Flyvberg’s research indicates megaprojects are prone to cost overruns, time delays and benefit shortfalls. “Overruns up to 50% in real terms are common, and over 50% overruns are not uncommon.” In fact, nine out of 10 have cost overruns.

“Political, technological, economical and aesthetic drivers seduce decision makers to underestimate hidden risks, and to overestimate benefits.”

Support theBreaker.news for as low as $2 a month on Patreon. Find out how. Click here.

Bob Mackin

Told ya so.

For the last two