Bob Mackin

It was supposed to be Vancouver’s concert highlight of 2017, but it turned into one of the most-embarrassing nights in the history of the 1983-opened B.C. Place Stadium.

U2 played The Joshua Tree in-full for the first time in front of a paying audience on May 12, to launch a 30th anniversary tour marking the 1987 classic album.

The floor lineup for U2 and Mumford and Sons stretched around the Parq casino construction site (Mackin)

Like the iNNOCENCE + eXPERIENCE tour, which began two years earlier across the street at Rogers Arena, a credit card entry system was employed, to crack down on ticket-scalping and counterfeiting.

B.C. Place staff and contractors were not ready for the crush of fans. Most were stuck outside while opener Mumford and Sons played. U2 delayed its set for about 20 minutes while thousands of fans who paid to stand on the floor — not stand in a lineup outside — were hustled-inside, without having their credit cards, bags or pockets checked.

While many vented their frustration on social media, angry fans in lineups with smartphones complained directly to stadium management by email. theBreaker obtained almost 500 pages of complaints from stadium operator B.C. Pavilion Corporation under the freedom of information law. The names of the correspondents were censored by PavCo for privacy.

“This is the first time I’ve attended an event at BC Place, and I have to say I am completely disgusted by the disorganization outside,” said one complainant at 7:07 p.m. on May 12. “There are absolutely no staff members outside directing foot traffic, and the lineup to get in is a giant hodgepodge of people stuck in one spot. I’ve been standing in the same spot in line for 20-30 minutes now, the Gate H doors wide open in my sight, and people aren’t being let in — despite the fact the doors opened at 5:30, and the concert is supposed to be starting now. Everyone around me is commenting that they’ve never encountered disorganization like this. If this is what events at B.C. Place are like, I have absolutely no interest in coming back.”

Another writer at 7:23 p.m. was blunt: “Over an hour in line. Get your shit together. If I miss anything I want a refund.”

“I’m standing outside the U2 concert…wondering if I’ll ever get in,” said a 7:27 p.m. complaint. “This is the most poorly organized event I’ve ever attended.”

Another at 7:36 p.m.: “You knew you had a sold out show. You knew how many people you were expecting. Why is this not better organized?”

And on it went, with more complaints at 7:41 p.m., 7:43 p.m., 7:59 p.m., 8:01 p.m., 8:04 p.m., 8:16 p.m., 8:23 p.m.

Bono during Running To Stand Still (Mackin)

“Half a Mumford and Sons song. I’m in tears,” wrote an 8:26 p.m. complainant. “This is terrible. We travelled from [CENSORED] and have three families managing our small children for this. You’ve ruined our trip.”

“I have now been queueing for 90 minutes and missed Mumford and Sons because clearly you were not sufficiently organised or ready,” said an 8:31 p.m. complainant. “I wish to enter a formal complaint and seek a refund on my ticket.”

More at 8:35 p.m., 8:47 p.m., 9:21 p.m., 11:22 p.m.

Two nights later, U2 played in Seattle’s CenturyLink Field. Wrote another fan, at 9:37 a.m. on May 22: “Got into the stadium in less than 30 minutes. They also did credit card entry.”

At 8:59 a.m. the next day, another complainant said security gave up and stopped checking bags or people for weapons.

“What if something had happened at your venue holding 40,000 innocent concert goers? After what just happened in Manchester [outside an Ariana Grande concert], you ‘building operators’ should be ashamed of yourselves and by the grace of god thankful that nothing happened that night.”

Among the sea of complaints, a few commendations.

“I know you had a mare of an evening last night, so I just wanted to pass on our thanks as a family for ensuring a reserved ticket and the availability of the [CENSORED],” wrote one at 11:32 a.m. on May 13. “We got in easily, had a Golf Kart to the elevators and ready to see Mumford and Sons, which pleased half (!) the family.”

Another, at 11:58 a.m. “I just wanted to express appreciation to your organization and staff for last night. Regardless of the frustration, when the issue of what was occurring was realized it was quickly resolved by allowing people in and removing the restrictions that had caused the mess outside the gates. For that….thank you.”

By the start of July, BC Place offered those fans that complained $50 Ticketmaster gift cards per U2 ticket, plus free admission to a Vancouver Whitecaps or B.C. Lions game and a $20 food and beverage voucher.

A statement to theBreaker from stadium management said B.C. Place won’t use the credit card entry system again, until it and Ticketmaster are both “confident it is able to accommodate the needs of the venue and its guests.”

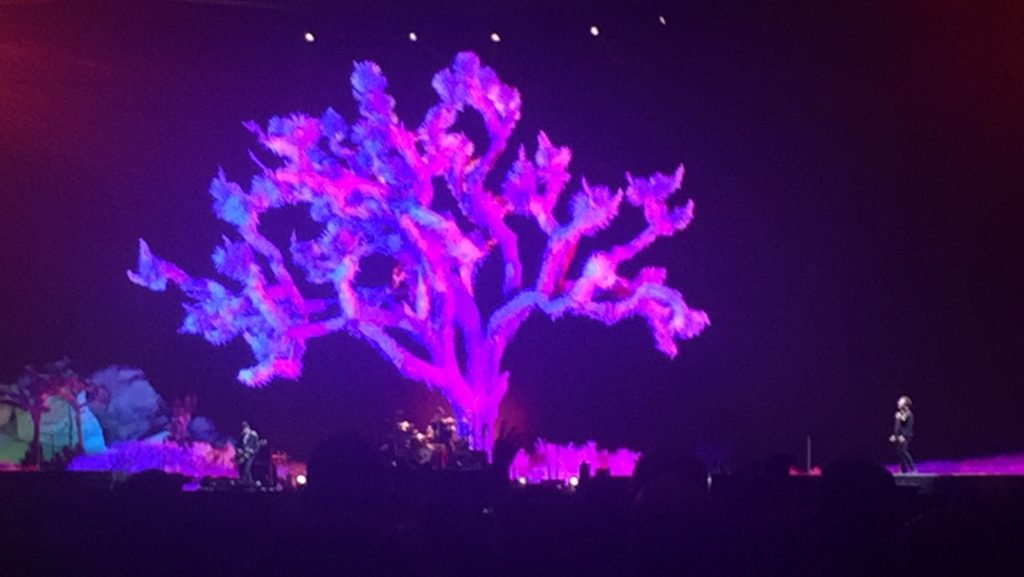

A technicolour Joshua Tree during In God’s Country (Mackin)

B.C. Place since hosted concerts headlined by Metallica, Guns ’n Roses and Coldplay and Canada Soccer and Rugby Canada events without similar access problems.

U2 had previously played BC Place in 1987, 1992, 1997 and 2009 and it is not known when or if the Irish band will play there again.

U2 begins the 2018 eXPERIENCE + iNNOCENCE arena tour on May 2 in Tulsa.

San Jose is the closest tour stop scheduled to Vancouver.

theBreaker originally requested the documents May 29. PavCo said it would respond by July 11, but invoked a delay to Aug. 23. It finally sent the documents on Dec. 1.

Jinny Sims, the NDP minister responsible for government FOI, was ordered in July by Premier John Horgan to “improve response and processing times for freedom of information requests.”

Support theBreaker.news for as low as $2 a month on Patreon. Find out how. Click here.

U2 Complaints BCPC-507 Part 1 of 2 by BobMackin on Scribd

U2 Complaints BCPC-507 Part 2 of 2 by BobMackin on Scribd

Bob Mackin

It was supposed to be Vancouver’s