Exclusive: Letters point to rift between B.C. Crown gambling company and regulator

Bob Mackin

British Columbia’s legal gambling monopoly claimed credit for alerting authorities to a suspected criminal, but it wasn’t getting the information that it wanted in order to shut out more shady gamblers from casinos.

In a May 12 letter to the head of the Gaming Policy and Enforcement Branch, CEO Jim Lightbody touted B.C. Lottery Corporation’s $3 million a year funding for the fledgling Joint Illegal Gaming Investigation Team, the onsite training and orientation provided by the BCLC anti-money laundering department and frequent communication between BCLC’s anti-money laundering director and JIGIT’s chief.

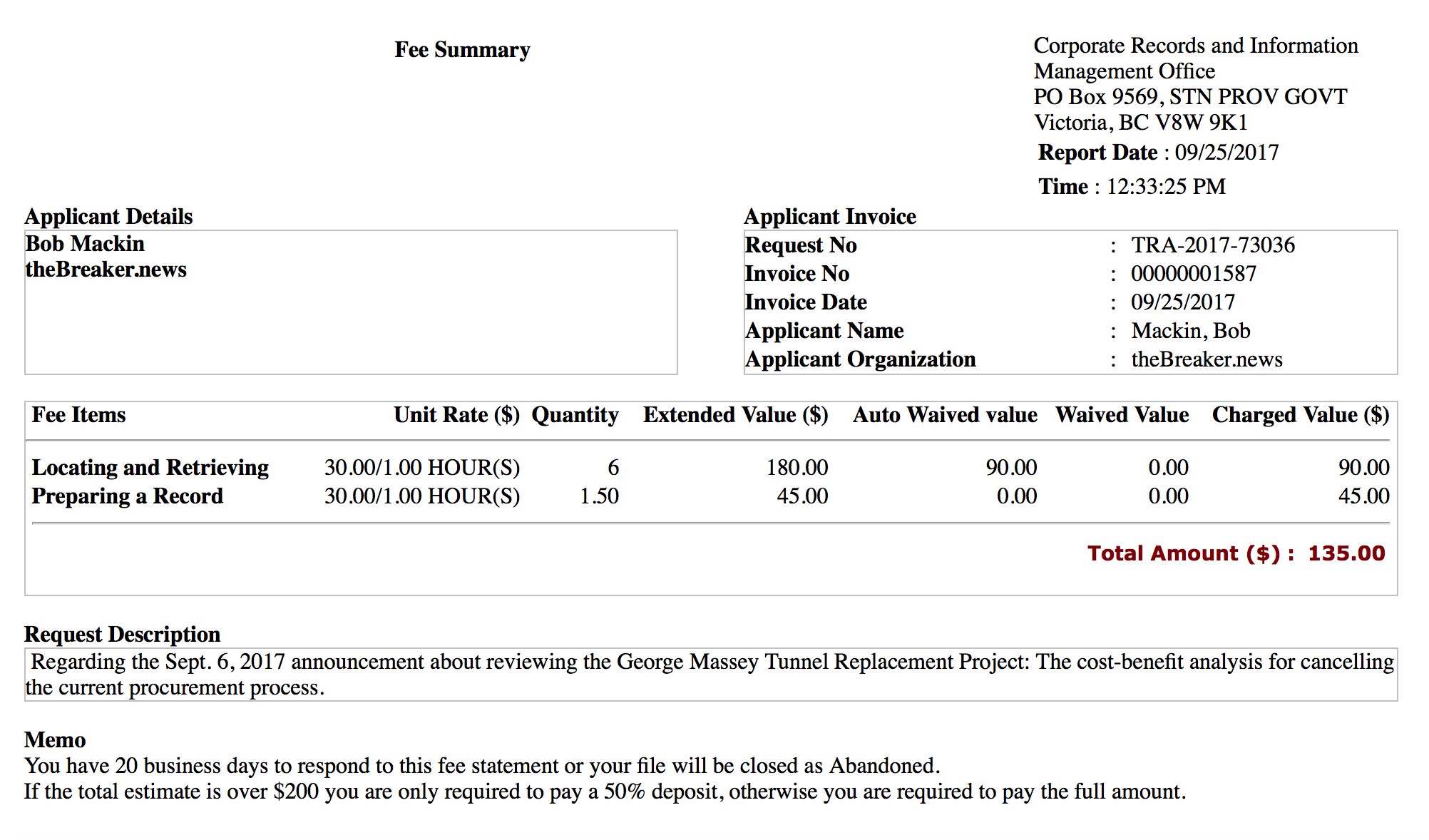

“In regard to support of police efforts more generally, please be reminded that it was BCLC’s analysis of transactions and other operational gaming data that led to the identification of a key suspect associated to illegal gaming operations in the Lower Mainland,” Lightbody wrote in a letter to assistant deputy minister John Mazure that was obtained by theBreaker under freedom of information. “Further it was BCLC’s complaint to the police and briefing on BCLC’s analysis that provided the information that allowed the police to begin to target that suspect. Prior to BCLC’s action on that matter, the activities of a suspected major illegal gaming crime figure appear to have gone undetected.”

BCLC CEO Jim Lightbody (right)(BCLC)

The letter said 260 individuals had been banned from provincial “gaming sites” stemming from cooperation after a 2014 information-sharing agreement between BCLC and the RCMP. Lightbody wrote that “tens of millions of dollars in cash transactions have been refused under BCLC’s program and 131 customers have been placed on buy-in restrictions.”

Mazure had written to Lightbody on May 8, the day before the provincial election, but that letter was not provided to theBreaker. The Vancouver Sun reported Sept. 26 that Mazure’s letter stated suspicious transactions at B.C. casinos amounted to a whopping $177 million in 2014. By 2016, that had been cut to $72 million. “However, $72 million is still a significant amount of suspicious cash,” wrote Mazure. “Further action is still required to mitigate the risk presented by the proceeds of crime entering B.C. gaming facilities.”

Lightbody’s letter indicated Mazure had several concerns, including casino customers presenting wads of $20 bills wrapped in elastic bands. Lightbody wrote that is a standard practice of “money services businesses” (an umbrella term for currency exchange, money transfer and cheque-cashing outlets) because $20 bills are the vast majority of currency circulated and “that is simply the most practical way for them to handle the money.”

He also highlighted bank drafts, but suggested that money laundering could be occurring before gamblers arrive at casinos with large sums of money.

“Ultimately BCLC has no means and no authority to require banks to disclose how a bank’s customer conducts its business with the bank,” Lightbody wrote. “GPEB and the police, however, do have access to court processes including search warrants and production orders which allow you to compel the disclosure of financial information and conduct much more in-depth inquiries than BCLC is permitted to do. We understand that through this type of work GPEB has concluded that some bank drafts are suspect — as you have noted in your letter.”

CEO wanted names, didn’t get them

Lightbody’s letter said that “several weeks ago” GPEB had advised BCLC that as many as 10 casino customers were using proceeds of crime to buy bank drafts at Canadian banks. BCLC had asked for their names, so that they could be banned from B.C. casinos under the Gaming Control Act.

“We have not yet received the names of the customers involved from GPEB,” Lightbody wrote. “I would welcome you doing anything you can to expedite BCLC being provided the names of customers in question so that we can get them out and keep them out of our gaming sites.”

Lightbody wrote another letter just over a month later, congratulating JIGIT after its June 13 announcement of nine people arrested for illegal gambling and money laundering with links to China. He also asked Asst. Comm. Kevin Hackett of the Coordinated Forces Special Enforcement Unit for information about the suspects’ names and their methodology, so they could be banned from casinos.

Two months later, BCLC had still not received any of those names or related intelligence.

(Bank of Canada)

“It was deeply alarming to hear that top tier organized crime figures participating in or linked to crimes such as kidnapping and extortion were frequenting our facilities,” Lightbody wrote on June 15 to Hackett.

BCLC corporate security vice-president Robert Kroeker wrote a similarly worded letter a day later to Len Meilleur, executive director of GPEB compliance. The letter was copied to Murray Dugger, the western regional manager of the Financial Transactions and Reports Analysis Centre.

In an Aug. 16 email to Kroeker, BCLC anti-money laundering director Ross Alderson wrote that he had not received any information about the identity of the nine suspects, nor had he received information on the suspects’ methodology used to commit crimes.

Attorney General David Eby announced Sept. 22 that he would order a review of money-laundering at Lower Mainland casinos. Eby released a damning July 2016 report by MNP about money laundering at River Rock Casino Resort that had been kept hidden by the previous BC Liberal government. Eby’s predecessor was Mike de Jong, who is running a second time for BC Liberal leadership.

The report said Richmond’s River Rock had been flooded with $13.5 million in $20 bills in July 2015. High rollers, mainly from China, were using underground banks to access large amounts of cash from suspected illicit activities. It also said high rollers were receiving shipments of cash to the casino or just off the property late at night.

MNP’s report found that staff at Great Canadian Gaming’s River Rock fostered “a culture accepting of large bulk cash transactions,” but there was lax detection by both the casino and the few BCLC investigators assigned to work there.

Authorities could have their hands full beginning Sept. 29 when the Parq Vancouver casino opens next to B.C. Place Stadium. The successor to Edgewater Casino is the flagship of Paragon Gaming’s $600 million development on B.C. Pavilion Corporation land. The opening comes on the eve of China’s National Day Golden Week, when visits by high rollers from the Middle Kingdom naturally increase to Vancouver.

BCLC 17-044 Lightbody Letters by BobMackin on Scribd

Bob Mackin British Columbia’s legal gambling monopoly claimed

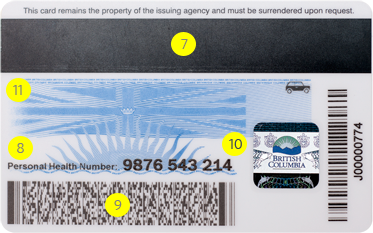

generally restrict foreign storage and information disclosure, but not for the Canadian Council of Motor Transport Administrators and Canadian Police Information Centre, which have legal authority to disclose information in foreign jurisdictions.

generally restrict foreign storage and information disclosure, but not for the Canadian Council of Motor Transport Administrators and Canadian Police Information Centre, which have legal authority to disclose information in foreign jurisdictions.