Bob Mackin

A security company that the NDP government licenced in July, despite its links to an accused money launderer, is allowed to operate while under a code of conduct review ordered in August.

Blackcore Security and Investigations is headquartered in the same Richmond gym that the government wants to seize in a civil forfeiture court action because it claims the true landlord is Paul King Jin. One of the three directors of May-incorporated Blackcore is Jin’s son, Jesse Jia.

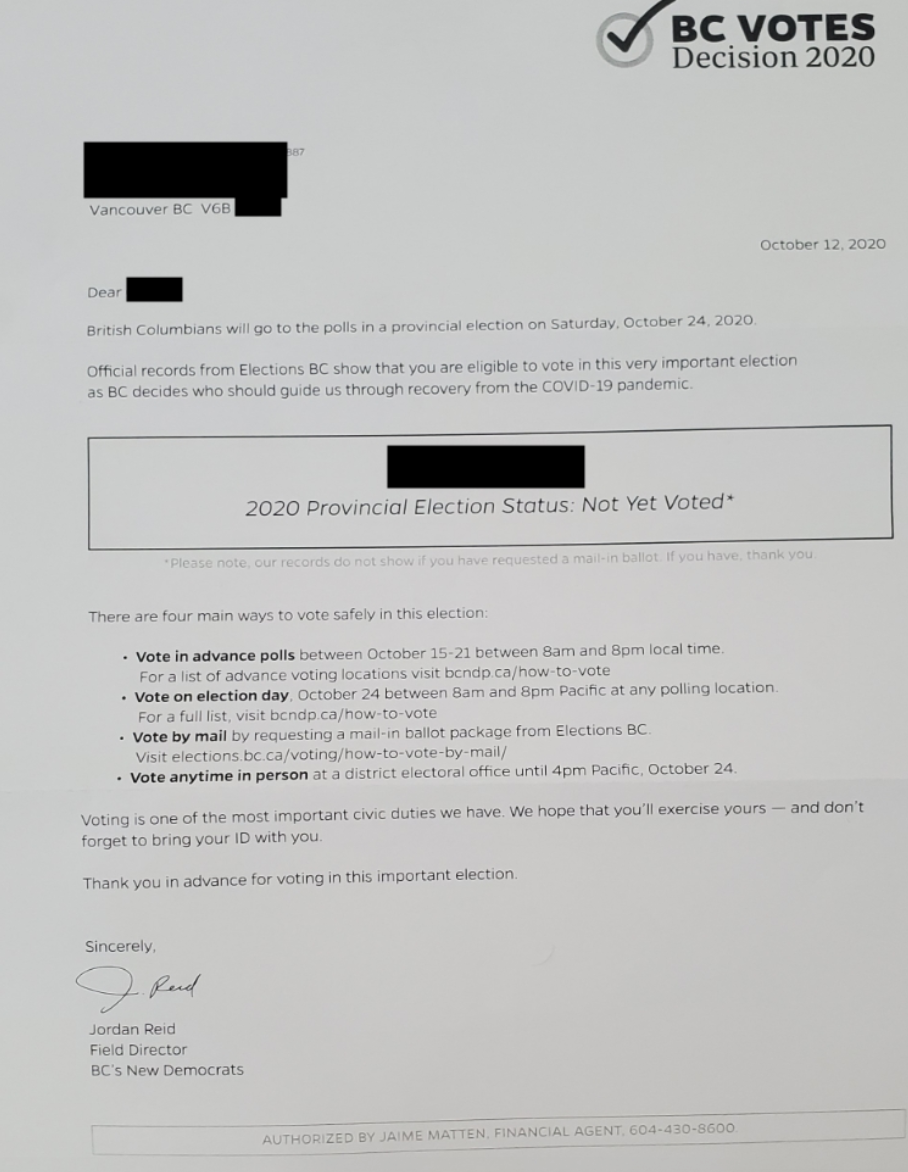

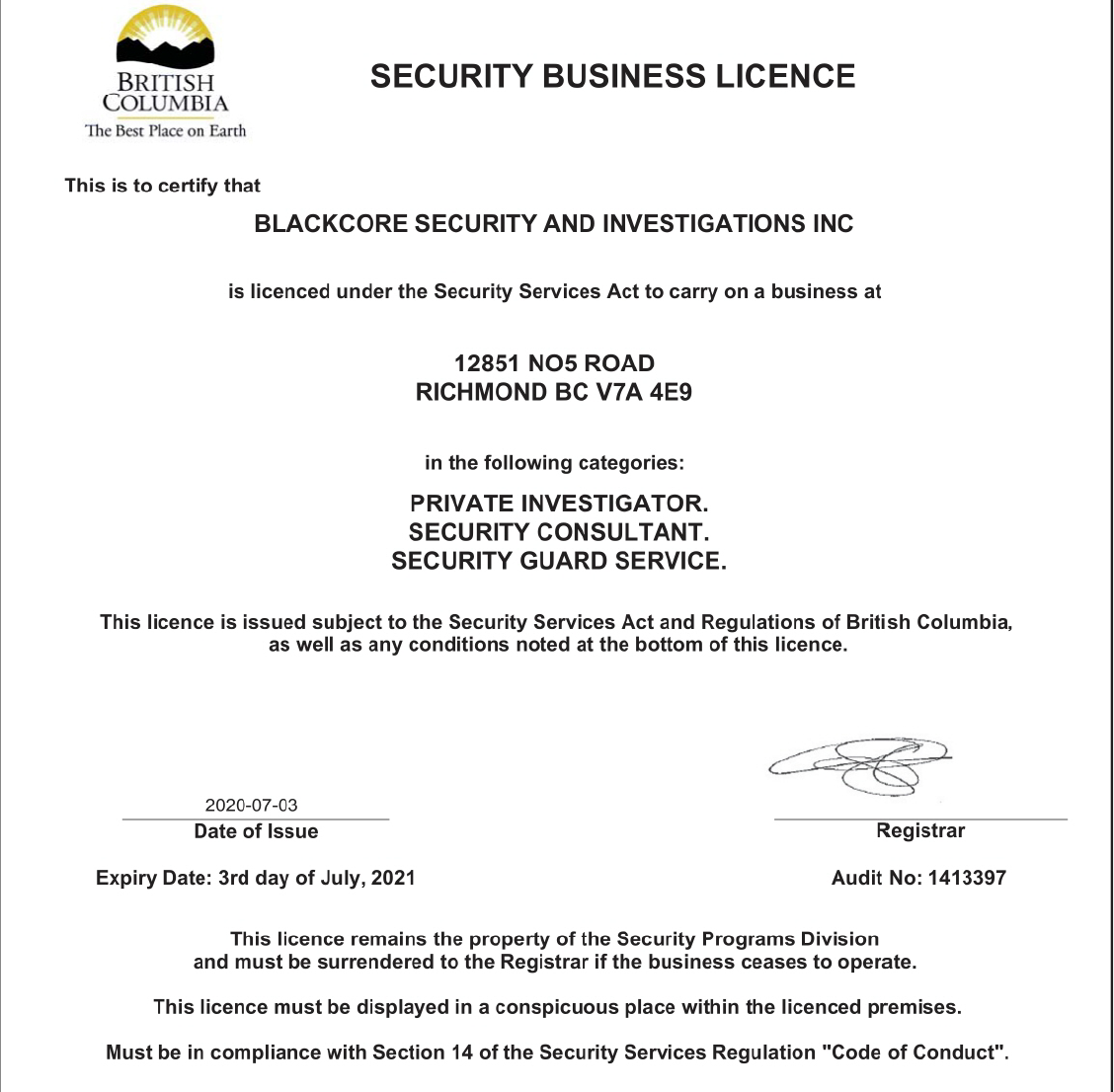

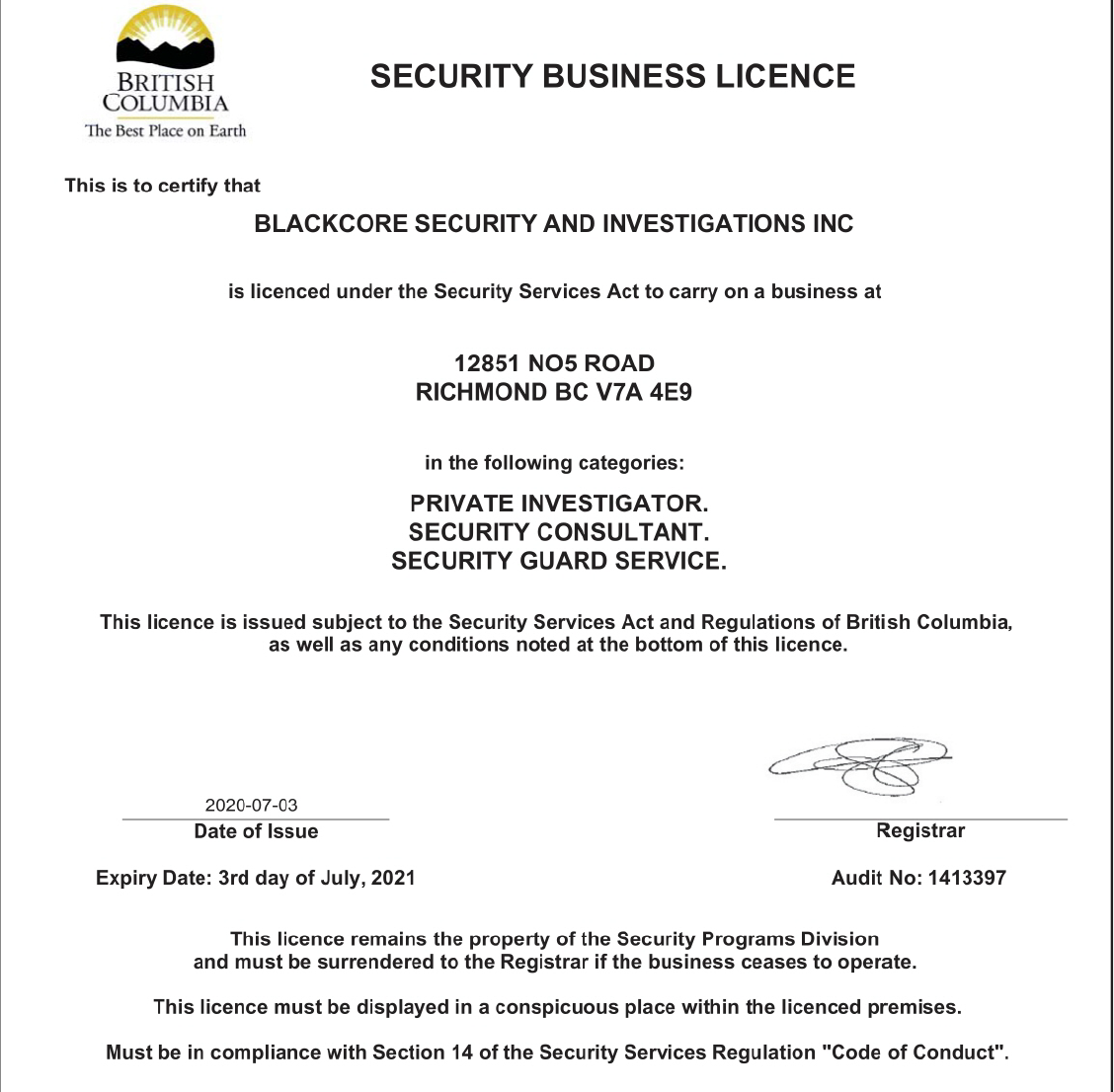

Blackcore Security licence (PSSG)

“The review is ongoing and a decision will be made once it is complete. It is not possible at this stage to provide a timeline for completion,” reads a statement from the ministry provided to theBreaker.news. “The business has maintained its licence to operate a security business, pending outcome of the review.”

NDP Port Coquitlam incumbent Mike Farnworth, the most-recent Solicitor General, declined to directly comment on the Aug. 7 case against Jin and the subsequent review of Blackcore’s licence. The government alleges Jin used proceeds of crime to buy the property at the south end of No. 5 Road in 2016. It was assessed at $7.7 million last year.

“The [Blackcore] application, what happened, is under review,” Farnworth told theBreaker.news on Oct. 8. “You need to wait until that review is done. The procedures and policies have been in there are quite comprehensive. This is the first time I’ve heard of an issue and that’s why it’s being reviewed, to see what happened.”

Jia’s fellow directors are Battlefield Fight League COO Trevor Carroll and Jamie Flynn, a former British Special Forces paratrooper who is now a Squamish BASE jumper and mixed martial arts athlete.

Documents obtained by theBreaker.news, under the freedom of information law, show Flynn began the application to the security programs division of Farnworth’s ministry on May 26. Bureaucrats initially deemed the application incomplete and demanded more paperwork. Flynn later provided a copy of Jia’s passport and his signed consent to conduct a criminal record check. The file released to theBreaker.news is heavily censored.

Internal email indicated a fourth person, with a private investigator and security guard licence, was involved as an employee of Blackcore. The person’s name was withheld by the government.

Paul King Jin (second from right) and Tourism Minister Lisa Beare (second from left) in 2019 at World Champion Club in Richmond (Mackin)

The company was already attracting attention before it got the licence. On June 29, registrar Heather Stewart emailed a co-worker, mentioning there was a media request for information. “Is there an application in the queue right now? Status?” Stewart wrote.

The next day, Stewart wrote in another message: “We are reviewing some principles (sic) of Blackcore Security in relation to their security business licence.”

The licence was granted July 3 in the categories of private investigator, security consultant and security guard service. The official letter to Blackcore said an inspector would contact the company within 60 days to discuss future inspections and review requirements under the Security Services Act. Conditions of licence included abiding by the code of conduct in section 14 of the Security Services Regulation, the section under which the review was called.

theBreaker.news called Blackcore’s phone number listed on its website during business hours, but there was no answer or voice mail. Flynn wrote in an email: “Blackcore is under review by the B.C. Security Programs, so no one from Blackcore will be making a comment until the investigation is over.”

Carroll also works with Kaban Protective Services Inc., according to proprietor Ozzie Kaban, who became Vancouver’s go-to security guy in the 1970s for visiting world leaders, Hollywood stars and aristocrats.

Kaban said he is not involved with Blackcore, but “put it this way, if [Carroll] needs advice, we’ll give him advice.”

Blackcore director Jamie Flynn in the company’s YouTube ad (Blackcore.ca)

Policy improvements needed

An industry veteran said B.C.’s licensing regime needs beefing-up, because the government conducts minimal due diligence on applicants.

“Essentially, they do a criminal record check and that’s it,” said Leo Knight, former chief operating officer of Paladin Security.

“As a security company, I have access to virtually everything my client has, regardless of client size or whatever. I can access their databases, their building, their property, I know who their employees are. I have an incredible amount of private information, just by holding a security contract.”

It remains a mystery how the government overlooked Jin’s family ties to Blackcore.

In March 2019, it sued Jin in a bid to seize more than $5 million in cash and assets that it claims are the proceeds of money laundering and loan sharking.

In August 2019, theBreaker.news exclusively reported that Tourism Minister Lisa Beare attended Jin’s World Champion Club for a photo op to announce legalization of professional kickboxing. Jin was there and joined Beare for a group photo. Beare told theBreaker.news that she was unaware of his connection to the venue or that he was there. As for Jin, he told theBreaker.news that he is an innocent and hard-working man, but said his lawyer advised him not to discuss the case against him.

Mike Farnworth announces $2,000 fines on April 19 (BC Gov)

Beare said the event had been arranged by the province’s athletic commissioner. Nobody in Government Communications and Public Engagement ever answered theBreaker.news queries about whether it conducts a security or reputation assessment prior to holding cabinet minister events on private property.

The director of civil forfeiture’s Aug. 7 claim in B.C. Supreme Court says Jin is the true owner and directing mind of Warrior Fighting Dream Ltd., parent company of World Champion Club. The government accuses Jin of laundering $23.5 million at licensed casinos from 2012 to 2015, generating $32 million in profits at two illegal gambling houses in 2015 and laundering the proceeds through the Silver International underground bank.

On Sept. 18, Jin, 51, suffered facial cuts from bullet-shattered glass when a gunman killed Silver International kingpin Jian Jun Zhu, 44, at the Manzo Japanese restaurant in Richmond.

One of the vehicles at the crime scene was a black van that matched one in Blackcore’s YouTube ad. The ad features a Mandarin voice over and English subtitles that declare Blackcore “#1 Security Company in Canada.”

According to a 2016 transcript obtained by the Vancouver Sun, Jin admitted being a loan shark during an interview with police. Jin offered to help police and said he came to Canada in 1989 as a boxing coach and owns a mine in Mongolia and hotel in China.

The documents obtained by theBreaker.news also show that a government security licensing employee named Gary Flynn handled the Blackcore application and dealt directly with Blackcore director Flynn.

Don Zadravec (LinkedIn)

Gary Flynn refused to respond to theBreaker.news’ query asking whether he is related to the applicant with the same last name. He referred phone and email messages to the communications department.

“We will not and cannot comment on the lives of public servants,” said Assistant Deputy Minister of Government Communications Don Zadravec, who said government workers are subject to a code of conduct and conflict of interest rules.

Asked whether they are related, Jamie Flynn initially replied: “I have no idea who Gary Flynn is.”

In a later message, after being reminded that he communicated with Gary Flynn in June, Jamie Flynn wrote: “I am not related to him and do not know him personally.”

theBreaker.news asked Farnworth to clarify, but he said he was precluded from answering due to privacy laws and human resources policies.

“Without violating those, I can tell you, or I would tell you, that I do not have a concern in that area,” Farnworth said.

Support theBreaker.news for as low as $2 a month on Patreon. Find out how. Click here.

Bob Mackin

A security company that the NDP