Bob Mackin

Suspended British Columbia Legislature Clerk Craig James and Sergeant-at-Arms Gary Lenz responded separately to the Legislative Assembly Management Committee on Feb. 7, after each received a six-day extension.

The Legislature voted unanimously to suspend them on Nov. 20. They are under investigation by the RCMP and two special prosecutors for allegations of corruption. They claim to be innocent and want to be reinstated. When it published the damning report by Speaker Darryl Plecas on Jan. 21, LAMC demanded an explanation from James and Lenz.

theBreaker.news obtained copies of their responses, which are published below in their entirety.

Gary Lenz (left), ex-speaker Linda Reid and Craig James (Commonwealth Parliamentary Association)

Meanwhile, theBreaker.news has learned that former Speaker Linda Reid has resigned as Assistant Deputy Speaker. The Richmond BC Liberal MLA since 1991 was implicated in the spending scandal and firing of an aide who blew the whistle on expense irregularities. Joan Isaacs will be put forward as Reid’s replacement when the Legislature reconvenes on Feb. 12.

theBreaker.news has analyzed James and Lenz’s replies and found several admissions, omissions and discrepancies that demand fact-checking.

WHAT DAY WAS THAT?

JAMES: First, the Sergeant-at-Arms had never even been to my house before November 21, 2018, the day we were removed from the Legislative Assembly.

LENZ: Until November 21, 2018, following my removal from the Legislature, I had never been to the Clerk’s residence.

FACT CHECK: The duo was suspended (with pay) on Nov. 20, 2018, by vote of the Legislature, and escorted to the parking lot. TV cameras caught images of Lenz as the driver of a car. James was the passenger.

HOW MUCH WOOD WOULD A CLERK SPLIT?

LENZ: My recollection is that the wood splitter was for the purpose of provide firewood for heat and light in the event of a disaster; and the trailer was to be available for whatever utility purposes were required, including potentially hauling wood.

JAMES: I was storing them while storage space at the Legislature (including a concrete pad and path for the trailer) was being constructed. This was supposed to be a short term proposition but it dragged on. All of this was done in the open and known to many people.

Wallenstein log splitter

I became frustrated at storing the trailer at my home because of its size. (I did not have the space – I live in a strata and not a rural property) and I arranged to have the trailer stored at an RV storage facility. This was known to the Executive Financial Officer (I recall raising the issue with her in my office). The Report suggests the “trailer was not at the Legislative Precinct as of November 20, 2018” and that it “subsequently materialized”. This is incorrect, I took the trailer to the Legislature prior to my removal form (sic) the Assembly on November 21, 2018 (sic). I have not been back there since. I called Randy Ennis to let him know that I was bringing the trailer a week or so before I dropped it off. When I was removed from the Assembly, I arranged through my lawyers for the pick-up of some personal items of mine from the Assembly and the delivery of items belonging to the Assembly, including the wood splitter.

FACT CHECK: Again, James and Lenz were suspended on Nov. 20, 2018, not Nov. 21, 2018. The Dec. 4, 2018 letter from his lawyer at Fasken said “Mr. James is also holding a log splitter…” The log splitter was compatible with the trailer.

According to the Plecas Report, “Mr. Ennis said the wood splitter never arrived at the Legislative Assembly, and instead was taken directly to Mr. James’ personal residence where Mr. James and Mr. Lenz were using it to split firewood. Mr. Ennis’ view was that there was no legitimate rationale for the Legislative Assembly to have purchased a wood splitter for emergency purposes or otherwise.”

The Legislature also has a well-resourced and well-stocked contractor that specializes in tree care. Bartlett Tree Experts was on the job outside the Parliament Buildings on Jan. 21. Its website said its services include cleaning up from storms. Bartlett provided the Christmas tree in the Legislature rotunda in 2013, after a local farmer who volunteered his trees for 40 years was snubbed.

EVERYBODY INTO THE… LUGGAGE POOL?

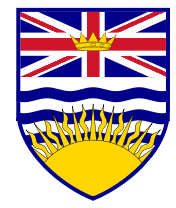

JAMES: The Report also refers to luggage I purchased in Hong Kong [for which he was reimbursed $1,138.14]. It is true I purchased this luggage. Several MLAs had requested the purchase of pieces of luggage which could form a small pool of luggage that would be available for anyone at the Legislative Assembly (staff or member) for official travel.

The Speaker himself had complained to me that he felt he did not have sufficient luggage for the travel he was engaged in. The purchase in Hong Kong (and another purchase in London) were for this purpose. In preparing this response it has been pointed out to me that the receipt for this luggage purchase contains three items, the two pieces of luggage and a watch. I claimed for two items. But it appears that I accidentally claimed for the watch rather than one of the pieces of luggage. The cost is approximately the same for the two items but I will reimburse the small difference.

LUNCHING WITH LAWYERS

JAMES: I met with John Hunter, Q.C. and Geoff Plant, Q.C. in relation to legal matters involving the Legislative Assembly. While we communicated by telephone and email in relation to routine matters, in person meetings were required from time to time. And I believed it was cheaper to have me travel to meet with counsel rather than to have a lawyer charge for his time travelling to Victoria. I met with current and former MLAs and the Speaker and Deputy Speaker in the Lower Mainland; again, for business purposes. In specific response to a criticism that I met with Mr. Plant and Mr. Barbeau, I did not meet with them at the same time – there were two separate meetings, one relating to legal advice to the Legislative Assembly, the other pertaining to obtaining reproductions of coastal BC paintings for legislature offices.

Paul Barbeau (LinkedIn)

FACT CHECK: James was silent about his meetings with Christy Clark [July 17, Oct. 13 and Dec. 14, 2017; and May 2, 2018] and the BC Liberal Vancouver office [Jan. 31, 2018, four days before the leadership election]. He was also silent about the reason given on his expense form for the June 20, 2018 trip to Vancouver to meet Plant and Barbeau: Vancouver-Point Grey, the name of Attorney General David Eby’s riding.

Neither ex-attorney general Plant nor BC Liberal president Barbeau have responded to theBreaker.news. At the time of his meeting with James, Barbeau was leader Andrew Wilkinson’s handpicked representative on the party board.

James’s expenses said he met on four occasions with Hunter, whose Hunter Litigation Chambers billed the Legislature $44,866 for the last fiscal year. Two of the meetings, on May 4 and 17, 2017, are in dispute by the spokesman for B.C.’s higher courts. Hunter was named as a judge to the B.C. Court of Appeal on April 12, 2017 and sworn-in eight days later. Bruce Cohen said Hunter told him he did not speak to or meet with James “at any time” after his judicial appointment was announced.

WHEN GARY THREW CRAIG UNDER THE BUS

LENZ: Again, in the limited time provided to me to respond to the Speaker’s report, I have concentrated on specific allegations about my conduct. I have not had the time or opportunity to deal with his detailed recitations of conversations that he says that we had about the Clerk’s conduct. Nor, frankly, do I see the purpose in this. The Speaker’s concerns about the Clerk should be dealt with on the basis of facts, not hearsay. I do wish to say, however that the Clerk has done much to improve the affairs of the Legislative Assembly.

FACT CHECK: Let the reader decide. Did Lenz deny in the above paragraph that he said the following to Plecas, as in the Plecas Report?

Mr. Lenz expressed the view that Mr. James was not impartial and that he was in fact very close with the BC Liberal party. Before I became Speaker, that was not something that I had heard before, so I determined to reserve judgment on that subject; however, this was the first time Mr. Lenz had said something to me that indicated he was not entirely aligned with Mr. James’ views and conduct. Mr. Lenz added that I should not trust Mr. James.

A LIBERAL PLANT?

JAMES: I do not agree that my advice to the Speaker was partisan in nature; I am aware of my obligation to act in an even handed manner. I do not vote in Provincial General Elections.

FACT CHECK: James was appointed clerk on June 2, 2011 when the BC Liberals used their majority in the Legislature, to the protest of the NDP opposition. The all-party LAMC did not make the decision. See above. In his Jan. 21 report, Plecas had written that, after returning from the U.K. in August 2018, James had asked him when he would submit his bill for an Ede and Ravenscroft suit. In that conversation, Plecas alleged that James had damaging informaiton about the BC Liberals and was willing and able to use it, in order to protect Plecas.

I said I wasn’t going to do that, but I didn’t want to alarm him, so I added something to the effect of me being a public figure and that my expenses are undoubtedly scrutinized by the Members of the Opposition. He replied that I shouldn’t worry. He said that if they took issue with my expenses, he could put an end to it because he had “so much dirt on the Liberals” and that he could threaten to “stop paying their legal bills” or “quit paying their severance payments”. I don’t know what he was talking about, but it seemed an unusual comment.

Here is James’s version:

Sometime after we returned from the U.K., the Speaker told me that he had decided not to submit a reimbursement claim for the suit he had bought as he was concerned about what the Liberals would say and how it might affect his potential recall. The suggestion in the Report that he played coy as he “didn’t want to alarm [me]” is laughable. If the Speaker had any concerns about my conduct, I would have expected him to raise them. He never did.

James was silent on the comment attributed to him, that he had “so much dirt on the Liberals” and could threaten to cut-off BC Liberals’ legal bills and severance payments.

So, what does James know about the BC Liberals and when did he know it? Questions for the RCMP and two special prosecutors to seek answers.

CALL ME COMMISSIONER, PLEASE

Clerk Craig James swore Christy Clark in as Westside-Kelowna MLA in 2013, near Clark’s Vancouver office. (Facebook)

JAMES: The Report also refers to the fact I asked the Speaker to appoint me and the Deputy Clerk as Commissioners. It is true that I asked the Speaker to appoint us commissioners under the Legislative Procedure Review Act, for the purposes of work we were performing to prepare a Fifth Edition of “Parliamentary Practice in British Columbia” and other procedural reform and research including review of the Standing Orders and legislation applicable to the Legislative Assembly. My motivation to be appointed Commissioner was driven by tradition, practice, and what I believed the Legislative Procedure Review Act required – not additional compensation, which in any event could not be paid unless it was “certified and approved by the Speaker” under s. 4(1).

BOOZE FOR BILL BARISOFF

LENZ: The incident the Speaker refers to happened in 2013. The Clerk, assisted by member of the Legislative Facilities staff loaded unopened boxes and bottles of alcohol into the Clerks truck on two occasions. This was done openly in the middle of the day. I am not responsible for managing the Clerks or Speakers supply of alcohol. I assumed at the time that the alcohol was unused and being returned. I had no reason to believe that anything wrong was happening. I had no involvement in the purchase or returning of the alcohol, other than to inform the Executive Finance Officer that the alcohol had been removed from the precinct by the Clerk.

JAMES: The Report refers to an incident in 2013 involving “$10,000 worth of liquor” and suggests I took this liquor to former Speaker Barisoff. My memory of this event, which took place more than 5 years ago, is imperfect. I categorically deny taking $10,000 of liquor, to Mr. Barisoff, or otherwise.

What I do remember is that, along with a desk and chair that had been presented to him, and other personal effects, I took some amount of alcohol to Mr. Barisoff’s house (certainly not $10,000 worth) in the Okanagan when I was scheduled to meet with him on Legislative Assembly related matters.

I remember that Mr. Barisoff provided a cheque for the alcohol, payable to the Legislative Assembly. It should be in the records, which are unavailable to me.

FACT CHECK: Barisoff was quoted by reporter Keith Lacey in the Kelowna Daily Courier on Jan. 23 denying that he received $10,000 worth of alcohol. He only admitted to receiving the desk he had been given at his retirement party. “The fact the reports suggest that I had received $10,000 worth of alcohol delivered to my house is troubling when it didn’t happen,” Barisoff said. “That’s the way it goes, I guess.”

HEADPHONES ILLUSTRATED OR AURAL DIGEST?

JAMES: I accept that expenses incurred for several subscriptions should not have been charged to the Legislative Assembly. I accept that I did not take the care I should have in reviewing these invoices before they were processed for reimbursement to segregate out personal subscriptions (i.e. a Bicycling magazine) from subscriptions that were for business use.

I will reimburse these expenses, and I will exercise scrupulous care on this matter moving forward.

I do not agree that other expenses identified in the Report are inappropriate. A camera was purchased and used for legislative business. I was responsible for taking photographs of our official visit to China, and have and continue to compile photo journals for the Legislature. The “Dial a Geek” and computer products that were purchased were for my home office, and Legislature office. They are proper and legitimate tools which I used for my job, and have returned while I am on administrative leave. Finally, the Report refers to noise cancelling headphones. I suffer from a condition which causes ear problems when flying arising from a combination of sound and cabin pressure. The noise cancelling headphones were purchased to alleviate that condition.

VACATION LUCRE

JAMES: I did not understand there to be any problem with the fact I received a payout for unused vacation. This was approved through appropriate channels, and was not a benefit that was unique to me. Receipt of a payout of vacation was consistent with settled practice…

I understand the Report to suggest that I am rarely in the office on Fridays. This is inaccurate, Audit Working Group meetings are held on Friday mornings. I am a member of the Audit Working Group and I attend its meetings, and work on Friday (and also often work evenings and weekends). Our lives are very similar to the Members – we are working 24/7 even when we find time to take our vacations.

LENZ: I have contributed well over 400 hours each year over and above my expected work hours… My leave and vacation payouts have been approved by the Clerk, as it is with all other staff that report to him.

FACT CHECK: According to Plecas, “the total amount paid to Mr. Lenz and Mr. James in lieu of vacation, it is, at a minimum, several hundreds of thousands of dollars.”

RETIREMENT BONANZA

JAMES: In relation to the retirement allowance I received in 2012 [$257,988.38], I note that: It was not my idea to create this benefit. The benefit was created by others who had the power to confer it on me and other officers. A legal opinion regarding the validity of the retirement allowance was provided to former Speaker Barisoff at his request.. After receiving the opinion Speaker Barisoff confirmed the program was in effect, but also brought it to an end.

Exclusive London tailor shop preferred by James and Lenz.

FACT CHECK: According to Plecas, “The same Retirement Allowance was paid in 2012 to Kate Ryan-Lloyd as Deputy Clerk and Clerk of Committees, in the amount of $118,915.84. This was apparently done at the instruction of Mr. Barisoff and with the written support of Mr. James. However, on February 20, 2013, Ms. Ryan-Lloyd wrote to Mr. James stating that she would voluntarily pay back the net amount she received in full, for “personal reasons”, which invites the inference that she did not believe it to be a legitimate benefit.”

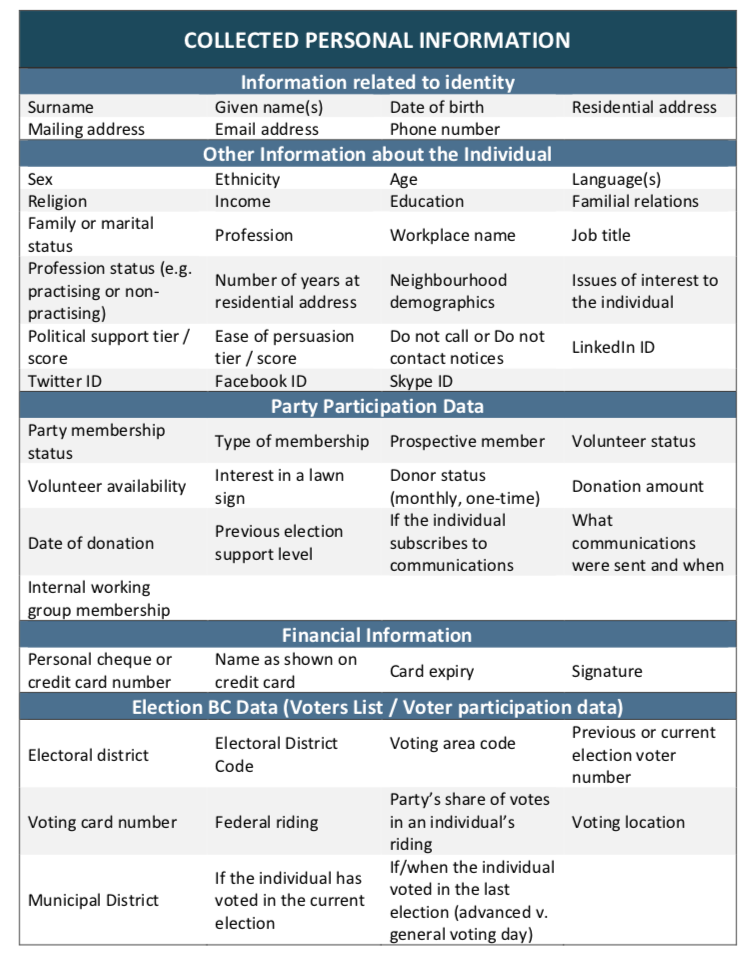

HABERDASH OR BALDERDASH?

LENZ: Studs, cufflinks and wing shirt were purchased for work use and approved and processed appropriately. These items are part of the Sergeant-at-Arms formal uniform… None of the items that I purchased and received reimbursement for were for personal gifts or personal non-work use.

JAMES: I bought a suit. I had been working on a plan to modernize the clothing worn at the Table in the House (which consists of cumbersome and expensive gowns), to be more akin to the business attire worn at the Table in the Quebec National Assembly and the Scottish Parliament. Transitioning to modern business attire for everyday use in the Legislative Assembly will lead to a savings of money, given the thousands of dollars that we spend each year on garments worn by the Table Officers and Presiding Officers currently cost.

FACT CHECK: There are numerous high-quality tailors located in British Columbia, but James and Lenz preferred the same London shop that supplies Queen Elizabeth II. Both James and Lenz’s replies are silent on the issues of declaration of imported goods and payment of duties and taxes. theBreaker.news reported exclusively that Canada Border Services Agency may be investigating the duo.

Plecas’s report said that, in December 2017, “When we were preparing to fly home [from the U.K.], I commented that I had bought quite a bit of scotch and that it was likely to cost me a fair sum in duties. Mr. James replied along the lines of, “do as I do – don’t declare anything”.

SAANICH STRATA SPACE

JAMES: I became frustrated at storing the trailer at my home because of its size. (I did not have the space – I live in a strata and not a rural property) and I arranged to have the trailer stored at an RV storage facility. This was known to the Executive Financial Officer (I recall raising the issue with her in my office).

FACT CHECK: According to a B.C. government website, “Over 1.5 million people live in strata housing. Strata housing can include: condos, townhouses, duplexes, even single family homes in bare land strata corporations.” James’s residence is not the type of “strata” that British Columbians in urban areas would associate with a strata. James lives on one of six strata lots in the Bonanza cul-de-sac near Cordova Bay in Saanich. The 1990-built house, with four bedrooms and three bathrooms, is 3,647 square feet and sits on 10,425 square feet of land, that includes a driveway, garage and street-level parking pad. The wood splitter and trailer (pictured above) are closer in size to a motorcycle than a car.

The property was assessed at $1.361 million last year, up from $1.268 million a year earlier.

Property records show Lenz has an apartment in Sidney worth $302,100 and a house worth $862,000 in North Saanich, east of John Dean Provincial Park.

LEAD, FOLLOW OR GET OUT OF THE WAY

LENZ: I note that the Speaker himself praised the leadership of the Clerk in my presence and requested that the Clerk provide a quote on leadership that could be used in the book on leadership that the Speaker was co-authoring.

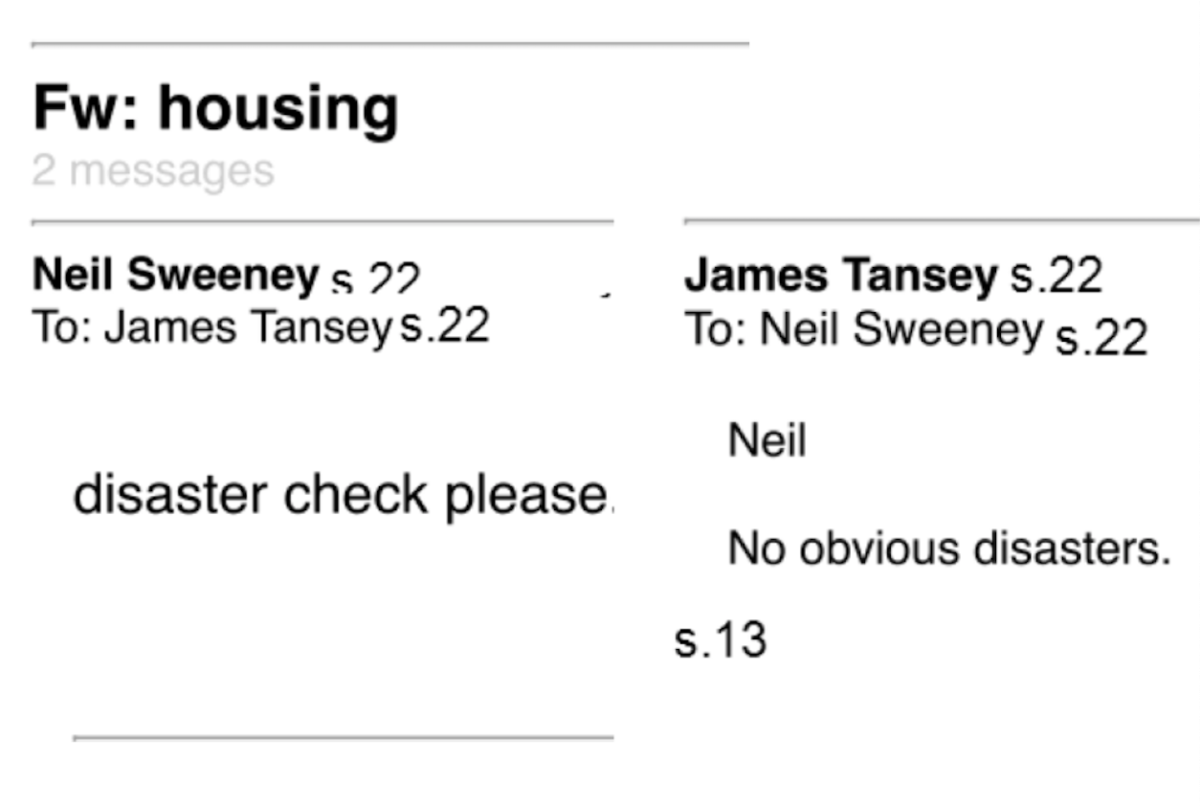

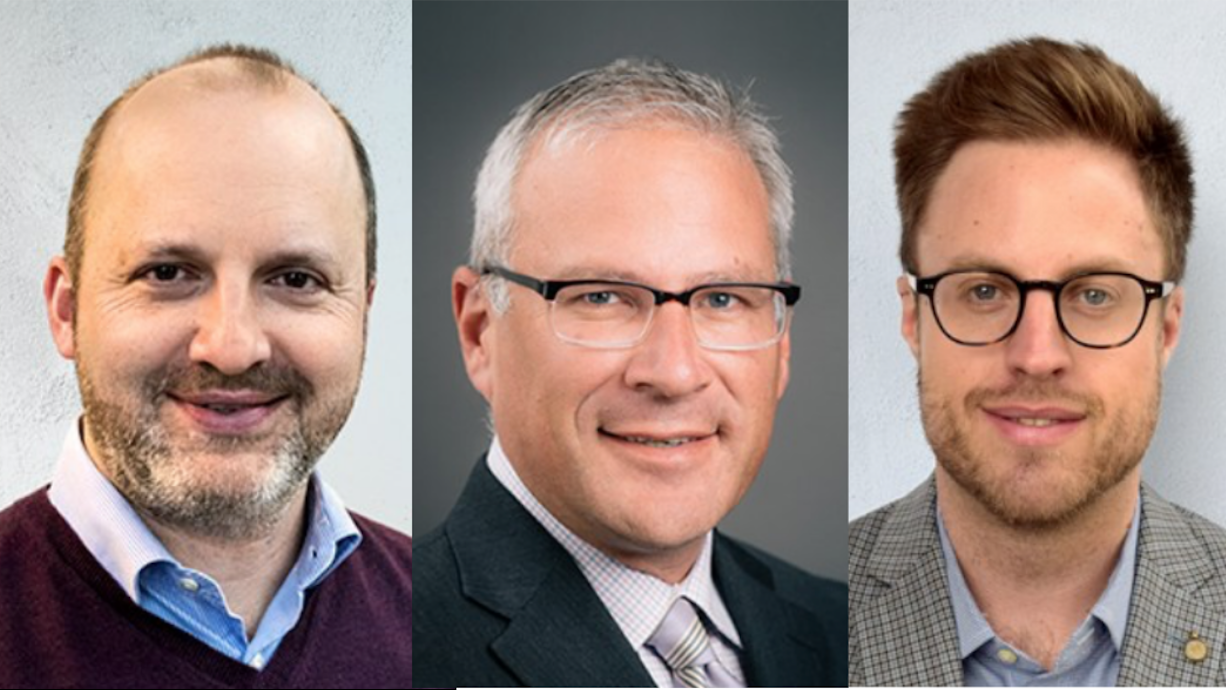

FACT CHECK: Plecas co-authored The Essentials of Leadership in Government: Understanding the Basics with Len Garis and Colette Squires. Lenz’s reply includes relevant pages and a link to the e-book in which James was quoted on page 75 of the first edition (“Successful leadership is directly attributable to the stimulation a leader brings to mobilizing an organization”) and Lenz on page 127 (“Knowing your weakness only makes you stronger”).

However, what Lenz does not mention is that both he and James were deleted from the second edition of the book, which is available for free from this University of the Fraser Valley page dated Feb. 23, 2018. Is it any surprise that Plecas would want to purge his book of quotes from two people who would be facing a criminal investigation for alleged corruption under their leadership?

Support theBreaker.news for as low as $2 a month on Patreon. Find out how. Click here.

James Final Response by on Scribd

Gary Lenz’s response

Lenz_SAA Response by on Scribd

Bob Mackin

Suspended British Columbia Legislature Clerk Craig