Victoria firm a Cambridge Analytica “franchise” that used horror to intimidate Nigerian voters: whistleblower

Bob Mackin

The Facebook and Cambridge Analytica whistleblower testified at a British parliamentary committee on March 27 that a Victoria company was deeply involved in the 2015 campaign against eventual Nigerian presidential election winner Muhammadu Buhari.

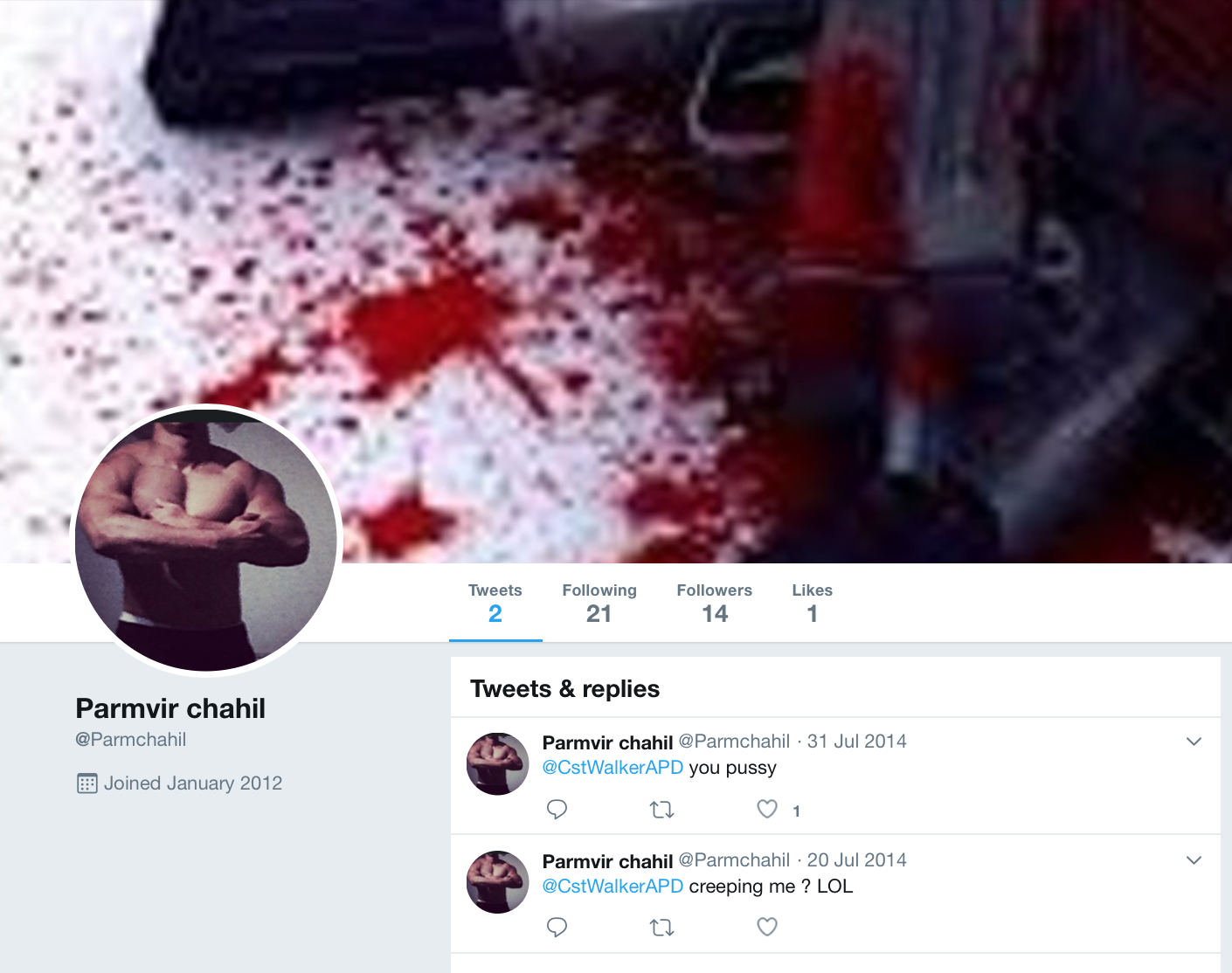

Christopher Wylie alleged that AggregateIQ handled hacked information, kompromat and horrifying videos.

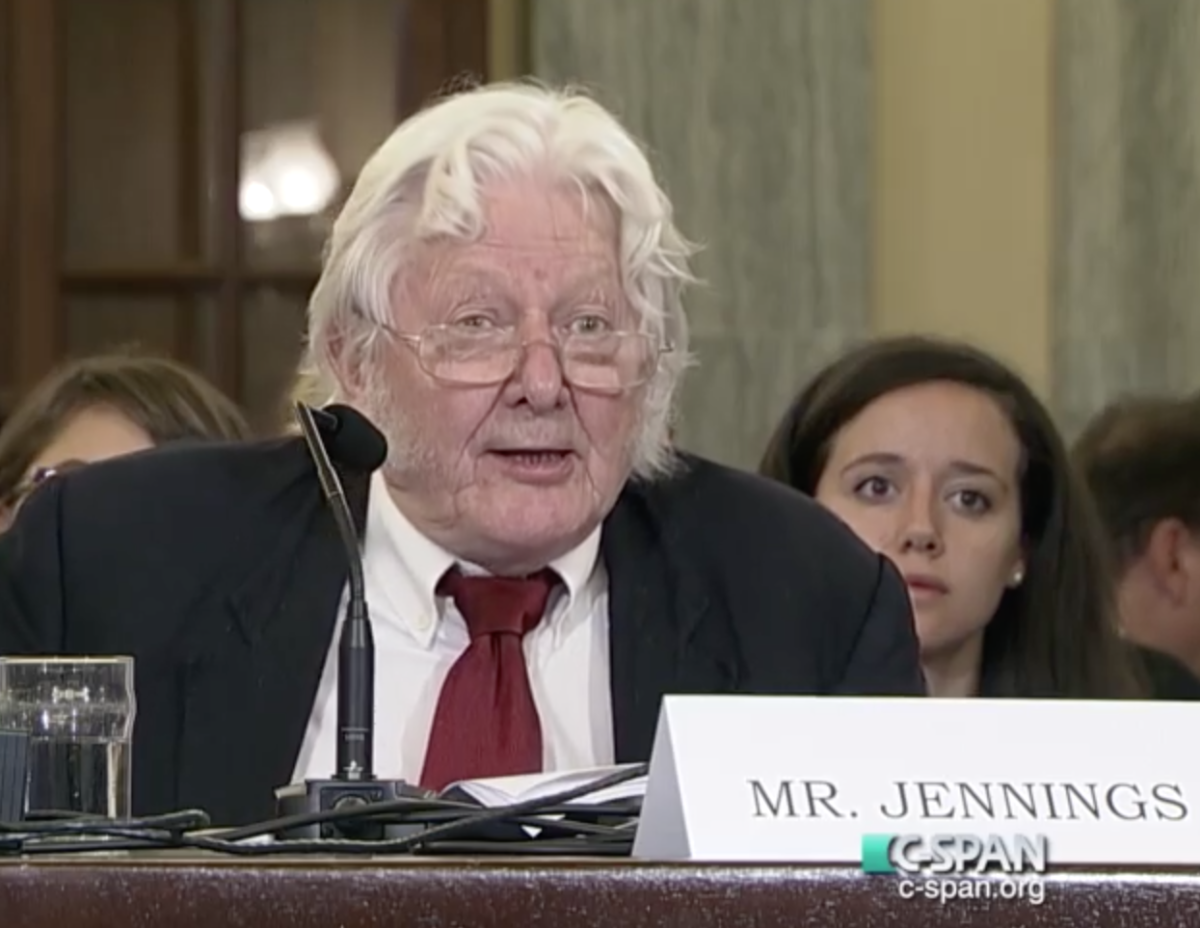

Christopher Wylie testifying to a U.K. Parliamentary committee on March 27.

“The videos that AggregateIQ distributed in Nigeria, with the sole intent of intimidating voters, included content where people were being dismembered, where people were having their throats cut and bled to death in a ditch,” Wylie told MPs on the Digital, Culture, Media and Sport Committee. “They were being burned alive. There was incredibly anti-Islamic and threatening messages portraying Muslims as violent.”

Wylie was asked about a March 24 statement published on the AggregateIQ website. The company called itself a 100% Canadian-owned and operated digital advertising, web and software developer that “has never been and is not a part of Cambridge Analytica or SCL.”

Wylie said “they’re using weasel words; that is all technically true.”

He said AIQ worked as a “franchise” of Cambridge Analytica through intellectual property agreements, and that it shared information with Cambridge Analytica. The overwhelming majority of AIQ projects and income, he said, came from Cambridge Analytica and SCL. Wylie pointed to AIQ’s work to build Cambridge Analytica’s “Ripon” voter identification database for the Republican Party’s 2016 campaign and said it “utilized the algorithms from the Facebook data.” He was referring to the data from 50 million Facebook users collected by Cambridge University professor Aleksandr Kogan.

“This is a company that has worked with hacked material,” said Wylie, a former Liberal Party of Canada caucus research contractor. “This is a company that will send out videos of people being murdered to intimidate voters. This is a company that goes out and tries to illicitly acquire live internet browsing data of everyone in an entire country. A lot of questions should be asked about the role of Aggregate IQ in this election and whether they were indeed compliant with the law here, beyond just spending infractions.”

Wylie also alleged that AIQ was “used as a proxy money-laundering vehicle” for the Vote Leave campaign in the 2016 Brexit referendum. The company was paid $5.75 million, or 40% of the winning campaign’s spending.

AggregateIQ co-founders Zack Massingham (left) and Jeff Silvester.

AIQ was founded in 2013 by Zack Massingham, from Mike de Jong’s 2011 leadership campaign, and Jeff Silvester, a former aide to MP Keith Martin. Neither Massingham nor Silvester responded to theBreaker.

Before the scandal broke in the United Kingdom, AIQ worked on the failed BC Liberal leadership campaign for ex-transportation minister Todd Stone. Almost 1,350 memberships were cancelled after party officials found AIQ registered domain names to create new email addresses that were designated to new party members recruited by the Stone campaign in Richmond and Surrey.

Cambridge Analytica, SCL and AggregateIQ are under investigation in both the U.K. and Canada. British Columbia’s incoming information and privacy commissioner, Michael McEvoy, was seconded last September to work on the probe under his former B.C. boss, U.K. Information Commissioner Elizabeth Denham.

AggregateIQ’s website features an image of Victoria’s Inner Harbour and the B.C. Parliament Buildings.

Support theBreaker.news for as low as $2 a month on Patreon. Find out how. Click here.

Bob Mackin The Facebook and Cambridge Analytica whistleblower