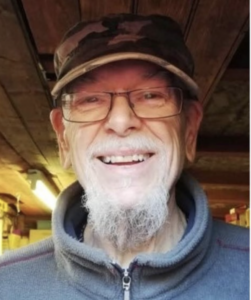

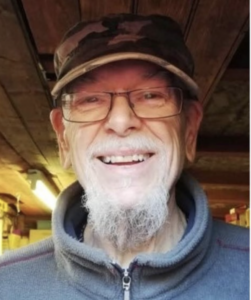

Bob Mackin

When Daniel Fontaine ran for New Westminster city council for the first time in 2018, he finished seventh in the race for six seats. Shortly afterward, he realized he was tired of seeing toxic messages directed at him on Twitter, so he quit and decided he would win for the New West Progressives party in 2022, “without Twitter, not because of Twitter.”

New Westminster City Councillor Daniel Fontaine (Zoom)

Fontaine chose old-fashioned knocking on doors — 4,500 to 5,000, by his count — and talking face-to-face with real people, with real names. He finished sixth last October, winning a seat with almost 1,900 more votes than his 2018 tally.

“I never regret that decision,” Fontaine said.

That didn’t solve the entire problem for Fontaine, who was the CEO of the Metis Nation B.C. from March 2020 to May 2022. He was still a target online.

“The only way I find out about them is if people screenshot them and send them to me,” said Fontaine. “So I am aware that there were several incredibly vile and disgusting tweets that were sent out and imagery on the @NWRegressives [account], putting me into orange T-shirts and mocking the fact that that I’m Indigenous was just beyond the pale.”

The most-notorious account was under the name Allan Whitterstone. Whistleblower Sarah Arboleda went public on June 14, with evidence that Community First New West (CFNW) school board trustee Dee Beattie was tweeting from @AlfromNW “to harass parents, teachers, and even the head of the BCTF for years.” Arboleda said she and her husband, James Plett, noticed odd comments from “Allan” any time they were critical of the school board.

Dee Beattie (second from left) in the 2022 Community First NW campaign photo (CFNW)

Beattie admitted to it, was kicked out of the the NDP-aligned party’s caucus and announced she would go on leave due to illness. She has resisted calls from the rest of the board and the District Parents’ Advisory Committee to resign. She refused an interview request.

Rather than launch an immediate internal investigation, party chair Cheryl Greenhalgh sent Plett a brisk message on June 16.

“You and Sarah are members of Community First and I would have expected that you make a complaint directly to the executive of CF or to the chair of the School Board rather than through Twitter,” Greenhalgh wrote. “That you chose to do that publicly makes it difficult for me to now have a conversation with you about the issue until it is resolved.”

Greenhalgh did not respond to an interview request.

Arboleda, Plett and Fontaine spoke at the June 20 school board meeting, but the school board rejected calls for a third-party investigation.

“There are still a lot of questions that remain unanswered and the only way that that will ever get answered is if there is an independent investigation as to what happened,” Fontaine said. “I’d like to know, did anyone know if Ms. Beattie had this account? Is there any elected official that was aware or had heard rumours? Or was potentially privy to information related to whether or not this account actually existed and was run by one of their colleagues? I don’t know. I certainly hope not.”

The “Allan Whitterstone” mugshot Dee Beattie used for her fraudulent account (Twitter).

Fontaine said he is encouraged that city council is in the middle of modernizing its code of conduct. It may result in the hiring of an external ethics commissioner to probe complaints from citizens, staff and politicians. He also said city manager Lisa Spitale moved swiftly in early January after a citizen complained that civic social media accounts were following @NWRegressives, the account that claimed to be a parody, but often pilloried Fontaine.

@NWRegressives shut down the day after Beattie’s June 16 announcement and subsequently disappeared. Some of the evidence was archived and re-posted as “@NWRegressFan.”

“The timing of it shutting down so quickly after the Dee Beattie affair seems a bit more than simply coincidental,” Fontaine said.

@NWRegressives’ parting messages called Beattie, Fontaine and others bullies, and claimed Fontaine had feigned offence. The four-part thread ended: “If you enjoyed the memes, I call on you to call out the many sock puppet, trolls, and assholes here adding nothing to #NewWest discourse, not even humour. You know who they are. Don’t cede this space to them. Bye.”

@NWRegressives first appeared Feb. 18, 2022, some eight months before the election. “We are not affiliated with any party,” said one of the first tweets, beside a winking emoji.

The #NewWestRegressives hashtag was, coincidentally, used the previous day in a tweet by New Westminster architect Robert Billard, when he called NWP “out of touch with what’s already going on.” Almost a year later, on Feb. 14, 2023, Billard issued a denial. “I am NOT @NWRegressives, and I don’t know who is.”

Billard frequently contacts elected and appointed officials on behalf of his clients seeking development permits. He donated $105 to CFNW on election day. On April 8, he quit tweeting, with a message expressing anger at “self-serving politicians, hateful people, unbridled racism, armchair experts, and chronic complainers. Twitter gets me so angry, wanting to ‘fix it’. I can’t. At times I say the wrong thing. My health can’t take it anymore. I’m getting off. Bye.”

Billard did not respond to phone messages left at his architecture practice from a reporter seeking his reaction to the Beattie scandal. Of the four email queries in the last week of June, he responded just once after a reporter noticed his dormant account was gone.

“Your email reminded me that I hadn’t fully shut it down instead of just stop using it,” Billard wrote. “Thanks for the reminder.”

Dee Beattie is not the first B.C. politician found using a pseudonym in a dirty tricks scandal. The most-famous happened 25 years ago in Parksville when the local newspaper caught BC Liberal MLA Paul Reitsma writing letters to the editor, in praise of himself and critical of opponents, under the pseudonym “Warren Betanko.” Reitsma quit, rather than face a recall vote, after a petition attracted more than enough signatures to oust him.

Some 20 years later, a 2018 investigation by The Ringer resulted in the resignation of Philadelphia 76ers president Bryan Colangelo, whose wife, Barbara Bottini, admitted she was behind anonymous accounts slamming NBA players (including some 76ers) and executives.

Earlier this month, the Washington Post questioned the legitimacy of a viral, polarizing account under the name Erica Marsh, who claimed to be a proud Democrat and denied being a parody, fake or bot.

Coun. Colleen Hardwick (left) and Mayor Kennedy Stewart at the April 12 city council meeting (City of Vancouver)

Reporters looked into the September 2022-created account, which was followed by 130,000 users and popular among Republicans. They couldn’t find anyone with that name in the Washington, D.C. phone directory or voting list. The Biden presidential campaign and Obama Foundation had no record of Marsh, despite her claims of involvement with both. The Washington Post story speculated that Marsh could have been the rage-baiting creation of an Eastern European “troll farm” service, aimed at influencing the midterm elections.

A Toronto-based thinktank’s June report on abusive content directed at candidates and parties in last fall’s elections in Vancouver and Surrey included a dire warning.

“These working conditions, facilitated by digital technologies, threaten to reduce participation and representation in our democracies,” said the report from the Samara Centre for Democracy.

Its “Sam-bot” found 13% of Tweets analyzed during the 35-day Surrey election period were either insults, toxic, threats, sexually explicit and/or identity attacks. Fourth-place mayoral candidate Jinny Sims, the NDP Surrey-Panorama MLA, had the most-abusive tweets received at 199, followed by eventual winner Brenda Locke at 169. Incumbent Doug McCallum had no account.

Vancouver had a similar 13% rate. Incumbent mayoral candidate Kennedy Stewart received one-in-five of the total abusive tweets (2,031), followed by TEAM for a Livable Vancouver’s Colleen Hardwick (599) and eventual winner Ken Sim (562).

Not all politicians are innocent.

In June 2022, Stewart got in trouble for falsely accusing Hardwick on Twitter of violating the non-binding agreement with First Nations and Whistler to explore a bid for the 2030 Winter Olympics. Integrity commissioner Lisa Southern reprimanded Stewart.

New West Regressives Twitter debut (Twitter)

Southern also reprimanded the co-chair of Vancouver’s renters’ advisory committee last October for calling Hardwick the “witch of the westside” on Facebook. Former BC Liberal operative Kit Sauder apologized to Hardwick before Easter. She hoped it would be a lesson for others.

“I’m glad it’s been dealt with, it would have been nice if it had been dealt with at the time,” Hardwick said. “It would have been nice if it hadn’t happened at all.”

Southern recently issued a bulletin, “Government vs. Personal Use of Twitter,” that opened the door to politicians blocking citizens on Twitter. Her guidance offered a reminder that councillors appear at open meetings and can be contacted through traditional means, such as email and regular mail.

Fontaine acknowledges that Twitter has, from time to time, been a tool for good, used by pro-democracy movements during the “Arab spring” of 2011, Hong Kong anti-Communist protests in 2019 and last year’s feminist uprising against Iran’s Islamic fundamentalist regime.

The reliability of the platform has eroded due to ownership, technical, regulatory and market changes. Owner Elon Musk’s rival Mark Zuckerberg has launched a similar service called Threads.

Fontaine said the uncertainty worries him, since Twitter can also be useful for a government to mass-communicate urgent messages about public safety and security. For instance, on July 2, when Musk announced a temporary cap on tweets, the B.C. Ministry of Transportation’s DriveBC highway alerts account was restricted in warning the public about crashes, delays and wildfire-related closures.

Fontaine said governments should not rely solely on multinational corporations to get the word out, when they have local newspapers and their own channels, specifically civic websites.

“I’m a huge fan of diversity of communication,” he said.

Support theBreaker.news for as low as $2 a month on Patreon. Find out how. Click here.

Bob Mackin

When Daniel Fontaine ran for New

“We do hold so many voices for Vancouver and that means that sometimes we hold things that people disagree with and we try not to judge what someone is coming into a library to explore,” de Castell said.

“We do hold so many voices for Vancouver and that means that sometimes we hold things that people disagree with and we try not to judge what someone is coming into a library to explore,” de Castell said.

“How do we understand and work out as a society, how we can function democratically, if we can’t read views different from our own? All we create is an echo chamber,” said sociology professor James Turk, director of the Centre for Free Expression (CFE) at Toronto Metropolitan University, formerly Ryerson.

“How do we understand and work out as a society, how we can function democratically, if we can’t read views different from our own? All we create is an echo chamber,” said sociology professor James Turk, director of the Centre for Free Expression (CFE) at Toronto Metropolitan University, formerly Ryerson.